Page 109 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 109

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – DIS

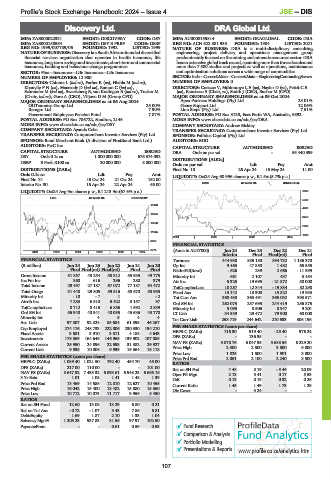

Discovery Ltd. DRA Global Ltd.

DIS DRA

ISIN: ZAE000022331 SHORT: DISCOVERY CODE: DSY ISIN: AU0000155814 SHORT: DRAGLOBAL CODE: DRA

ISIN: ZAE000158564 SHORT: DSY B PREF CODE: DSBP REG NO: ACN 622 581 935 FOUNDED: 1984 LISTED: 2021

REG NO: 1999/007789/06 FOUNDED: 1992 LISTED: 1999 NATURE OF BUSINESS: DRA is a multi-disciplinary consulting,

NATURE OF BUSINESS: Discovery is a South African-founded diversified engineering, project delivery and operations management group

financial services organisation that operates in health insurance, life predominantly focused on the mining and minerals resources sector. DRA

insurance,long-termsavingsandinvestments,short-termandcommercial hasanextensiveglobaltrack record, spanningmorethanthree decadesand

insurance, banking and behaviour-change programmes. more than 7 500 studies and projects as well as operations, maintenance

SECTOR: Fins—Insurance—Life Insurance—Life Insurance and optimisation solutions across a wide range of commodities.

NUMBER OF EMPLOYEES: 12 980 SECTOR: Inds—Constr&Mats—Constr&Mats—EngineeringContractingServcs

DIRECTORS: Chiume L (ind ne), Farber R (ne), Hlahla M (ind ne), NUMBER OF EMPLOYEES: 0

KhanyileFN(ne), Macready D (ind ne), Ramon C (ind ne), DIRECTORS: CoetzeeV,Mthimunye LE (ne), Naylor D (ne), Pettit C E

Schreuder M (ind ne), Swartzberg B, van Kralingen B (ind ne), Tucker M (ne), RandazzoS(Chair, ne), Smith J (CEO), Sucher M (CFO)

(Chair, ind ne), Gore A (CEO), Viljoen D M (Group CFO) MAJOR ORDINARY SHAREHOLDERS as at 09 Oct 2024

MAJOR ORDINARY SHAREHOLDERS as at 06 Aug 2024 Apex Partners Holdings (Pty) Ltd. 25.01%

OUTsurance Group Ltd. 25.00% Gency Support Ltd. 12.06%

Remgro Ltd. 7.90% Lion Steps (Pty) Ltd. 7.51%

Government Employees Pension Fund 7.87% POSTAL ADDRESS: PO Box 3130, East Perth WA, Australia, 6892

POSTAL ADDRESS: PO Box 786722, Sandton, 2146 MORE INFO: www.sharedata.co.za/sdo/jse/DRA

MORE INFO: www.sharedata.co.za/sdo/jse/DSY COMPANY SECRETARY: Andrew Bickley

COMPANY SECRETARY: Ayanda Ceba TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Pallidus Capital (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) AUDITORS: BDO

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED DRA Ords no par val - 55 440 399

DSY Ords 0.1c ea 1 000 000 000 676 374 092 DISTRIBUTIONS [AUDc]

DSBP B Prefs R100 ea 20 000 000 8 000 000

Ords no par val Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 10 26 Apr 24 15 May 24 11.00

Ords 0.1c ea Ldt Pay Amt LIQUIDITY: Oct24 Avg 60 996 shares p.w., R1.5m(5.7% p.a.)

