Page 113 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 113

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – EOH

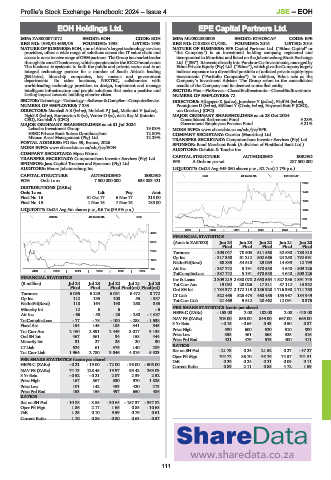

EOH Holdings Ltd. EPE Capital Partners Ltd.

EOH EPE

ISIN: ZAE000071072 SHORT: EOH CODE: EOH ISIN: MU0522S00005 SHORT: ETHOSCAP CODE: EPE

REG NO: 1998/014669/06 FOUNDED: 1998 LISTED: 1998 REG NO: C138883 C1/GBL FOUNDED: 2016 LISTED: 2016

NATURE OF BUSINESS: EOH, one of Africa’s largest technology services NATURE OF BUSINESS: EPE Capital Partners Ltd. (“Ethos Capital” or

providers, offers a wide range of solutions across the IT value chain and “the Company”) is an investment holding company, registered and

access to an extensive range of OEM partners. The Group is a market leader incorporated in Mauritius and listed on the Johannesburg Stock Exchange

through its core IT businesses, which operate under the iOCO brand name. Ltd. (“JSE”). It invests directly into Funds or Co-Investments, managed by

The business is systemic to both the public and private sector and is an Ethos Private Equity (Pty) Ltd. (“Ethos”), which give the Company largely

integral technology partner for a number of South Africa’s leading indirect exposure to a diversified portfolio of unlisted private equity-type

JSE-listed, blue-chip companies, key metros and government investments (“Portfolio Companies”). In addition, Ethos acts as the

departments. Its other business, NEXTEC, collaborates with Company’s Investment Advisor. The Group refers to the consolidated

world-leading technology providers to design, implement and manage results of the Company and its deemed controlled entity.

intelligent infrastructure and people solutions that make a positive and SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

lasting impact towards building smarter cities. NUMBER OF EMPLOYEES: 72

SECTOR:Technology—Technology—Software&CompSer—ComputerService DIRECTORS: Allagapen K (ind ne), Juwaheer Y (ind ne), Pfaff M (ind ne),

NUMBER OF EMPLOYEES: 7 333 Prout-Jones D (ind ne), Stillhart Y (Chair, ind ne), Hayward-Butt P (CEO),

DIRECTORS: Marshall A B (ind ne), Moleketi P J (ne), Motloutsi V (ind ne), van Onselen J (CFO)

Ngidi S (ind ne), Summerton R (ne), Venter D (ne), de la Rey M (Interim MAJOR ORDINARY SHAREHOLDERS as at 28 Oct 2024

CEO), Kooblall A (CFO) Consolidated Retirement Fund 9.28%

MAJOR ORDINARY SHAREHOLDERS as at 31 Jul 2024 Government Employees Pension Fund 5.21%

Lebashe Investment Group 19.03% MORE INFO: www.sharedata.co.za/sdo/jse/EPE

HSBC Private Bank Suisse Omnibusclient 12.80% COMPANY SECRETARY: Ocorian (Mauritius) Ltd.

Mianzo Asset Management (Pty) Ltd. 12.29% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 59, Bruma, 2026 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

MORE INFO: www.sharedata.co.za/sdo/jse/EOH AUDITORS: Deloitte & Touche Inc.

COMPANY SECRETARY: Mpeo Nkuna

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. EPE A Ords no par val - 287 500 000

AUDITORS: Moore Johannesburg Inc. LIQUIDITY: Oct24 Avg 649 060 shares p.w., R2.7m(11.7% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED EQII 40 Week MA ETHOSCAP

EOH Ords 1c ea 7 500 000 000 638 083 421

2090

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt 1740

Final No 16 31 Oct 17 6 Nov 17 215.00

1390

Final No 15 1 Nov 16 7 Nov 16 185.00

LIQUIDITY: Oct24 Avg 5m shares p.w., R6.7m(39.5% p.a.) 1040

SCOM 40 Week MA EOH

690

340

2019 | 2020 | 2021 | 2022 | 2023 |

4595

FINANCIAL STATISTICS

3473 (Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final Final Final Final

2350 Turnover - 303 047 70 603 511 568 32 530 - 780 818

Op Inc - 317 350 61 212 502 666 24 258 - 792 591

1228

NetIntPd(Rcvd) 68 835 54 510 29 089 14 639 12 799

105 Att Inc - 387 742 5 191 470 538 4 640 - 809 126

2019 | 2020 | 2021 | 2022 | 2023 | 2024

TotCompIncLoss - 387 742 5 191 470 538 4 640 - 809 126

FINANCIAL STATISTICS Inv & Loans 2 309 219 2 688 078 2 650 564 1 827 336 1 891 743

(R million) Jul 24 Jul 23 Jul 22 Jul 21 Jul 20 Tot Curr Ass 19 092 20 026 17 311 57 112 13 332

Final Final Final Final(rst) Final(rst) Ord SH Int 1 784 377 2 172 119 2 186 928 1 716 390 1 711 750

Turnover 6 035 6 229 6 031 6 472 8 772 LT Liab 522 465 526 473 460 485 155 967 184 949

Op Inc 112 135 100 55 - 937 Tot Curr Liab 21 469 9 512 20 462 12 091 8 376

NetIntPd(Rcvd) 118 164 190 268 385

Minority Int 12 6 6 - - 6 PER SHARE STATISTICS (cents per share)

AttInc -66 - 58 -25 - 280 -1687 HEPS-C (ZARc) - 153.00 2.00 182.00 2.00 - 413.00

TotCompIncLoss - 77 - 78 - 100 - 288 - 1 538 NAV PS (ZARc) 703.00 856.00 849.00 667.00 665.00

Fixed Ass 154 145 185 341 545 3 Yr Beta - 0.15 - 0.65 0.43 0.50 0.87

Tot Curr Ass 2 160 2 391 2 449 3 017 3 135 Price High 530 600 620 510 800

Ord SH Int 467 561 34 158 444 Price Low 353 461 368 325 316

Minority Int 31 27 26 20 30 Price Prd End 421 479 575 400 411

LT Liab 624 61 576 140 289 RATIOS

Tot Curr Liab 1 964 2 780 3 046 4 816 5 523 Ret on SH Fnd - 21.73 0.24 21.52 0.27 - 47.27

Oper Pft Mgn 104.72 86.70 98.26 74.57 101.51

PER SHARE STATISTICS (cents per share) D:E 0.29 0.24 0.21 0.09 0.11

HEPS-C (ZARc) - 0.21 - 19.00 - 72.00 - 98.00 - 505.00 Current Ratio 0.89 2.11 0.85 4.72 1.59

NAV PS (ZARc) 74.13 128.45 19.97 93.42 263.03

3 Yr Beta - 0.52 - 0.21 2.07 2.39 2.52

Price High 167 567 830 970 1 825

Price Low 101 142 453 420 213

Price Prd End 153 156 497 650 486

RATIOS

Ret on SH Fnd - 10.88 - 8.85 - 30.64 - 157.37 - 357.82

Oper Pft Mgn 1.86 2.17 1.65 0.85 - 10.68

D:E 1.25 0.10 9.59 0.79 0.61

Current Ratio 1.10 0.86 0.80 0.63 0.57

111