Page 105 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 105

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – CRO

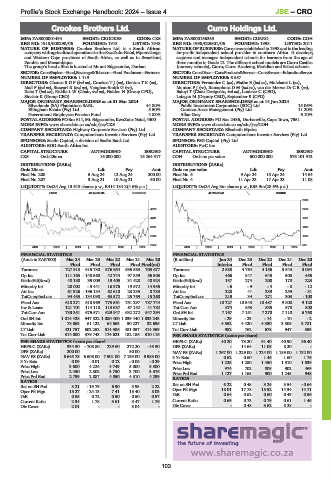

Crookes Brothers Ltd. Curro Holdings Ltd.

CRO CUR

ISIN: ZAE000001434 SHORT: CROOKES CODE: CKS ISIN: ZAE000156253 SHORT: CURRO CODE: COH

REG NO: 1913/000290/06 FOUNDED: 1913 LISTED: 1948 REG NO: 1998/025801/06 FOUNDED: 1998 LISTED: 2011

NATURE OF BUSINESS: Crookes Brothers Ltd. is a South African NATURE OF BUSINESS: Curro was established in 1998 and is the leading

company with agricultural operationsin the KwaZulu-Natal,Mpumalanga for-profit independent school provider in southern Africa. It develops,

and Western Cape provinces of South Africa, as well as in Swaziland, acquires and manages independent schools for learners from the age of

Zambia and Mozambique. three months to Grade 12. The different school models are Curro Castles

The group’s head office is located at Mount Edgecombe, Durban. (nursery schools), Curro, Curro Academy, Meridian and Select schools.

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—EducationServcs

NUMBER OF EMPLOYEES: 1 119 NUMBER OF EMPLOYEES: 6 557

DIRECTORS: ChanceRGF(ind ne), CrookesTJ(ne), DentonTK(ne), DIRECTORS: Fernandez C (ne), Mathe B (ind ne), Molebatsi L (ne),

Mall F (ind ne), Stewart R (ind ne), Vaughan-Smith G (ne), MoutonPJ(ne), RamaphosaDM(ind ne), van der Merwe DrCR(ne),

Xaba T (ind ne), Riddle L W (Chair, ind ne), Naidoo N (Group CFO), Baloyi T (Chair Designate, ind ne), Loubser C (CEO),

Sinclair K (Group CEO) Lategan M (Deputy CEO), September B (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 MAJOR ORDINARY SHAREHOLDERS as at 14 Jun 2024

Silverlands (SA) Plantations SARL 44.80% Public Investment Corporation (SOC) Ltd. 15.06%

Ellingham Estate (Pty) Ltd. 5.50% Camissa Asset Management (Pty) Ltd. 11.20%

Government Employees Pension Fund 4.83% Allan Gray 6.10%

POSTAL ADDRESS:POBox611, Mt.Edgecombe, KwaZulu-Natal,4300 POSTAL ADDRESS: PO Box 2436, Durbanville, Cape Town, 7551

MORE INFO: www.sharedata.co.za/sdo/jse/CKS MORE INFO: www.sharedata.co.za/sdo/jse/COH

COMPANY SECRETARY: Highway Corporate Services (Pty) Ltd. COMPANY SECRETARY: Elizabeth Mpeke

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: BDO South Africa Inc. AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

CKS Ords 25c ea 16 000 000 15 264 317 COH Ords no par value 600 000 000 576 101 913

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords 25c ea Ldt Pay Amt Ords no par value Ldt Pay Amt

Final No 208 5 Aug 24 12 Aug 24 200.00 Final No 5 9 Apr 24 15 Apr 24 14.64

Final No 207 3 Aug 21 10 Aug 21 50.00 Final No 4 11 Apr 23 17 Apr 23 11.08

LIQUIDITY: Oct24 Avg 13 619 shares p.w., R414 184.2(4.6% p.a.) LIQUIDITY: Oct24 Avg 3m shares p.w., R35.9m(28.6% p.a.)

FOOD 40 Week MA CROOKES 40 Week MA CURRO

2885

4870 2418

4241 1951

3611 1485

2982 1018

2352 551

2019 | 2020 | 2021 | 2022 | 2023 | 2024 2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 (R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Final Final Final Final Final(rst) Interim Final Final Final Final

Turnover 727 913 615 730 576 654 635 583 703 677 Turnover 2 588 4 764 4 156 3 543 3 094

Op Inc 111 163 - 148 560 42 744 97 859 56 503 Op Inc 466 847 645 508 455

NetIntPd(Rcvd) 40 180 39 009 19 405 31 428 40 924 NetIntPd(Rcvd) 157 274 208 170 223

Minority Int 28 002 - 3 441 16 376 19 572 14 955 Minority Int - 6 - 9 - 4 - 8 - 12

Att Inc 61 326 - 196 134 62 610 23 235 8 733 Att Inc 228 41 239 259 - 31

TotCompIncLoss 94 453 - 134 098 63 572 25 769 15 260 TotCompIncLoss 219 34 271 303 - 108

Fixed Ass 618 271 618 969 773 561 751 297 787 744 Fixed Ass 10 727 10 543 10 487 9 800 9 120

Inv & Loans 121 701 114 118 113 637 67 152 41 782 Tot Curr Ass 674 553 535 578 800

Tot Curr Ass 733 351 676 571 629 947 632 272 547 294 Ord SH Int 7 167 7 151 7 270 7 110 6 768

Ord SH Int 1 014 428 947 522 1 080 400 1 039 440 1 033 243 Minority Int - 29 - 23 - 14 - 10 - 2

Minority Int 73 063 61 122 64 563 50 227 32 695 LT Liab 4 552 4 420 4 330 3 505 3 781

LT Liab 421 757 502 252 514 986 481 057 414 559 Tot Curr Liab 982 762 678 947 553

Tot Curr Liab 314 000 379 743 174 621 182 186 310 116 PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 40.20 73.20 61.40 40.90 36.40

HEPS-C (ZARc) 334.50 - 708.80 229.60 272.20 - 48.50 DPS (ZARc) - 14.64 11.08 8.20 -

DPS (ZARc) 200.00 - - 50.00 - NAV PS (ZARc) 1 267.00 1 229.00 1 224.00 1 189.00 1 132.00

NAV PS (ZARc) 6 645.75 6 608.00 7 501.00 7 139.00 6 983.00 3 Yr Beta 0.62 0.60 1.46 1.60 1.76

3 Yr Beta 0.09 0.01 0.12 - 0.06 - 0.29 Price High 1 225 1 280 1 450 1 310 1 839

Price High 3 600 4 224 4 749 5 000 5 500 Price Low 974 702 805 902 469

Price Low 2 450 2 802 3 750 3 700 3 376 Price Prd End 1 127 1 165 900 1 245 948

Price Prd End 2 799 2 887 4 050 4 310 4 299 RATIOS

RATIOS

Ret on SH Fnd 8.21 - 19.79 6.90 3.93 2.22 Ret on SH Fnd 6.22 0.45 3.24 3.54 - 0.64

Oper Pft Mgn 15.27 - 24.13 7.41 15.40 8.03 Oper Pft Mgn 18.01 17.78 15.52 14.34 14.71

D:E 0.55 0.72 0.50 0.50 0.57 D:E 0.64 0.62 0.60 0.49 0.56

Current Ratio 2.34 1.78 3.61 3.47 1.76 Current Ratio 0.69 0.73 0.79 0.61 1.45

Div Cover 2.01 - - 3.04 - Div Cover - 0.48 3.62 5.28 -

103