Page 111 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 111

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – EFO

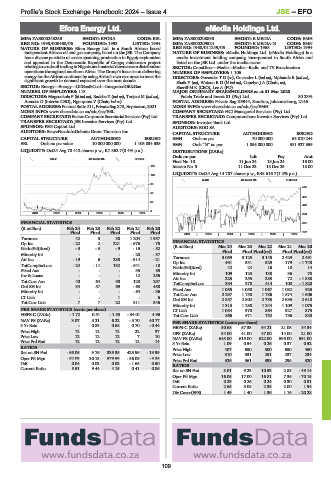

Efora Energy Ltd. eMedia Holdings Ltd.

EFO EME

ISIN: ZAE000248258 SHORT: EFORA CODE: EEL ISIN: ZAE000208898 SHORT: E MEDIA CODE: EMH

REG NO: 1993/000460/06 FOUNDED: 1993 LISTED: 1994 ISIN: ZAE000209524 SHORT: E MEDIA-N CODE: EMN

NATURE OF BUSINESS: Efora Energy Ltd. is a South African based REG NO: 1968/011249/06 FOUNDED: 1968 LISTED: 1994

independent African oil and gas company, listed on the JSE. The Company NATURE OF BUSINESS: eMedia Holdings Ltd. (eMedia Holdings) is a

has a diverse portfolio of assets spanning production in Egypt; exploration media investment holding company, incorporated in South Africa and

and appraisal in the Democratic Republic of Congo; midstream project listed on the JSE Ltd. under the media sector.

relatingtocrudeoiltradinginNigeriaandmaterialdownstreamdistribution SECTOR: ConsDiscr—Media—Media—Radio and TV Broadcasters

operations throughout southern Africa. The Group’s focus is on delivering NUMBER OF EMPLOYEES: 1 106

energy for the African continent by using Africa’s own resources to meet the DIRECTORS: Govender T G (ne), Govender L (ind ne), Mphande E (ind ne),

significant growth in demand expected over the next decade. Shaik Y (ne), Watson R D (ld ind ne), Copelyn J A (Chair, ne),

SECTOR: Energy—Energy—OilGas&Coal—IntegratedOil&Gas Sheriff M K (CEO), Lee A (FD)

NUMBER OF EMPLOYEES: 113 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2023

DIRECTORS: Mngconkola P (ld ind ne), Radebe Z (ind ne), Tonjeni M (ind ne), Fulela Trade and Invest 81 (Pty) Ltd. 80.23%

Arendse D (Interim CEO), Ngonyama V (Chair, ind ne) POSTAL ADDRESS: Private Bag X9944, Sandton, Johannesburg, 2146

POSTAL ADDRESS:PostnetSuite211, PrivateBagX75,Bryanston,2021 MORE INFO: www.sharedata.co.za/sdo/jse/EMH

MORE INFO: www.sharedata.co.za/sdo/jse/EEL COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd.

COMPANY SECRETARY: FusionCorporateSecretarialServices(Pty)Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Investec Bank Ltd.

SPONSOR: PSG Capital Ltd. AUDITORS: BDO SA

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED EMH Ords no par 70 000 000 63 810 244

EEL Ords no par value 10 000 000 000 1 103 834 635 EMN Ords “N” no par 1 055 000 000 381 927 359

LIQUIDITY: Oct24 Avg 78 412 shares p.w., R7 862.7(0.4% p.a.) DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

OILP 40 Week MA EFORA

Final No 10 11 Jun 24 18 Jun 24 16.00

152 Interim No 9 11 Dec 23 18 Dec 23 18.00

LIQUIDITY: Oct24 Avg 14 787 shares p.w., R48 616.7(1.2% p.a.)

123

ALSH 40 Week MA EMEDIA

95

555

66

491

38

428

9

2019 | 2020 | 2021 | 2022 | 2023 | 2024 364

FINANCIAL STATISTICS 301

(R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final Final Final Final 2019 | 2020 | 2021 | 2022 | 2023 | 2024 237

Turnover 42 8 38 1 204 1 957

Op Inc - 22 2 221 - 676 - 75 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 3 - 3 - 9 - 15 - 52 (R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final

Final Final(rst)

Final Final(rst)

Minority Int - - - - 28 - 37

2 491

AttInc -19 6 230 -514 -21 Turnover 3 059 3 125 3 145 2 429 - 1 748

Op Inc

529

179

531

491

TotCompIncLoss - 24 - 11 132 - 541 - 18 NetIntPd(Rcvd) 42 24 16 10 14

Fixed Ass - - - 35 85

73

Inv & Loans - - - 12 256 Minority Int 109 123 138 36 - 1 888

255

283

Att Inc

72

225

Tot Curr Ass 40 64 90 128 297

378

100

414

334

Ord SH Int 34 57 69 - 63 450 TotCompIncLoss 1 055 1 058 1 067 1 082 - 1 820

Fixed Ass

925

Minority Int - - - - 64 - 36 Tot Curr Ass 2 297 1 758 1 786 1 574 1 606

LT Liab - - 1 - 6 Ord SH Int 2 857 2 802 2 753 2 635 2 618

Tot Curr Liab 7 7 22 311 346

Minority Int 1 313 1 288 1 244 1 109 1 075

PER SHARE STATISTICS (cents per share) LT Liab 1 084 970 864 927 875

HEPS-C (ZARc) - 1.72 0.51 - 1.53 - 34.01 4.96 Tot Curr Liab 866 571 752 786 830

NAV PS (ZARc) 3.07 5.21 6.22 - 5.70 40.77 PER SHARE STATISTICS (cents per share)

3 Yr Beta - 0.83 0.68 0.70 - 0.44 HEPS-C (ZARc) 50.68 57.33 64.21 21.08 34.34

Price High 12 12 12 22 37 DPS (ZARc) 34.00 41.00 47.00 14.00 21.00

Price Low 12 12 12 7 10

Price Prd End 12 12 12 12 14 NAV PS (ZARc) 645.00 615.00 622.00 595.00 591.00

0.54

3 Yr Beta

0.37

1.09

0.52

0.26

RATIOS

Price High 407 550 500 550 450

Ret on SH Fnd - 56.05 9.76 335.35 425.96 - 13.99 Price Low 310 331 251 237 234

Oper Pft Mgn - 52.03 30.13 579.59 - 56.09 - 3.85 Price Prd End 326 361 398 295 320

D:E 0.04 0.03 0.03 - 1.65 0.50

Current Ratio 5.51 9.44 4.15 0.41 0.86 RATIOS

Ret on SH Fnd 8.01 9.23 10.53 2.88 - 49.14

Oper Pft Mgn 16.05 17.00 16.81 7.36 - 70.15

D:E 0.29 0.26 0.24 0.30 0.31

Current Ratio 2.65 3.08 2.38 2.00 1.94

Div Cover(EPS) 1.49 1.40 1.36 1.16 - 20.28

109