Final No 31 15 Oct 24 21 Oct 24 152.00

Interim No 30 16 Apr 24 22 Apr 24 65.00 IDMS 40 Week MA DRAGLOBAL

LIQUIDITY: Oct24 Avg 9m shares p.w., R1 213.9m(67.6% p.a.) 6398

LIFE 40 Week MA DISCOVERY

5419

18149

4439

15874

3459

13599

2480

11325

1500

2021 | 2022 | 2023 | 2024

9050

FINANCIAL STATISTICS

6775 (Amts in AUD’000) Jun 24 Dec 23 Dec 22 Dec 21

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Interim Final Final(rst) Final

FINANCIAL STATISTICS Turnover 444 938 885 180 894 732 1 186 370

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Op Inc 9 463 47 850 1 482 65 555

Final Final(rst) Final(rst) Final Final NetIntPd(Rcvd) - 626 239 2 666 - 11 399

Gross Income 51 857 45 254 58 312 55 935 49 775 Minority Int 661 2 107 437 3 454

Inc Fm Inv 860 616 296 280 379 Att Inc 5 325 19 695 - 21 872 50 000

Total Income 29 497 27 187 67 072 77 187 64 472 TotCompIncLoss 10 257 12 344 - 19 834 52 298

Total Outgo 31 448 29 805 59 516 58 670 50 935 Fixed Ass 13 142 13 300 13 822 19 933

Minority Int - 10 - 7 1 - - 2 Tot Curr Ass 368 430 363 491 365 032 393 571

Attrib Inc 7 283 6 510 5 422 3 157 97 Ord SH Int 262 073 257 695 244 419 256 875

TotCompIncLoss 8 712 8 415 6 856 1 592 2 839 Minority Int 5 095 8 506 8 947 9 201

Ord SH Int 56 940 48 941 40 035 45 636 43 770 LT Liab 34 539 29 472 79 900 68 008

Minority Int - 4 5 4 4 Tot Curr Liab 253 719 244 642 210 533 306 196

Act. Liab 97 807 92 824 85 684 61 595 46 267 PER SHARE STATISTICS (cents per share)

Cap Employed 274 176 248 733 222 006 230 330 194 210 HEPS-C (ZARc) 116.30 519.40 - 25.40 976.24

Fixed Assets 3 581 3 910 3 811 4 188 4 643

136.35

Investments 179 369 164 646 146 965 139 902 107 085 DPS (ZARc) 5 870.76 - 6 047.95 5 688.56 - 6 229.20 -

NAV PS (ZARc)

Current Assets 25 950 24 896 22 593 31 382 29 927 Price High 2 500 2 500 3 500 6 000

Current Liab 9 935 10 006 9 939 16 364 16 118

Price Low 1 825 1 500 1 501 3 000

PER SHARE STATISTICS (cents per share) Price Prd End 2 051 2 100 2 240 3 500

HEPS-C (ZARc) 1 089.40 1 021.50 792.40 454.70 45.00 RATIOS

DPS (ZARc) 217.00 110.00 - - 101.00 Ret on SH Fnd 4.48 8.19 - 8.46 20.09

NAV PS (ZARc) 8 647.92 7 433.32 6 093.61 6 948.23 6 666.16 Oper Pft Mgn 2.13 5.41 0.17 5.53

3 Yr Beta 1.01 1.08 1.41 1.48 1.39 D:E 0.13 0.19 0.32 0.26

Price Prd End 13 469 14 585 12 810 12 627 10 455 Current Ratio 1.45 1.49 1.73 1.29

Price High 16 042 15 400 18 482 15 880 15 360 Div Cover - 3.24 - -

Price Low 10 712 10 073 11 717 9 956 5 450

RATIOS

Ret on SH Fund 12.60 13.08 13.29 6.80 0.21

Ret on Tot Ass - 0.72 - 1.07 3.43 7.86 6.81

Debt:Equity 1.69 1.87 2.10 1.33 1.04

Solvency Mgn% 1 203.23 937.83 81.56 97.97 102.50

Payouts:Prem - - 0.61 0.59 0.53 Fund Research

Comparison & Analysis

Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm

107