Page 157 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 157

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – NEW

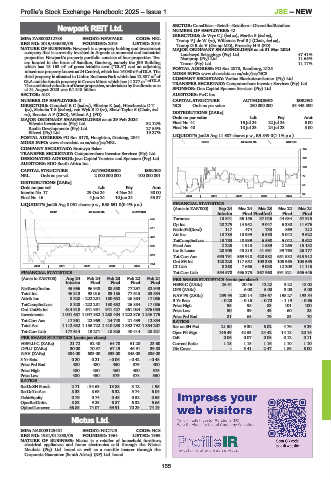

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers

Newpark REIT Ltd. NUMBER OF EMPLOYEES: 42

NEW DIRECTORS: de VryeCJ(ind ne), Martin S (ind ne),

ISIN: ZAE000212783 SHORT: NEWPARK CODE: NRL TrompPJdeW(ne), Willemse Prof B J (Chair, ind ne),

REG NO: 2015/436550/06 FOUNDED: 2015 LISTED: 2016 TrompGRdeV (Group MD), Prozesky H E (FD)

NATURE OF BUSINESS: Newpark is a property holding and investment MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

company that is currently invested in A-grade commercial and industrial Landswyd Beleggings (Pty) Ltd. 47.41%

properties. Newpark’s property portfolio consists of four properties. Two Namprop (Pty) Ltd. 11.65%

are located in the heart of Sandton, Gauteng, namely the JSE Building Trocor (Pty) Ltd. 11.17%

which has 18 163 m 2 of gross lettable area (“GLA”) and an adjoining POSTAL ADDRESS: PO Box 2878, Randburg, 2125

mixed-use property knownas24 Central,which has16 030 m 2 ofGLA.The MORE INFO: www.sharedata.co.za/sdo/jse/NCS

third property is situated in Linbro Business Park which has 12 387 m 2 of COMPANY SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

GLA and the fourth property in Crown Mines which has 11 277 m 2 of GLA.

The combined valuationofthese properties, undertakenby the directors as TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

at 31 August 2023 was R1.318 billion. SPONSOR: One Capital Sponsor Services (Pty) Ltd.

SECTOR: AltX AUDITORS: PwC Inc.

NUMBER OF EMPLOYEES: 0 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: CampbellRC(ind ne), Ellerine K (ne), Hirschowitz D T NCS Ords no par value 250 000 000 53 443 500

(ne), SishubaTS(ind ne), van WykBD(ne), Shaw-Taylor S (Chair, ind DISTRIBUTIONS [ZARc]

ne), Benatar A F (CEO), Wilson A J (FD)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 Ords no par value Ldt Pay Amt

Ellwain Investments (Pty) Ltd. 32.12% Final No 41 16 Jul 24 22 Jul 24 6.00

Renlia Developments (Pty) Ltd. 27.55% Final No 40 18 Jul 23 24 Jul 23 5.00

Ellvest (Pty) Ltd. 19.27% LIQUIDITY: Jan25 Avg 11 687 shares p.w., R9 849.0(1.1% p.a.)

POSTAL ADDRESS: PO Box 3178, Houghton, Gauteng, 2041

GERE 40 Week MA NICTUS

MORE INFO: www.sharedata.co.za/sdo/jse/NRL

COMPANY SECRETARY: Bronwyn Baker 145

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd. 122

AUDITORS: BDO South Africa Inc.

100

CAPITAL STRUCTURE AUTHORISED ISSUED

NRL Ords no par val 2 000 000 000 100 000 001 77

DISTRIBUTIONS [ZARc]

55

Ords no par val Ldt Pay Amt

Interim No 17 29 Oct 24 4 Nov 24 30.00 32

2020 | 2021 | 2022 | 2023 | 2024 |

Final No 16 4 Jun 24 10 Jun 24 35.37

FINANCIAL STATISTICS

LIQUIDITY: Jan25 Avg 8 061 shares p.w., R38 691.0(0.4% p.a.)

