Page 29 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 29

Profile’s Stock Exchange Handbook: 2025 – Issue 1 NSX – NHL

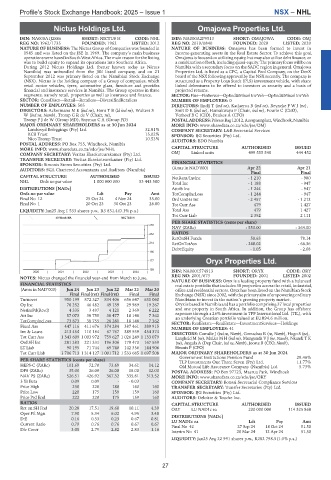

Nictus Holdings Ltd. Omajowa Properties Ltd.

NHL OMJ

ISIN: NA000A1J2SS6 SHORT: NICTUS H CODE: NHL ISIN: NA000A2P9513 SHORT: OMAJOWA CODE: OMJ

REG NO: 1962/1735 FOUNDED: 1962 LISTED: 2012 REG NO: 2019/0840 FOUNDED: 2020 LISTED: 2020

NATURE OF BUSINESS: The Nictus Group of Companies was founded in NATURE OF BUSINESS: Omajowa has been formed to invest in

1945 and was listed on the JSE in 1969. The company’s main business income-generating assets in the Real Estate Sector. To achieve this goal,

operationswerebasedinSouthWestAfrica. Themainreasonforthelisting Omajowaisfocusedonutilisingequity,butmayalsoutilisedebtfinance;or

was to build equity to expand its operations into Southern Africa. acombinationofboth, includingquasi-equity.Theprimaryfocuswillbe on

During 2012 Nictus Holdings Ltd. (better known today as Nictus Namibia with a secondary focus on the SADC region in general. Omajowa

Namibia) was unbundled from the JSE listed company, and on 21 Properties Ltd. is listed as a CPC, a Capital Pool Company, on the DevX

September 2012 was primary listed on the Namibian Stock Exchange board of the NSX following approval by the NSX recently. The company is

(NSX). Nictus is the holding company of a Group of companies, which structured as a Property Loan Stock (PLS) investment vehicle, with share

retail motor vehicles, tyres, automotive glass, furniture and provides linked debentures to be offered to investors as security and a basis of

financial and insurance services in Namibia. The Group operates in three projected returns.

segments, namely retail, properties as well as insurance and finance. SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 505 DIRECTORS: Iindji T (ind ne), Katjaerua B (ind ne), ReynekePWJ(ne),

DIRECTORS: AckermannME(ind ne), HornTB(ld ind ne), Walters S SmitDE(ind ne), Hamukwaya F (Chair, ind ne), Fourie C (CEO),

W(ind ne, Namb), TrompGRdeV (Chair, ne), Verhoef B C (CIO), Beukes A (CFO)

TrompPJdeW (Group MD), Snyman C A (Group FD) POSTALADDRESS:PrivateBag12012,Ausspannplatz,Windhoek,Namibia

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 MORE INFO: www.sharedata.co.za/sdo/jse/OMJ

Landswyd Beleggings (Pty) Ltd. 32.81% COMPANY SECRETARY: L&B Secretarial Services

KCB Trust 15.02% SPONSOR: IJG Securities (Pty) Ltd.

Nico Tromp Trust 10.53% AUDITORS: BDO Nambia

POSTAL ADDRESS: PO Box 755, Windhoek, Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/NHL CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd. OMJ Linked units 499 555 548 444 452

TRANSFER SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

SPONSOR: Simonis Storm Securities (Pty) Ltd. FINANCIAL STATISTICS

AUDITORS: SGA Chartered Accountants and Auditors (Namibia) (Amts in NAD’000) Apr 22 Apr 21

Final Final

CAPITAL STRUCTURE AUTHORISED ISSUED NetRent/InvInc - 1 210 - 980

NHL Ords no par value 1 000 000 000 53 443 500

Total Inc - 1 188 - 947

DISTRIBUTIONS [NADc] Attrib Inc - 1 244 - 947

Ords no par value Ldt Pay Amt TotCompIncLoss - 1 244 - 947

Final No 12 25 Oct 24 4 Nov 24 35.00 Ord UntHs Int - 2 457 - 1 212

Final No 1 20 Oct 23 30 Oct 23 26.00 Tot Curr Ass 479 1 427

LIQUIDITY: Jan25 Avg 1 533 shares p.w., R3 831.4(0.1% p.a.) Total Ass 479 1 427

Tot Curr Liab 2 352 2 111

40 Week MA NICTUS H

PER SHARE STATISTICS (cents per share)

250

NAV (ZARc) - 553.00 - 364.00

232 RATIOS

RetOnSH Funds 50.63 78.14

214 RetOnTotAss - 248.02 - 66.36

Debt:Equity - 1.05 - 2.08

195

177 Oryx Properties Ltd.

ORY

159

2020 | 2021 | 2022 | 2023 | 2024 | ISIN: NA0001574913 SHORT: ORYX CODE: ORY

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002

NOTES: Nictus changed the financial year-end from March to June.

