Page 108 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 108

JSE – DIP Profile’s Stock Exchange Handbook: 2024 – Issue 4

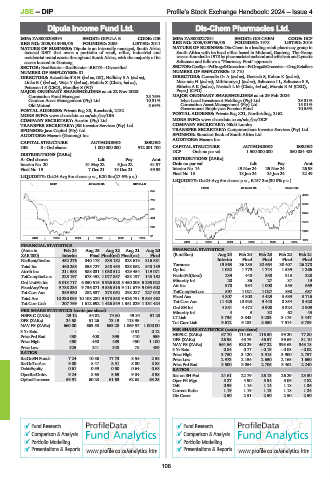

Dipula Income Fund Ltd. Dis-Chem Pharmacies Ltd.

DIP DIS

ISIN: ZAE000203394 SHORT: DIPULA B CODE: DIB ISIN: ZAE000227831 SHORT: DIS-CHEM CODE: DCP

REG NO: 2005/013963/06 FOUNDED: 2005 LISTED: 2011 REG NO: 2005/009766/06 FOUNDED: 1978 LISTED: 2016

NATURE OF BUSINESS: Dipula is an internally managed, South Africa NATURE OF BUSINESS: Dis-Chem is a leading retail pharmacy group in

focused REIT that owns a portfolio of retail, office, industrial and South Africa with its head office based in Midrand, Gauteng. The Group

residential rental assets throughout South Africa, with the majority of its was co-founded in 1978 by pharmacists husband and wife Ivan and Lynette

assets located in Gauteng. Saltzman and follows a “Pharmacy First” approach.

SECTOR: RealEstate—RealEstate—REITS—Diversified SECTOR:CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—DrugRetailers

NUMBER OF EMPLOYEES: 81 NUMBER OF EMPLOYEES: 18 710

DIRECTORS: AzizollahoffBH(ind ne, UK), HallidaySA(ind ne), DIRECTORS: Coovadia Dr A (ind ne), Goetsch S, Kobue K (ind ne),

LinksE((ind ne), Waja Y (ind ne), Matlala Z (Chair, ind ne), Masondo H (ind ne), Mthimunye J (ind ne), Saltzman I L, Saltzman S E,

Petersen I S (CEO), Moodley S (FD) SithebeAK(ind ne), Nestadt L M (Chair, ind ne), Morais R M (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 22 Nov 2023 Pope J (CFO)

Coronation Fund Managers 25.76% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Camissa Asset Management (Pty) Ltd. 10.31% Ivlyn Local Investment Holdings (Pty) Ltd. 29.31%

Old Mutual 5.69% Coronation Asset Management (Pty) Ltd. 15.01%

POSTAL ADDRESS: Private Bag X3, Rosebank, 2132 Government Employees Pension Fund 10.55%

MORE INFO: www.sharedata.co.za/sdo/jse/DIB POSTAL ADDRESS: Private Bag X21, Northriding, 2162

COMPANY SECRETARY: Acorim (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/DCP

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. COMPANY SECRETARY: Nikki Lumley

SPONSOR: Java Capital (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Mazars (Gauteng) Inc. SPONSOR: Standard Bank of South Africa Ltd.

AUDITORS: Mazars Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DIB B - Ord shares 1 000 000 000 912 001 700 CAPITAL STRUCTURE AUTHORISED ISSUED

DCP Ords no par val 1 500 000 000 860 084 483

DISTRIBUTIONS [ZARc]

A- Ord shares Ldt Pay Amt DISTRIBUTIONS [ZARc]

Interim No 20 31 May 22 6 Jun 22 61.97 Ords no par val Ldt Pay Amt

Final No 19 7 Dec 21 13 Dec 21 59.93 Interim No 14 19 Nov 24 25 Nov 24 26.98

Final No 13 18 Jun 24 24 Jun 24 22.49

LIQUIDITY: Oct24 Avg 5m shares p.w., R20.0m(27.6% p.a.)