(Amts in ZAR’000) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

REIV 40 Week MA NEWPARK Interim Final Final(rst) Final Final

575 Turnover 13 841 35 156 37 046 44 634 57 915

Op Inc 20 275 14 952 9 047 6 330 11 676

511 NetIntPd(Rcvd) 117 474 730 869 212

Att Inc 13 783 10 939 6 590 5 042 9 622

447

TotCompIncLoss 13 783 10 939 6 590 5 042 9 622

382 Fixed Ass 2 225 1 918 1 689 2 265 15 132

Inv & Loans 28 905 40 819 41 691 39 763 26 177

318

Tot Curr Ass 653 791 569 918 428 582 651 532 613 912

Ord SH Int 128 228 117 652 109 385 105 965 103 595

254

2020 | 2021 | 2022 | 2023 | 2024 | LT Liab 8 268 7 666 9 038 12 209 11 115

FINANCIAL STATISTICS Tot Curr Liab 554 570 496 375 367 960 591 821 556 446

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 PER SHARE STATISTICS (cents per share)

Interim Final Final Final Final HEPS-C (ZARc) 26.51 20.46 12.22 9.22 18.02

NetRent/InvInc 45 996 96 948 88 558 77 297 82 949 DPS (ZARc) - 6.00 5.00 3.00 5.00

Total Inc 46 313 98 016 89 186 77 613 83 554 NAV PS (ZARc) 239.93 220.14 204.67 198.27 193.84

Attrib Inc 8 328 - 222 281 130 652 26 884 17 086 3 Yr Beta - 0.28 - 0.16 - 0.70 - 1.19 - 0.66

TotCompIncLoss 8 328 - 222 281 130 652 26 884 17 086 Price High 95 98 83 101 100

Ord UntHs Int 614 910 641 951 941 427 861 024 876 053 Price Low 50 39 43 60 28

Investments 1 041 687 1 047 982 1 288 404 1 222 376 1 246 775 Price Prd End 81 65 79 83 70

Tot Curr Ass 17 361 22 969 24 748 21 439 12 854 RATIOS

Total Ass 1 112 532 1 135 722 1 410 253 1 352 792 1 384 207 Ret on SH Fnd 21.50 9.30 6.02 4.76 9.29

Tot Curr Liab 177 614 19 271 18 826 40 414 28 521 Oper Pft Mgn 146.49 42.53 24.42 14.18 20.16

PER SHARE STATISTICS (cents per share) D:E 0.06 0.07 0.08 0.12 0.11

HEPLU-C (ZARc) 21.72 52.40 64.78 51.20 23.60 Current Ratio 1.18 1.15 1.16 1.10 1.10

DPLU (ZARc) 30.00 70.37 67.19 46.91 39.88 Div Cover - 3.41 2.47 1.89 6.00

NAV (ZARc) 584.00 603.00 893.00 845.00 885.00

3 Yr Beta 0.20 0.21 - 0.06 - 0.42 - 0.48

Price Prd End 480 480 450 379 400

Price High 480 480 460 400 575

Price Low 480 450 379 378 350

RATIOS

RetOnSH Funds 2.71 - 34.63 13.88 3.12 1.95

RetOnTotAss 8.33 8.63 6.32 5.74 6.04

Debt:Equity 0.76 0.74 0.48 0.52 0.55

OperRetOnInv 8.83 9.25 6.87 6.32 6.65

OpInc:Turnover 66.85 74.07 69.91 70.29 74.19

Nictus Ltd.

NIC

ISIN: NA0009123481 SHORT: NICTUS CODE: NCS

REG NO: 1981/011858/06 FOUNDED: 1964 LISTED: 1969

NATURE OF BUSINESS: Nictus is a retailer of household furniture,

electrical appliances and home electronics sold through the Nictus

Meubels (Pty) Ltd. brand as well as a non-life insurer through the

Corporate Guarantee (South Africa) (RF) Ltd. brand.

155