NATURE OF BUSINESS: Oryx is a leading property fund with a balanced

FINANCIAL STATISTICS real estate portfolio that includes 38 properties across the retail, industrial,

(Amts in NAD’000) Jun 24 Jun 23 Jun 22 Mar 21 Mar 20 office and residential sectors. Oryx has been listed on the Namibian Stock

Final Final(rst) Final(rst) Final Final Exchange(NSX)since2002, withtheprimaryaimofempoweringordinary

Turnover 950 199 872 327 834 406 656 647 631 060 Namibians to invest in the nation’s growing property market.

Op Inc 76 252 46 482 49 139 29 989 19 267 Oryx isbasedinNamibia andhasaportfoliocomprising 37 localproperties

NetIntPd(Rcvd) 4 335 3 497 4 121 2 369 6 222 and one property in South Africa. In addition, the Group has offshore

Att Inc 57 073 38 755 38 477 18 148 7 362 exposure through a 26% investment in TPF International Ltd. (TIL), with

an underlying Croatian portfolio valued at EUR94.6 million.

TotCompIncLoss 73 873 38 755 26 281 18 148 7 362 SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

Fixed Ass 447 116 411 676 374 284 387 461 389 915 NUMBER OF EMPLOYEES: 41

Inv & Loans 213 454 110 184 67 767 389 939 454 374 DIRECTORS: Comalie J (ind ne, Namb), GomachasR(ne, Namb), HugoS(ne),

Tot Curr Ass 1 343 609 1 003 972 759 627 1 026 249 1 133 079 Langheld M (ne), Muller M H (ind ne), Mungunda V J (ne, Namb), Nkandi T K

Ord SH Int 281 383 221 331 196 306 179 470 167 559 (ne), Angula A (Dep Chair, ind ne, Namb), Jooste B (CEO, Namb),

LT Liab 90 195 71 744 69 740 142 356 144 906 Heunis F (CFO)

Tot Curr Liab 1 706 713 1 314 127 1 001 712 1 533 685 1 697 508 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Government Institutions Pension Fund 29.46%

PER SHARE STATISTICS (cents per share) TLP Investments One Three Seven (Pty) Ltd. 11.77%

HEPS-C (ZARc) 101.69 72.70 73.69 34.61 14.12 Old Mutual Life Assurance Company (Namibia) Ltd. 5.73%

DPS (ZARc) 35.00 26.00 26.00 18.00 12.00 POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek

NAV PS (ZARc) 526.51 426.92 367.32 335.81 313.52 MORE INFO: www.sharedata.co.za/sdo/jse/ORY

3 Yr Beta 0.09 0.09 - - 0.03 - COMPANY SECRETARY: Bonsai Secretarial Compliance Services

Price High 230 220 180 160 160 TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

Price Low 220 175 159 159 160 SPONSOR: IJG Securities (Pty) Ltd.

Price Prd End 222 220 175 159 160 AUDITORS: Deloitte & Touche Inc.

RATIOS CAPITAL STRUCTURE AUTHORISED ISSUED

Ret on SH Fnd 20.28 17.51 19.60 10.11 4.39 ORY LU NAD1c ea 200 000 000 114 325 868

Oper Pft Mgn 7.90 5.34 6.02 4.95 3.48

D:E 0.16 0.33 0.23 0.67 0.81 DISTRIBUTIONS [NADc]

LU NAD1c ea Ldt Pay Amt

Current Ratio 0.79 0.76 0.76 0.67 0.67 Final No 42 27 Sep 24 18 Oct 24 51.50

Div Cover 3.05 2.79 2.82 2.83 1.16

Interim No 41 20 Mar 24 12 Apr 24 51.50

LIQUIDITY: Jan25 Avg 22 991 shares p.w., R282 798.5(1.0% p.a.)

27