Page 112 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 112

JSE – EMI Profile’s Stock Exchange Handbook: 2024 – Issue 4

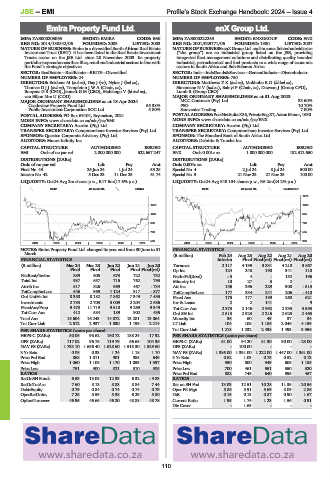

Emira Property Fund Ltd. enX Group Ltd.

EMI ENX

ISIN: ZAE000203063 SHORT: EMIRA CODE: EMI ISIN: ZAE000222253 SHORT: ENXGROUP CODE: ENX

REG NO: 2014/130842/06 FOUNDED: 2003 LISTED: 2003 REG NO: 2001/029771/06 FOUNDED: 1980 LISTED: 2007

NATURE OF BUSINESS: Emira is a diversified South African Real Estate NATURE OF BUSINESS: enX Group Ltd. and its consolidated subsidiaries

Investment Trust (REIT). It has been listed in the Real Estate Investment (“the group”) are an industrial group listed on the JSE, providing

Trusts sector on the JSE Ltd. since 28 November 2003. Its property integrated fleet management solutions and distributing quality branded

portfolioisspreadacrossthe office, retail andindustrialsectorsinlinewith industrial, petrochemical and fuel products to a wide range of economic

the Fund’s strategic objectives. sectors in South Africa and Sub-Saharan Africa.

SECTOR: RealEstate—RealEstate—REITS—Diversified SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

NUMBER OF EMPLOYEES: 24 NUMBER OF EMPLOYEES: 750

DIRECTORS: Bekkens M (ind ne), Day J (ne), Nyker J (ind ne), DIRECTORS: MatthewsZK(ind ne), MokhoboRD(ld ind ne),

ThomasDJJ(ind ne), TempletonJWA (Chair, ne), SimamaneNV(ind ne), Baloyi P (Chair, ne), Dawson J (Group CFO),

Booyens G S (CFO), Jennett G M (CEO), Mahlangu V (ld ind ne), Lumb R (Group CEO)

van Biljon Mrs U (COO) MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2023

MAJOR ORDINARY SHAREHOLDERS as at 18 Apr 2024 MCC Contracts (Pty) Ltd. 33.60%

Castleview Property Fund Ltd. 55.38% PSG 10.70%

Public Investment Corporation SOC Ltd. 5.80% Samvenice Trading 7.00%

POSTAL ADDRESS: PO Box 69104, Bryanston, 2021 POSTALADDRESS:PostNetSuiteX86,PrivateBagX7,AstonManor,1630

MORE INFO: www.sharedata.co.za/sdo/jse/EMI MORE INFO: www.sharedata.co.za/sdo/jse/ENX

COMPANY SECRETARY: Acorim (Pty) Ltd. COMPANY SECRETARY: Acorim (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. SPONSOR: The Standard Bank of South Africa Ltd.

AUDITORS: Moore Infinity Inc. AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

EMI Ords of no par val 2 000 000 000 522 667 247 ENX Ords 0.001c ea 1 000 000 000 182 312 650

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords of no par val Ldt Pay Amt Ords 0.001c ea Ldt Pay Amt

Final No 43 25 Jun 24 1 Jul 24 55.28 Special No 4 2 Jul 24 8 Jul 24 500.00

Interim No 42 5 Dec 23 11 Dec 23 61.74 Special No 3 21 Nov 23 27 Nov 23 100.00

LIQUIDITY: Oct24 Avg 2m shares p.w., R17.6m(17.6% p.a.) LIQUIDITY: Oct24 Avg 848 104 shares p.w., R6.2m(24.2% p.a.)

REIV 40 Week MA EMIRA GENI 40 Week MA ENXGROUP

1275

1426 1090

1207 905

988 720

769 535

550 350

2019 | 2020 | 2021 | 2022 | 2023 | 2024 2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Emira Property Fund Ltd. changed its year end from 30 June to 31 FINANCIAL STATISTICS

March. (R million) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20

FINANCIAL STATISTICS Interim Final Final(rst) Final(rst) Final(rst)

(R million) Mar 24 Mar 23 Jun 22 Jun 21 Jun 20 Turnover 2 117 4 195 3 331 4 210 3 867

Final Final Final Final Final(rst) Op Inc 124 248 190 341 110

NetRent/InvInc 889 605 673 722 732 NetIntPd(Rcvd) - 3 4 - 152 196

Total Inc 937 657 715 762 793 Minority Int 10 27 3 2 -

Attrib Inc 517 826 969 467 - 734 Att Inc 156 296 229 300 - 513

TotCompIncLoss 646 969 1 124 317 - 577 TotCompIncLoss 177 334 241 206 - 410

Ord UntHs Int 8 350 8 182 7 862 7 349 7 435 Fixed Ass 175 177 199 260 621

Investments 2 783 2 703 3 009 2 204 2 686 Inv & Loans 2 2 141 - 9

FixedAss/Prop 9 473 11 719 9 510 9 269 9 949 Tot Curr Ass 2 373 2 146 2 992 2 335 3 593

Tot Curr Ass 412 584 189 902 435 Ord SH Int 2 513 2 523 2 216 2 625 2 463

Total Ass 15 604 16 243 14 072 13 281 13 864 Minority Int 36 60 49 37 34

Tot Curr Liab 2 512 2 937 1 830 1 199 2 214 LT Liab 104 108 1 186 2 046 4 159

PER SHARE STATISTICS (cents per share) Tot Curr Liab 1 218 1 232 2 438 1 493 3 956

HEPS-C (ZARc) 50.05 98.62 160.72 188.24 17.92 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 117.02 96.78 119.79 66.65 104.36 HEPS-C (ZARc) 61.00 94.20 81.30 90.00 - 23.00

NAV PS (ZARc) 1 733.10 1 696.40 1 628.60 1 518.30 1 529.60 DPS (ZARc) - 100.00 - - -

3 Yr Beta 0.08 0.33 1.24 1.18 1.10 NAV PS (ZARc) 1 386.00 1 391.00 1 222.00 1 447.00 1 361.00

Price Prd End 868 1 011 901 985 649 3 Yr Beta 0.62 1.03 0.75 0.52 0.13

Price High 1 060 1 108 1 170 1 053 1 397 Price High 950 800 949 605 1 185

Price Low 751 900 821 510 505 Price Low 700 461 551 350 320

RATIOS Price Prd End 882 745 640 595 467

RetOnSH Funds 6.53 13.08 12.33 6.32 - 9.83 RATIOS

RetOnTotAss 7.60 8.13 8.83 8.84 7.44 Ret on SH Fnd 13.03 12.51 10.28 11.35 - 20.56

Debt:Equity 0.79 0.84 0.74 0.74 0.79 Oper Pft Mgn 5.86 5.91 5.69 8.09 2.86

OperRetOnInv 7.25 5.59 5.38 6.29 5.80 D:E 0.15 0.13 0.87 0.90 1.67

OpInc:Turnover 46.95 46.65 46.20 48.88 48.78 Current Ratio 1.95 1.74 1.23 1.56 0.91

Div Cover - 1.63 - - -

110