Page 149 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 149

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – MON

Mondi plc Montauk Renewables Inc.

MON MON

ISIN: GB00BMWC6P49 SHORT: MONDIPLC CODE: MNP ISIN: US61218C1036 SHORT: MNTKRENEW CODE: MKR

REG NO: 6209386 FOUNDED: 2007 LISTED: 2007 REG NO: 85-3189583 FOUNDED: 2020 LISTED: 2021

NATURE OF BUSINESS: Mondi is a global leader in packaging and paper, NATURE OF BUSINESS: Montauk is a fully-integrated renewable energy

contributing to a better world by producing products that are sustainable company specializing in the management, recovery, and conversion of

by design. We employ 22 000 people in more than 30 countries and operate biogas into renewable energy. Montauk has over 30 years of experience in

an integrated business with expertise spanning the entire value chain, the development, operation, and management of biogas-fuelled renewable

enabling us to offer our customers a broad range of innovative solutionsfor energy projects. Montauk is a leader in renewable energy development

consumer and industrial end-use applications. Sustainability is at the from biogas. It specializes in developing projects which collectively benefit

centre of our strategy, with our ambitious commitments to 2030 focused all parties involved. The company’s portfolio is diversified and positioned

on circular driven solutions, created by empowered people, taking action towithstandmarketfluctuations,aswellastocaptureemerging trendsand

on climate. future demand.

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng SECTOR: Energy—Energy—AltEnergy—AltFuels

NUMBER OF EMPLOYEES: 22 000 NUMBER OF EMPLOYEES: 151

DIRECTORS: Brandtzaeg S R (ind ne), Clark S (snr ind ne), Govil S (ind ne), DIRECTORS: Ahmed M H (ind ne), CopelynJA(ne), Cunningham J (ind ne),

Groth A (ind ne), Macozoma S (ind ne), Strank Dame A (ind ne), Govender K (ne), Shaik Y (ind ne), McClain S F (CEO, USA)

Williams D (ind ne, UK), Yea P (Chair, ne), King A (CEO), MAJOR ORDINARY SHAREHOLDERS as at 14 Apr 2023

Young S (Sen Deputy Gvnr, ind ne, UK), Powell M (CFO) John A. Copelyn 40.10%

MAJOR ORDINARY SHAREHOLDERS as at 08 Jan 2025 Peresec Prime Brokers (Pty) Ltd. 14.10%

Public Investment Corporation SOC Ltd. 9.94% Theventheran G. Govender 12.20%

BlackRock, Inc. 7.06% POSTAL ADDRESS:680 AndersenDrive,5thFloor,Pittsburgh, PA,15220

Coronation Fund Managers 6.98% MORE INFO: www.sharedata.co.za/sdo/jse/MKR

POSTAL ADDRESS: Building 1, 1st Floor, Aviator Park, Station Road, COMPANY SECRETARY: John Ciroli

Addlestone, Surrey, United Kingdom, KT15 2PG TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/MNP

COMPANY SECRETARY: Jenny Hampshire CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MKR Ords USD0.01 ea 690 000 000 141 015 213

SPONSOR: Merrill Lynch SA (Pty) Ltd. LIQUIDITY: Jan25 Avg 234 783 shares p.w., R21.7m(8.7% p.a.)

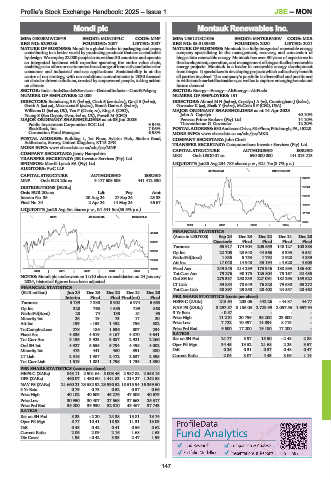

AUDITORS: PwC LLP 40 Week MA MNTKRENEW

CAPITAL STRUCTURE AUTHORISED ISSUED

32367

MNP Ords EUR 20c ea 3 177 608 605 441 412 530

DISTRIBUTIONS [EURc] 27224

Ords EUR 20c ea Ldt Pay Amt

Interim No 35 20 Aug 24 27 Sep 24 23.33 22080

Final No 34 2 Apr 24 14 May 24 46.67

16937

LIQUIDITY: Jan25 Avg 5m shares p.w., R1 541.5m(55.5% p.a.)

