Page 156 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 156

JSE – NEP Profile’s Stock Exchange Handbook: 2025 – Issue 1

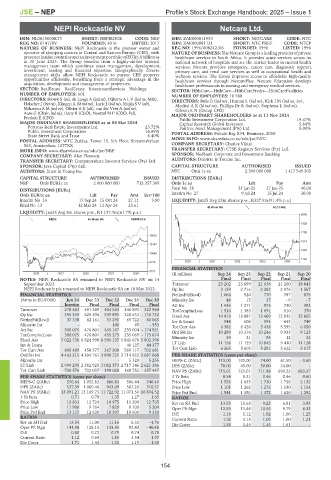

NEPI Rockcastle NV Netcare Ltd.

NEP NET

ISIN: NL0015000RT3 SHORT: NEPIROCK CODE: NRP ISIN: ZAE000011953 SHORT: NETCARE CODE: NTC

REG NO: 014178V FOUNDED: 2016 LISTED: 2017 ISIN: ZAE000081121 SHORT: NTC PREF CODE: NTCP

NATURE OF BUSINESS: NEPI Rockcastle is the premier owner and REG NO: 1996/008242/06 FOUNDED: 1996 LISTED: 1996

operator of shopping centres in Central and Eastern Europe (CEE), with NATURE OF BUSINESS: The Netcare Group is a leading provider of private

presenceinninecountriesandaninvestmentportfolioofEUR6.8billionas healthcare services in South Africa. It provides acute services across its

at 30 June 2023. The Group benefits from a highly-skilled internal national network of hospitals and are the market leader in mental health

management team which combines asset management, development, services. Netcare provides emergency, cancer care, diagnostic support,

investment, leasing and financial expertise. Geographically diverse primary care, and renal care services as well as occupational health and

management skills allow NEPI Rockcastle to pursue CEE property wellness services. The Group improves access to affordable high-quality

opportunities efficiently, benefiting from a strategic advantage in the healthcare services through NetcarePlus. Netcare Education develops

acquisition, development and management of properties. healthcare professionals in nursing and emergency medical services.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareFacilities

NUMBER OF EMPLOYEES: 601 NUMBER OF EMPLOYEES: 18 568

DIRECTORS: Brown S (ne), de Lange A (ind ne), Dijkstra A L V (ind ne, Neth), DIRECTORS: Bulo B (ind ne), Human L (ind ne), KirkIM(ind ne, Ire),

Holscher J (ind ne), Klingen A (ld ind ne), Lurie J (ind ne), Majija S V (alt), MaditsiAK(ld ind ne), Phillips Dr R (ind ne), Stephens L (ind ne),

Mihaescu A M (ind ne), Olivier A K (alt), van der Veer A (ind ne), Gibson K N (Group CFO)

Aase G (Chair, ind ne), Dany R (CEO), Noetzel M P (COO, Pol), MAJOR ORDINARY SHAREHOLDERS as at 11 Nov 2024

Predoiu E (CFO) Public Investment Corporation Ltd. 19.67%

MAJOR ORDINARY SHAREHOLDERS as at 04 Mar 2024 Capital Research Global Investors 5.64%

Fortress Real Estate Investments Ltd. 23.72% Fairtree Asset Management (Pty) Ltd. 5.00%

Public Investment Corporation 16.69% POSTAL ADDRESS: Private Bag X34, Benmore, 2010

State Street Bank and Trust 6.40%

POSTAL ADDRESS: WTC Zuidas, Tower 10, 5th Floor, Strawinskylaan MORE INFO: www.sharedata.co.za/sdo/jse/NTC

563, Amsterdam, 1077XX COMPANY SECRETARY: Charles Vikisi

MORE INFO: www.sharedata.co.za/sdo/jse/NRP TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

COMPANY SECRETARY: Alex Florescu SPONSOR: Nedbank Corporate and Investment Banking

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: Deloitte & Touche Inc.

SPONSOR: Java Capital (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Ernst & Young Inc. NTC Ords 1c ea 2 500 000 000 1 417 549 301

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

NRP Ords EUR1c ea 2 000 000 000 712 357 309 Ords 1c ea Ldt Pay Amt

Final No 28 21 Jan 25 27 Jan 25 40.00

DISTRIBUTIONS [EURc]

Ords EUR1c ea Ldt Pay Amt Scr/100 Interim No 27 9 Jul 24 15 Jul 24 30.00

Interim No 14 17 Sep 24 15 Oct 24 27.11 3.80 LIQUIDITY: Jan25 Avg 25m shares p.w., R327.9m(91.4% p.a.)

