Page 32 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 32

NSX – SNO Profile’s Stock Exchange Handbook: 2025 – Issue 1

SBN Holdings Ltd. Stimulus Investments Ltd.

SNO SILP

ISIN: NA000A2PQ3N5 SHORT: SBN HOLDINGS CODE: SNO ISIN: NA000A1JN0Z7 SHORT: STIMULUS CODE: SILP

REG NO: 2006/306 FOUNDED: 1915 LISTED: 2019 REG NO: 2004/482 FOUNDED: 2004 LISTED: 2004

NATURE OF BUSINESS: Incorporated on 25 July 2006, SBN Holdings is NATURE OF BUSINESS: Stimulus Investment Ltd. is a private equity firm

the holding company of Standard Bank Namibia, one of the leading specializing in investments in logistics, renewable energy, tourism, and

financial services institutions in Namibia. The establishment of SBN high value retailing. The firm seeks to invest in Namibia. Stimulus

Holdings provided Standard Bank Namibia with the benefit of a dedicated Investment Ltd. is based in Namibia.

holding company strengthening the Bank’s operational oversight, SECTOR: Add—Debt—Preference Shares—Pref Shares

leadership, governance and regulatory compliance. SBN Holdings NUMBER OF EMPLOYEES: 0

supervises and oversees the execution of the Bank’s strategy, values and DIRECTORS: Geingos M (ne), McleodEI(ind ne), Okafor C (ind ne),

vision through a single board of directors. Furthermore, the establishment Mwatotele J S (CEO)

of SBN Holdings to act as the primary listed entity serves to demonstrate POSTAL ADDRESS: PO Box 97438, Windhoek, Namibia

the Bank’s commitment to the transformation objectives of the NFSC

aimed at diversifying the financial services sector. MORE INFO: www.sharedata.co.za/sdo/jse/SILP

SECTOR: Fins—Banks—Banks—Banks COMPANY SECRETARY: MMM Consultancy CC

NUMBER OF EMPLOYEES: 1 700 TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

DIRECTORS: Hornung S (ne), Mwatotele J S (ind ne), RiedelJG(ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Schlebusch P (ne), SiphiweThembaBruce MadonselaSTB(ne), SILP Pref shares - 4 650 786

Tjipitua N A (ind ne), Lucas N (Acting CEO), Tjombonde I H (Chair, ind ne), LIQUIDITY: Jan25 Avg 397 shares p.w., R50 805.2(0.4% p.a.)

TjipukaE(CEO), MatendaAT(CFO)

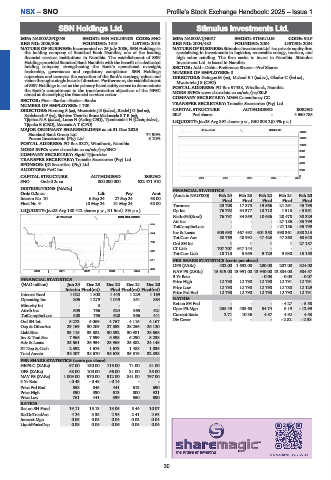

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 40 Week MA STIMULUS

Standard Bank Group Ltd. 74.90% 14000

Purros Investments (Pty) Ltd. 8.10% 12000

POSTAL ADDRESS: PO Box 3327, Windhoek, Namibia 10000

MORE INFO: www.sharedata.co.za/sdo/jse/SNO

8000

COMPANY SECRETARY: Sigrid Tjijorokisa

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. 6000

SPONSOR: IJG Securities (Pty) Ltd. 4000

AUDITORS: PwC Inc. 2000

CAPITAL STRUCTURE AUTHORISED ISSUED 0

2021 2022 2023 2024 2025

SNO Ords 0.2c ea 800 000 000 522 471 910

DISTRIBUTIONS [NADc] FINANCIAL STATISTICS

Ords 0.2c ea Ldt Pay Amt (Amts in NAD’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Interim No 10 6 Sep 24 27 Sep 24 68.00 Final Final Final Final Final

Final No 9 10 May 24 31 May 24 58.00 Turnover 29 708 17 373 19 566 21 291 45 795

LIQUIDITY: Jan25 Avg 180 412 shares p.w., R1.6m(1.8% p.a.) Op Inc 76 792 84 377 10 710 1 318 - 5 951

NetIntPd(Rcvd) 76 797 84 359 10 686 28 478 30 329

40 Week MA SBN HOLDINGS

AttInc - - - -27186 -35799

955

TotCompIncLoss - - - - 27 186 - 35 799

Inv & Loans 503 690 467 492 601 358 598 361 588 213

844

Tot Curr Ass 50 769 40 992 47 423 47 360 68 648

733 Ord SH Int 1 1 1 1 27 187

LT Liab 707 707 647 144 - - -

622

Tot Curr Liab 18 713 3 955 9 729 9 630 15 150

511 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 402.00 1 692.00 200.00 207.00 324.00

400

2020 | 2021 | 2022 | 2023 | 2024 | NAV PS (ZARc) 15 619.00 13 991.00 13 940.00 13 884.00 584.57

3 Yr Beta - - - 0.03 - 0.03 - 0.07

FINANCIAL STATISTICS Price High 12 790 12 790 12 790 12 791 12 791

(NAD million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final(rst) Final Final(rst) Final(rst) Price Low 12 790 12 790 12 790 12 780 12 129

Interest Rcvd 1 022 1 800 1 445 1 229 1 169 Price Prd End 12 790 12 790 12 790 12 790 12 791

Operating Inc 805 1 279 1 049 851 864 RATIOS

Minority Int - 3 - - - RetonSHFnd - - - -4.27 - 5.58

Attrib Inc 505 766 624 365 421 Oper Pft Mgn 258.49 485.68 54.74 6.19 - 12.99

TotCompIncLoss 508 765 628 366 441 Current Ratio 2.71 10.36 4.87 4.92 4.53

Ord SH Int 5 273 5 069 4 767 4 115 4 167 Div Cover - - - - 2.82 - 2.38

Dep & OtherAcc 29 169 30 209 27 353 28 256 26 120

Liabilities 33 115 33 582 30 892 30 981 28 658

Inv & Trad Sec 7 966 7 599 5 398 6 290 5 238

Adv & Loans 25 561 26 954 25 969 25 382 24 148

ST Dep & Cash 2 392 1 675 1 673 1 488 1 036

Total Assets 38 407 38 670 35 675 35 319 32 838

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 97.00 150.00 119.00 71.00 81.00

DPS (ZARc) 68.00 100.00 66.00 31.00 35.00

NAV PS (ZARc) 1 009.00 970.00 912.00 841.00 797.00

3 Yr Beta - 0.43 - 0.48 - 0.14 - -

Price Prd End 858 845 441 613 690

Price High 890 890 613 800 921

Price Low 761 441 399 550 690

RATIOS

Ret on SH Fund 19.11 15.13 13.05 8.44 10.07

RetOnTotalAss 4.24 3.35 2.98 2.41 2.63

Interest Mgn 0.05 0.05 0.04 0.03 0.04

LiquidFnds:Dep 0.08 0.06 0.06 0.05 0.04

30