Page 148 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 148

JSE – MET Profile’s Stock Exchange Handbook: 2025 – Issue 1

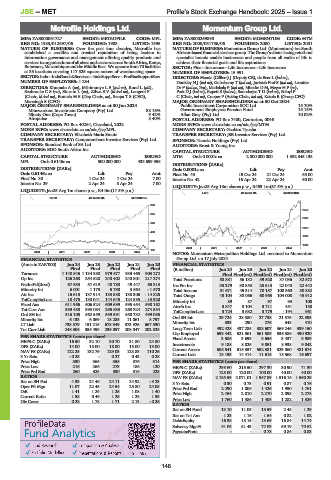

Metrofile Holdings Ltd. Momentum Group Ltd.

MET MOM

ISIN: ZAE000061727 SHORT: METROFILE CODE: MFL ISIN: ZAE000269890 SHORT: MOMENTUM CODE: MTM

REG NO: 1983/012697/06 FOUNDED: 1983 LISTED: 1995 REG NO: 2000/031756/06 FOUNDED: 2000 LISTED: 2001

NATURE OF BUSINESS: Over the past four decades, Metrofile has NATURE OF BUSINESS: Momentum Group Ltd. (Momentum) is a South

established a credible and trusted reputation of being leaders in African-basedfinancialservices group. The Group’sclient-facing retailand

information governance and management offering quality products and specialist brands enable businesses and people from all walks of life to

services to organisations of all sizes and sectors across South Africa, Kenya, achieve their financial goals and life aspirations.

Botswana,Mozambique and the Middle East. We operate from 70 facilities SECTOR: Fins—Insurance—Life Insurance—Life Insurance

at 35 locations covering 117 525 square meters of warehousing space. NUMBER OF EMPLOYEES: 15 991

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—ProfBusSupportServ DIRECTORS: Marais (Cilliers) J (Deputy CE), de Beer L (ind ne),

NUMBER OF EMPLOYEES: 1 234 Dunkley N J (ind ne), Gobalsamy T (ind ne), Jurisich Prof S (ind ne), Leautier

DIRECTORS: Khumalo A (ne), MthimunyeLE(ind ne), Rood L (alt), Dr F (ind ne, Tzn), Matlakala P (ind ne), Mbethe D M, Meyer H P (ne),

SeabrookeCS(ne), Storom L (ne), ZilwaSV(ld ind ne), Langeni P Park D J (ind ne), Rapeti S (ind ne), Soondarjee T D (ind ne), Baloyi P

(Chair, ld ind ne), Bomela M S (Dep Chair, ne), Seopa T S (CEO), C(Chair, ind ne), Cooper P (Acting Chair, ind ne), Ketola R (Group CFO)

Mansingh S (CFO) MAJOR ORDINARY SHAREHOLDERS as at 30 Oct 2024

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 Public Investment Corporation SOC Ltd. 15.70%

Mineworkers Investment Company (Pty) Ltd. 38.16% Government Employees Pension Fund 15.15%

Ninety One (Cape Town) 9.42% Allan Gray (Pty) Ltd. 10.02%

Afropulse 8.40% POSTAL ADDRESS: PO Box 7400, Centurion, 0046

POSTAL ADDRESS: PO Box 40264, Cleveland, 2022 MORE INFO: www.sharedata.co.za/sdo/jse/MTM

MORE INFO: www.sharedata.co.za/sdo/jse/MFL COMPANY SECRETARY: Gcobisa Tyusha

COMPANY SECRETARY: Elizabeth Maria Smuts TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Tamela Holdings (Pty) Ltd.

SPONSOR: Standard Bank of SA Ltd. AUDITORS: Ernst & Young Inc.

AUDITORS: BDO South Africa Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED MTM Ords 0.0001c ea 2 000 000 000 1 392 345 135

MFL Ords 0.6146c ea 500 000 000 433 699 958

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 0.0001c ea Ldt Pay Amt

Ords 0.6146c ea Ldt Pay Amt Final No 43 15 Oct 24 21 Oct 24 65.00

Final No 30 1 Oct 24 7 Oct 24 7.00 Interim No 42 16 Apr 24 22 Apr 24 60.00

Interim No 29 2 Apr 24 8 Apr 24 7.00

LIQUIDITY: Jan25 Avg 18m shares p.w., R453.1m(67.5% p.a.)