Final No 13 12 Mar 24 12 Apr 24 25.61 -

40 Week MA NETCARE

LIQUIDITY: Jan25 Avg 8m shares p.w., R1 137.7m(61.7% p.a.)

2096

REDS 40 Week MA NEPIROCK

1902

1708

15610

1514

13147

1320

10684

1126

8220 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

5757

2020 | 2021 | 2022 | 2023 | 2024 | (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

NOTES: NEPI Rockcastle SA renamed to NEPI Rockcastle NV on 14 Final Final Final Final Final

September 2022 Turnover 25 202 23 699 21 636 21 200 18 843

NEPI Rockcastle plc renamed to NEPI Rockcastle SA on 18 May 2022. Op Inc 3 159 2 716 2 282 2 076 1 567

FINANCIAL STATISTICS NetIntPd(Rcvd) 1 064 920 770 787 875

(Amts in EUR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 Minority Int 48 15 37 - 9 - 7

Interim Final Final Final Final Att Inc 1 436 1 271 975 730 392

Turnover 278 463 491 209 404 565 346 891 322 964 TotCompIncLoss 1 514 1 383 1 091 810 370

Op Inc 395 359 629 496 539 895 320 632 - 130 732 Fixed Ass 14 413 13 887 13 469 12 915 12 665

NetIntPd(Rcvd) 37 338 62 161 53 291 65 722 60 045 Inv & Loans 544 606 594 643 749

Minority Int - - 106 65 - 953 Tot Curr Ass 6 382 6 428 5 438 5 595 6 050

Att Inc 300 075 476 801 435 167 235 004 - 174 921 Ord SH Int 10 289 10 376 10 246 9 933 9 123

TotCompIncLoss 300 075 476 801 435 273 235 069 - 175 874

Fixed Ass 7 022 738 6 824 990 6 596 137 5 841 676 5 802 398 Minority Int 39 21 54 12 32

Inv & Loans - - - 46 125 44 377 LT Liab 11 156 11 159 10 045 9 410 11 128

Tot Curr Ass 806 409 458 577 367 300 569 117 702 681 Tot Curr Liab 6 263 5 603 5 281 5 622 5 017

Ord SH Int 4 433 315 4 304 761 3 898 721 3 714 922 3 687 068 PER SHARE STATISTICS (cents per share)

Minority Int - - - 5 320 5 255 HEPS-C (ZARc) 113.00 101.00 74.00 61.50 - 3.60

LT Liab 2 999 295 2 582 925 3 052 373 2 717 146 2 621 386 DPS (ZARc) 70.00 65.00 50.00 34.00 -

Tot Curr Liab 720 576 722 037 198 028 160 752 357 447 NAV PS (ZARc) 715.01 721.01 711.98 690.23 683.37

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.54 0.31 0.46 0.46 0.60

HEPS-C (ZARc) 576.64 1 052.82 886.83 586.44 340.40 Price High 1 556 1 633 1 730 1 738 2 132

DPS (ZARc) 537.39 1 060.46 943.09 587.20 310.57 Price Low 1 101 1 262 1 276 1 130 1 154

NAV PS (ZARc) 13 091.21 13 169.73 11 722.92 11 071.50 10 834.52 Price Prd End 1 541 1 350 1 372 1 620 1 292

3 Yr Beta 0.71 0.70 1.35 1.27 1.65 RATIOS

Price High 13 833 12 724 10 975 11 299 12 765 Ret on SH Fnd 13.53 11.65 9.25 6.81 3.93

Price Low 11 900 9 764 7 829 8 700 5 204 Oper Pft Mgn 12.53 11.46 10.55 9.79 8.32

Price Prd End 13 137 12 638 10 307 10 600 9 350 D:E 1.16 1.12 1.02 1.06 1.25

RATIOS Current Ratio 1.02 1.15 1.03 1.00 1.21

Ret on SH Fnd 13.54 11.08 11.16 6.32 - 4.76 Div Cover 1.58 1.45 1.45 1.61 -

Oper Pft Mgn 141.98 128.15 133.45 92.43 - 40.48

D:E 0.80 0.72 0.79 0.74 0.78

Current Ratio 1.12 0.64 1.85 3.54 1.97

Div Cover 1.71 1.42 1.31 1.15 - 1.69

154