Page 25 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 25

Profile’s Stock Exchange Handbook: 2025 – Issue 1 NSX – DYL

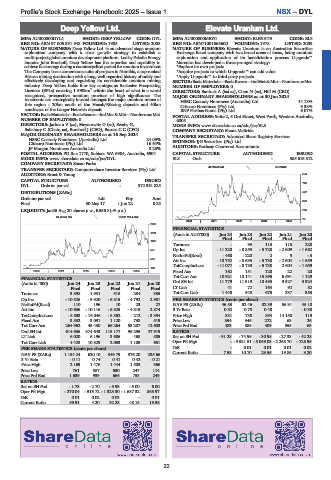

Deep Yellow Ltd. Elevate Uranium Ltd.

DYL EL8

ISIN: AU000000DYL4 SHORT: DEEP YELLOW CODE: DYL ISIN: AU000000MEY0 SHORT: ELEVATE CODE: EL8

REG NO: ABN 97 006 391 948 FOUNDED: 1985 LISTED: 2008 REG NO: ABN71001666600 FOUNDED: 1978 LISTED: 2009

NATURE OF BUSINESS: Deep Yellow Ltd. is an advanced stage uranium NATURE OF BUSINESS: Elevate Uranium is an Australian Securities

exploration company with a clear growth strategy to establish a Exchange listed company with two broad areas of focus, being uranium

multi-project global uranium development platform. Led by Paladin Energy exploration and application of its beneficiation process U-pgrade™.

founder John Borshoff, Deep Yellow has the expertise and capability to Marenica has developed a three-pronged strategy:

achieve its strategy during a countercyclical period for uranium investment. *Explore its own projects

The Company has a cornerstone suite of projects in Namibia, a top-ranked *Acquire projects to which U-pgrade™ can add value

African mining destination with a long, well regarded history of safely and *Apply U-pgrade™ to third party projects

effectively developing and regulating its considerable uranium mining SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

industry. Deep Yellow holds four key contiguous Exclusive Prospecting NUMBER OF EMPLOYEES: 0

Licences (EPLs) covering 1 590km 2 within the heart of what is a world DIRECTORS: Bantock A (ind ne), Chen N (ne), Hill M (CEO)

recognised, prospective uranium province of high significance. The MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

tenements are strategically located amongst the major uranium mines of HSBC Custody Nominees (Australia) Ltd. 14.18%

this region - 20km south of the Husab/Rössing deposits and 40km Citicorp Nominees (Pty) Ltd. 9.38%

southwest of the Langer Heinrich deposit. BNP Paribas Noms (Pty) Ltd. 6.07%

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet POSTAL ADDRESS: Suite 2, 5 Ord Street, West Perth, Western Australia,

NUMBER OF EMPLOYEES: 0 6005

DIRECTORS: Jackson V (ne), Meyerowitz G (ne), Swaby G, MORE INFO: www.sharedata.co.za/sdo/jse/EL8

Salisbury C (Chair, ne), Borshoff J (CEO), Barnes C C (CFO) COMPANY SECRETARY: Shane McBride

MAJOR ORDINARY SHAREHOLDERS as at 16 Sep 2024 TRANSFER SECRETARY: Advanced Share Registry Services

HSBC Custody Nominees (Australia) Ltd. 24.09%

Citicorp Nominees (Pty) Ltd. 16.64% SPONSOR: IJG Securities (Pty) Ltd.

JP Morgan Nominees Australia Ltd. 8.28% AUDITORS: Rothsay Chartered Accountants

POSTAL ADDRESS: PO Box 1770, Subiaco WA 6904, Australia, 6904 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/DYL EL8 Ords - 385 615 812

COMPANY SECRETARY: Susan Parks

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 40 Week MA ELEVATE

AUDITORS: Ernst & Young 894

CAPITAL STRUCTURE AUTHORISED ISSUED

720

DYL Ords no par val - 972 361 825

DISTRIBUTIONS [ZARc] 547

Ords no par val Ldt Pay Amt

Final 30 May 17 1 Jun 22 0.25 373

LIQUIDITY: Jan25 Avg 20 shares p.w., R356.8(-% p.a.) 200

40 Week MA DEEP YELLOW

26

2020 | 2021 | 2022 | 2023 | 2024 |

2060

FINANCIAL STATISTICS

1674 (Amts in AUD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final Final Final Final

1288

Turnover - 93 113 115 228

Op Inc - 11 220 - 8 855 - 5 728 - 2 609 - 1 662

901

NetIntPd(Rcvd) - 468 - 220 2 5 - 3

515 Att Inc - 10 752 - 8 635 - 5 730 - 2 604 - 1 659

TotCompIncLoss - 11 077 - 8 783 - 5 730 2 604 - 1 659

129

2020 | 2021 | 2022 | 2023 | 2024 | Fixed Ass 162 151 120 22 20

Tot Curr Ass 10 921 10 141 15 895 6 691 1 129

FINANCIAL STATISTICS

(Amts in ‘000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Ord SH Int 11 779 11 519 18 493 9 527 3 924

Final Final Final Final Final LT Liab 41 72 164 92 82

Turnover 3 898 1 931 515 284 335 Tot Curr Liab 1 440 948 675 337 353

Op Inc - 10 526 - 9 920 - 6 815 - 4 792 2 901 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 110 196 10 23 27 NAV PS (ZARc) 46.53 52.46 82.39 56.91 45.18

Att Inc - 10 636 - 10 116 - 6 825 - 4 815 2 874 3 Yr Beta 0.52 0.78 0.48 - - 0.38

TotCompIncLoss - 8 833 - 16 046 - 8 852 - 212 - 3 394 Price High 831 738 894 14 150 119

Fixed Ass 3 532 3 091 1 120 738 519 Price Low 354 346 272 63 26

Tot Curr Ass 264 962 45 430 66 264 53 207 12 603 Price Prd End 483 385 409 355 63

Ord SH Int 614 636 374 643 115 177 96 295 47 919 RATIOS

LT Liab 6 020 6 196 3 686 468 585 Ret on SH Fnd - 91.28 - 74.96 - 30.98 - 27.33 - 42.28

Tot Curr Liab 4 423 10 829 2 053 1 105 651 Oper Pft Mgn - - 9 521.51 - 5 069.03 - 2 268.70 - 728.95

PER SHARE STATISTICS (cents per share) D:E - 0.01 0.01 0.01 0.02

NAV PS (ZARc) 1 154.24 620.10 349.79 376.20 235.66 Current Ratio 7.58 10.70 23.55 19.85 3.20

3 Yr Beta - 0.11 0.74 0.41 0.42 - 0.21

Price High 2 169 1 476 1 444 1 503 366

Price Low 761 587 630 247 114

Price Prd End 1 639 939 666 753 249

RATIOS

Ret on SH Fnd - 1.73 - 2.70 - 5.93 - 5.00 6.00

Oper Pft Mgn - 270.04 - 513.72 - 1 323.30 - 1 687.32 865.97

D:E 0.01 0.02 0.03 - 0.01

Current Ratio 59.91 4.20 32.28 48.15 19.36

23