LIQUIDITY: Oct24 Avg 5m shares p.w., R157.3m(30.0% p.a.)

REIV 40 Week MA DIPULA B

FOOR 40 Week MA DIS-CHEM

875

4306

718

3780

561

3254

404

2728

248

2203

91

2019 | 2020 | 2021 | 2022 | 2023 | 2024 1677

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

(Amts in Feb 24 Aug 23 Aug 22 Aug 21 Aug 20 FINANCIAL STATISTICS

ZAR’000) Interim Final Final(rst) Final(rst) Final (R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

NetRent/InvInc 452 276 840 178 833 182 823 613 816 881 Interim Final Final Final Final

Turnover 19 563 36 283 32 664 30 407 26 278

Total Inc 460 258 855 727 848 455 838 062 848 189

Attrib Inc 211 558 588 031 1 080 512 429 454 119 071 Op Inc 1 032 1 779 1 744 1 539 1 266

TotCompIncLoss 225 197 678 452 1 077 857 483 197 143 162 NetIntPd(Rcvd) 239 440 350 313 328

Ord UntHs Int 6 018 717 6 050 615 5 926 588 5 450 805 5 295 022 Minority Int 20 36 27 37 19

FixedAss/Prop 9 788 235 9 736 071 9 586 516 9 111 679 9 094 502 Att Inc 578 984 1 000 853 669

Tot Curr Ass 389 530 282 337 275 052 298 287 227 048 TotCompIncLoss 597 1 021 1 027 890 687

Total Ass 10 230 098 10 108 280 9 973 558 9 526 791 9 584 462 Fixed Ass 4 807 4 800 4 429 3 689 3 716

Tot Curr Liab 207 769 1 612 692 1 426 849 1 361 829 1 131 424 Tot Curr Ass 11 425 10 923 9 448 8 854 8 420

Ord SH Int 4 851 4 472 3 900 3 324 2 909

PER SHARE STATISTICS (cents per share) Minority Int 4 3 32 62 43

HEPS-C (ZARc) 29.12 54.82 74.60 49.84 51.28 LT Liab 3 736 3 843 3 233 3 175 3 447

DPS (ZARc) 24.58 51.26 73.19 118.95 - Tot Curr Liab 9 612 9 183 8 350 7 514 6 789

NAV PS (ZARc) 660.00 663.50 663.20 1 069.57 1 000.00

3 Yr Beta - - - 0.51 0.12 PER SHARE STATISTICS (cents per share)

Price Prd End 430 408 395 410 559 HEPS-C (ZARc) 67.70 114.60 116.50 99.20 77.80

26.98

DPS (ZARc)

45.73

31.10

39.69

46.57

Price High 450 450 489 450 1 100 NAV PS (ZARc) 564.56 520.29 457.22 393.63 343.18

Price Low 325 241 348 78 489 3 Yr Beta 0.84 0.77 - 0.19 - 0.08 - 0.02

RATIOS Price High 3 750 3 120 3 915 3 900 2 757

RetOnSH Funds 7.24 10.86 17.73 8.54 2.58 Price Low 2 973 2 154 2 650 2 165 1 650

RetOnTotAss 9.00 8.47 8.51 8.80 8.88 Price Prd End 3 500 3 054 2 705 3 462 2 240

Debt:Equity 0.61 0.59 0.60 0.64 0.68 RATIOS

OperRetOnInv 9.24 8.63 8.69 9.04 8.98 Ret on SH Fnd 24.61 22.79 26.13 26.29 23.30

OpInc:Turnover 59.91 60.23 61.63 62.68 63.25 Oper Pft Mgn 5.27 4.90 5.34 5.06 4.82

D:E 0.99 1.16 1.14 1.18 1.36

Current Ratio 1.19 1.19 1.13 1.18 1.24

Div Cover 2.50 2.51 2.50 2.50 2.50

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

106