Page 151 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 151

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – MPA

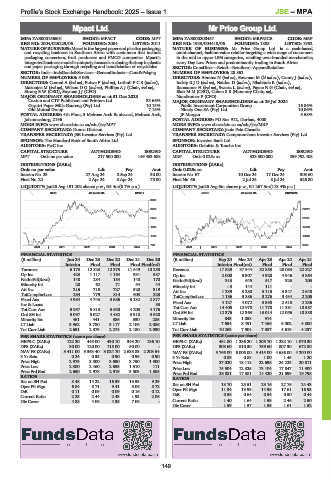

Mpact Ltd. Mr Price Group Ltd.

MPA MRP

ISIN: ZAE000156501 SHORT: MPACT CODE: MPT ISIN: ZAE000200457 SHORT: MRPRICE CODE: MRP

REG NO: 2004/025229/06 FOUNDED: 2004 LISTED: 2011 REG NO: 1933/004418/06 FOUNDED: 1885 LISTED: 1952

NATURE OF BUSINESS: Mpact is the largest paper and plastics packaging NATURE OF BUSINESS: Mr Price Group Ltd. is a cash-based,

and recycling business in Southern Africa with customers that include omni-channel, fashion-value retailer targeting a wide range of customers

packaging converters, fruit producers and FMCG companies. Mpact’s in the mid to upper LSM categories, retailing own-branded merchandise,

integratedbusinessmodelisuniquely focusedonclosingtheloopinplastic every Day Low Prices and predominantly trading in South Africa.

and paper packaging through recycling and beneficiation of recyclables. SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng NUMBER OF EMPLOYEES: 28 862

NUMBER OF EMPLOYEES: 5 095 DIRECTORS: Abrams N (ind ne), Bowman M (ld ind ne), Canny J (ind ne),

DIRECTORS: Conrad A (ind ne), Futwa F (ind ne), LuthuliPCS(ind ne), InskipRJD(ind ne), Naidoo D (ind ne), Nkabinde R (ind ne),

Makanjee M (ind ne), WilsonDG(ind ne), Phillips A J (Chair, ind ne), Ramsumer H (ind ne), Swartz L (ind ne), Payne N G (Chair, ind ne),

Strong B W (CEO), Snyman J J (CFO) Blair M M (CEO), Cohen S B (Honorary Chair, ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 Nundkumar P (CFO)

Caxton and CTP Publishers and Printers Ltd. 33.66% MAJOR ORDINARY SHAREHOLDERS as at 29 Jul 2024

Gayatri Paper Mills Gauteng (Pty) Ltd. 10.13% Public Investment Corporation Group 16.86%

Old Mutual Group 7.15% Ninety One SA (Pty) Ltd. 10.06%

POSTAL ADDRESS: 4th Floor, 3 Melrose Arch Boulevard, Melrose Arch, JP Morgan 5.58%

Johannesburg, 2196 POSTAL ADDRESS: PO Box 912, Durban, 4000

MORE INFO: www.sharedata.co.za/sdo/jse/MPT MORE INFO: www.sharedata.co.za/sdo/jse/MRP

COMPANY SECRETARY: Donna Dickson COMPANY SECRETARY: Janis Peta Cheadle

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: The Standard Bank of South Africa Ltd. SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc. AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

MPT Ords no par value 217 500 000 149 453 688 MRP Ords 0.025c ea 323 300 000 259 792 408

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Ords 0.025c ea Ldt Pay Amt

Interim No 23 27 Aug 24 2 Sep 24 30.00 Interim No 67 10 Dec 24 17 Dec 24 303.60

Final No 22 2 Apr 24 8 Apr 24 75.00 Final No 66 2 Jul 24 8 Jul 24 526.80

LIQUIDITY: Jan25 Avg 191 202 shares p.w., R5.4m(6.7% p.a.) LIQUIDITY: Jan25 Avg 6m shares p.w., R1 267.3m(118.4% p.a.)

GENI 40 Week MA MPACT GERE 40 Week MA MRPRICE

3588

3020 25812

2453 21851

1885 17889

1318 13928

750 9966

2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 (R million) Sep 24 Mar 24 Apr 23 Apr 22 Apr 21

Interim Final Final Final Final(rst) Interim Final(rst) Final Final Final

Turnover 6 173 12 823 12 373 11 549 10 258 Revenue 17 629 37 944 32 853 28 083 22 827

Op Inc 423 1 117 1 164 931 587 Op Inc 2 000 5 307 4 920 4 946 3 864

NetIntPd(Rcvd) 148 284 184 140 170 NetIntPd(Rcvd) 313 645 517 323 203

Minority Int 20 62 71 54 44 Minority Int - 3 144 111 - -

Att Inc 216 715 727 520 319 Att Inc 1 239 3 280 3 115 3 347 2 648

TotCompIncLoss 234 779 814 603 325 TotCompIncLoss 1 136 3 386 3 276 3 434 2 205

Fixed Ass 4 984 4 743 3 686 3 132 2 877

Inv & Loans - - - - 83 Fixed Ass 4 127 4 072 3 598 2 518 2 236

Tot Curr Ass 5 957 5 813 5 530 4 203 4 176 Tot Curr Ass 14 405 12 978 11 778 11 381 10 587

Ord SH Int 5 097 5 027 4 482 3 910 3 628 Ord SH Int 12 376 12 363 13 014 12 056 10 838

Minority Int 461 441 386 330 285 Minority Int 843 1 058 914 - -

LT Liab 3 962 3 780 3 117 2 106 2 086 LT Liab 7 654 8 491 7 466 6 002 4 800

Tot Curr Liab 2 651 2 379 2 274 2 180 2 030 Tot Curr Liab 10 263 7 904 7 387 4 619 4 237

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 122.20 443.00 430.10 343.20 186.10 HEPS-C (ZARc) 481.80 1 286.20 1 205.70 1 282.10 1 070.30

DPS (ZARc) 30.00 120.00 115.00 50.00 - DPS (ZARc) 303.60 810.30 759.60 807.30 672.80

NAV PS (ZARc) 3 411.00 3 363.40 3 024.70 2 638.83 2 203.54 NAV PS (ZARc) 5 766.00 6 006.00 5 415.00 4 686.00 4 200.00

3 Yr Beta 0.24 0.35 0.90 0.99 0.90 3 Yr Beta 0.89 0.88 1.00 1.45 1.20

Price High 2 979 3 500 3 690 3 750 1 900 Price High 27 020 18 118 22 698 24 225 20 011

Price Low 2 300 2 460 2 635 1 310 111 Price Low 15 504 12 325 13 104 17 847 11 300

Price Prd End 2 650 2 978 2 919 3 503 1 385 Price Prd End 26 881 17 381 14 420 21 599 19 798

RATIOS RATIOS

Ret on SH Fnd 8.48 14.22 16.39 13.53 9.29 Ret on SH Fnd 18.70 25.51 23.16 27.76 24.43

Oper Pft Mgn 6.84 8.71 9.41 8.06 5.72 Oper Pft Mgn 11.34 13.99 14.98 17.61 16.93

D:E 0.11 0.09 0.09 0.16 0.12

Current Ratio 2.25 2.44 2.43 1.93 2.06 D:E 0.58 0.64 0.54 0.50 0.44

Div Cover 4.88 4.06 4.35 7.06 - Current Ratio 1.40 1.64 1.59 2.46 2.50

Div Cover 1.59 1.57 1.59 1.61 1.52

149