11793

GENI 40 Week MA MONDIPLC

6650

2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

41459

(Amts in USD’000) Sep 24 Dec 23 Dec 22 Dec 21 Dec 20

36037 Quarterly Final Final Final Final

Turnover 65 917 174 904 205 559 148 127 100 383

30616 Op Inc 22 708 23 640 44 566 3 335 3 581

NetIntPd(Rcvd) 1 835 5 753 1 792 2 928 4 339

25194

Att Inc 17 048 14 948 35 194 - 4 528 4 603

19772 Fixed Ass 249 845 214 289 175 946 180 893 186 401

2020 | 2021 | 2022 | 2023 | 2024 |

Tot Curr Ass 79 276 90 175 125 804 75 167 32 485

NOTES: Mondi plc underwent an 11:10 share consolidation on 24 January Ord SH Int 275 337 250 239 227 091 182 293 159 622

2024, historical figures have been adjusted.

LT Liab 59 884 70 649 76 823 79 630 65 272

FINANCIAL STATISTICS Tot Curr Liab 38 897 29 350 28 402 24 557 28 462

(EUR million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final(rst) Final PER SHARE STATISTICS (cents per share)

Turnover 3 739 7 330 8 902 6 974 6 663 HEPS-C (ZARc) 215.64 203.06 442.26 - 44.37 44.77

Op Inc 328 763 1 685 789 868 NAV PS (ZARc) 3 297.57 3 186.03 2 728.99 2 057.55 1 657.94

NetIntPd(Rcvd) 28 74 138 81 95 3 Yr Beta - 0.87 - - - -

Minority Int 26 19 73 17 20 Price High 11 210 20 799 36 200 23 000 -

Att Inc 199 - 153 1 452 756 582 Price Low 7 722 10 497 14 094 8 719 -

TotCompIncLoss 278 186 1 636 807 234 Price Prd End 9 500 17 200 19 180 17 200 -

Fixed Ass 4 835 4 619 4 167 4 870 4 641 RATIOS

Tot Curr Ass 3 136 3 923 3 887 2 921 2 260 Ret on SH Fnd 24.77 5.97 15.50 - 2.48 2.88

Ord SH Int 4 927 5 655 5 794 4 498 4 002 Oper Pft Mgn 34.45 13.52 21.68 2.25 3.57

Minority Int 473 441 460 391 380 D:E 0.26 0.31 0.37 0.48 0.47

LT Liab 2 516 1 987 2 472 2 637 2 595 Current Ratio 2.04 3.07 4.43 3.06 1.14

Tot Curr Liab 1 519 1 881 1 796 1 735 1 390

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 843.11 2 901.64 5 003.46 2 987.82 2 558.16

DPS (ZARc) 460.07 1 480.60 1 441.83 1 214.27 1 242.58

NAV PS (ZARc) 21 660.21 23 582.92 23 990.52 18 515.94 16 359.50

3 Yr Beta 0.79 0.73 0.52 0.57 0.66

Price High 40 102 40 609 45 276 47 306 40 679

Price Low 30 950 30 407 27 568 37 663 25 317

Price Prd End 35 200 39 930 32 010 43 467 37 743

RATIOS

Ret on SH Fnd 8.33 - 2.20 24.38 15.81 13.74

Oper Pft Mgn 8.77 10.41 18.93 11.31 13.03

D:E 0.48 0.42 0.41 0.56 0.62

Current Ratio 2.06 2.09 2.16 1.68 1.63

Div Cover 1.95 - 0.42 3.93 2.47 1.99

147