LIQUIDITY: Jan25 Avg 1m shares p.w., R4.0m(17.5% p.a.)

LIFE 40 Week MA MOMENTUM

SUPS 40 Week MA METROFILE

960

2758

805

2393

649

2029

493

1664

338

1300

2020 | 2021 | 2022 | 2023 | 2024 |

182

2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Momentum Metropolitan Holdings Ltd. renamed to Momentum

FINANCIAL STATISTICS Group Ltd. on 17 July 2024.

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 FINANCIAL STATISTICS

Final Final Final Final Final (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Turnover 1 140 546 1 134 380 979 677 933 465 903 272 Final Final(rst) Final(rst) Final(rst) Final(rst)

Op Inc 126 268 254 620 240 402 240 801 217 274 Total Premiums 58 881 56 132 59 520 37 036 32 572

NetIntPd(Rcvd) 67 533 57 619 48 780 49 447 65 313 Inc Fm Inv 35 279 30 853 25 513 22 040 22 442

Minority Int 6 001 1 175 5 750 3 664 - 1 570 Total Income 51 671 45 314 70 157 108 360 50 882

Att Inc 16 615 137 914 133 588 138 306 - 14 825 Total Outgo 43 104 38 066 60 963 104 008 45 912

TotCompIncLoss 18 475 138 041 144 645 124 585 - 13 920 Minority Int 89 87 97 93 108

Fixed Ass 611 966 606 524 609 699 595 454 598 162 Attrib Inc 3 847 3 104 3 711 451 188

Tot Curr Ass 393 488 393 084 295 633 268 324 274 554 TotCompIncLoss 3 724 3 682 3 779 - 194 961

Ord SH Int 516 105 562 559 559 591 558 732 499 085

Minority Int 6 133 6 069 18 285 11 061 8 797 Ord SH Int 29 724 28 580 27 738 21 575 22 593

LT Liab 738 579 151 215 678 349 573 925 667 530 Minority Int 333 290 276 348 410

Tot Curr Liab 248 306 855 499 236 057 208 847 202 825 Long-Term Liab 492 428 437 285 383 607 369 246 339 150

Cap Employed 693 442 621 561 561 589 536 386 490 920

PER SHARE STATISTICS (cents per share) Fixed Assets 3 586 3 699 3 656 3 437 3 989

HEPS-C (ZARc) 16.50 32.10 30.70 31.80 24.80

DPS (ZARc) 14.00 18.00 18.00 15.00 13.00 Investments 9 188 8 825 9 051 8 938 9 042

NAV PS (ZARc) 122.25 132.79 129.03 128.83 110.26 Current Assets 685 541 615 357 552 381 529 860 481 674

3 Yr Beta - 0.25 - 0.27 0.43 0.28 Current Liab 13 193 14 414 11 615 18 568 16 697

Price High 330 365 355 376 314 PER SHARE STATISTICS (cents per share)

Price Low 216 266 273 186 120 HEPS-C (ZARc) 298.60 215.50 297.30 30.90 71.30

Price Prd End 260 325 330 316 225 DPS (ZARc) 125.00 120.00 100.00 40.00 40.00

RATIOS NAV PS (ZARc) 2 185.59 2 071.01 1 947.89 1 516.16 1 560.29

Ret on SH Fnd 4.33 24.46 24.11 24.92 - 3.23 3 Yr Beta 0.30 0.73 0.91 0.87 0.76

Oper Pft Mgn 11.07 22.45 24.54 25.80 24.05 Price Prd End 2 290 1 806 1 426 1 950 1 761

D:E 1.41 1.24 1.25 1.08 1.40 Price High 2 454 2 010 2 270 2 098 2 278

Current Ratio 1.58 0.46 1.25 1.28 1.35 Price Low 1 760 1 386 1 405 1 282 1 326

Div Cover 0.28 1.78 1.71 2.13 - 0.26

RATIOS

Ret on SH Fund 13.10 11.05 13.59 2.48 1.29

Ret on Tot Ass 1.23 1.16 1.64 0.82 1.02

Debt:Equity 16.38 15.15 13.69 16.84 14.74

Solvency Mgn% 51.05 51.43 72.03 59.19 70.62

Payouts:Prem - - 0.78 0.84 0.83

146