Page 107 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 107

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – DEN

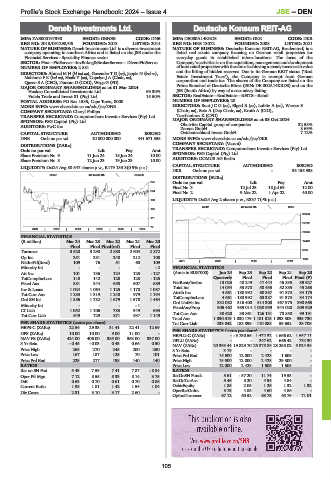

Deneb Investments Ltd. Deutsche Konsum REIT-AG

DEN DEU

ISIN: ZAE000197398 SHORT: DENEB CODE: DNB ISIN: DE000A14KRD3 SHORT: DKR CODE: DKR

REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014 REG NO: HRB 13072 FOUNDED: 2008 LISTED: 2021

NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment NATURE OF BUSINESS: Deutsche Konsum REIT-AG, Broderstorf, is a

company operating in southern Africa and is listed on the JSE under the listed real estate company focusing on German retail properties for

Financial Services - Speciality Finance sector. everyday goods in established micro-locations. The focus of the

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs Company’s activities is on the acquisition, management and development

NUMBER OF EMPLOYEES: 2 581 of local retail properties with the aim of achieving a steady increase in value

DIRECTORS: Ahmed M H (ld ind ne), Govender T G (ne), Jappie N (ind ne), and the lifting of hidden reserves. Due to its German REIT status (‘Real

Mahloma F K (ind ne), Shaik Y (ne), Copelyn J A (Chair, ne), Estate Investment Trust’), the Company is exempt from German

Queen S A (CEO), Duncan D (COO), Wege G (FD) corporation and trade tax. The shares of the Company are listed on the

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Prime Standard of Deutsche Börse (ISIN: DE 000A14KRD3) and on the

Hosken Consolidated Investments Ltd. 69.30% JSE (South Africa) by way of a secondary listing.

Fulela Trade and Invest 81 (Pty) Ltd. 15.50% SECTOR: RealEstate—RealEstate—REITS—Retail

POSTAL ADDRESS: PO Box 1585, Cape Town, 8000 NUMBER OF EMPLOYEES: 20

MORE INFO: www.sharedata.co.za/sdo/jse/DNB DIRECTORS: BootJCG(ne), Elgeti R (ne), Lubitz A (ne), Wasser S

COMPANY SECRETARY: Cheryl Philips (Chair, ne), Betz A (Dep Chair, ne), Kroth A (CIO),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Turchaninov K (CFO)

SPONSOR: PSG Capital (Pty) Ltd. MAJOR ORDINARY SHAREHOLDERS as at 03 Oct 2024

AUDITORS: PwC Inc. Obotritia Capital group of companies 32.58%

8.69%

Zerena GmbH

CAPITAL STRUCTURE AUTHORISED ISSUED Ostdeutschland Invest GmbH 7.12%

DNB Ords no par val 10 000 000 000 441 671 558 MORE INFO: www.sharedata.co.za/sdo/jse/DKR

COMPANY SECRETARY: (Vacant)

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Share Premium No 9 11 Jun 24 18 Jun 24 10.00 SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: DOMUS AG Berlin

Share Premium No 8 12 Jun 23 19 Jun 23 10.00

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Oct24 Avg 80 547 shares p.w., R179 133.3(0.9% p.a.)

DKR Ords no par val - 35 155 938

GENF 40 Week MA DENEB

DISTRIBUTIONS [EURc]

275 Ords no par val Ldt Pay Amt

Final No 3 12 Jul 23 18 Jul 69 12.00

234

Final No 2 9 Mar 22 1 Apr 22 40.00

193 LIQUIDITY: Oct24 Avg 2 shares p.w., R337.7(-% p.a.)

REIV 40 Week MA DKR

152

33664

111

27252

70

2019 | 2020 | 2021 | 2022 | 2023 | 2024

20840

FINANCIAL STATISTICS

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 14429

Final Final Final(rst) Final Final

8017

Turnover 3 528 3 290 2 880 2 604 2 872

Op Inc 251 281 240 212 108 1605

NetIntPd(Rcvd) 109 76 51 60 109 2021 | 2022 | 2023 | 2024

Minority Int - - - - - 2 FINANCIAL STATISTICS

Att Inc 101 136 124 125 - 127 (Amts in EUR’000) Jun 24 Sep 23 Sep 22 Sep 21 Sep 20

TotCompIncLoss 118 142 128 128 - 125 Quarterly Final Final Final Final (P)

Fixed Ass 881 844 658 607 689 NetRent/InvInc 13 023 48 249 47 444 45 835 39 927

Inv & Loans 1 024 1 064 1 125 1 178 1 087 Total Inc 14 054 53 570 58 435 52 885 45 263

Tot Curr Ass 1 283 1 319 1 240 979 1 194 Attrib Inc 4 661 - 180 992 60 387 91 373 34 175

Ord SH Int 1 856 1 782 1 679 1 578 1 464 TotCompIncLoss 4 661 - 180 992 60 387 91 373 34 174

Minority Int - - - - 1 - Ord UntHs Int 332 082 316 400 514 300 467 975 390 665

809 929

989 014 1 030 959

944 020

905 462

FixedAss/Prop

LT Liab 1 052 1 106 783 949 693 Tot Curr Ass 30 620 33 861 126 131 78 850 99 191

Tot Curr Liab 649 729 871 637 1 149

Total Ass 1 030 319 1 030 179 1 181 815 1 093 303 935 730

PER SHARE STATISTICS (cents per share) Tot Curr Liab 233 042 183 899 110 088 59 652 28 708

HEPS-C (ZARc) 22.54 29.33 31.41 22.41 12.69 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 10.00 10.00 9.00 11.00 - HEPLU-C (ZARc) - - 3 730.56 1 472.32 1 666.62 1 657.11

NAV PS (ZARc) 424.00 406.00 385.00 363.00 337.00 DPLU (ZARc) - - 247.62 666.42 732.30

3 Yr Beta - 0.45 - 0.03 0.43 0.66 0.50 NAV (ZARc) 20 368.44 19 829.70 25 878.88 23 255.02 5 024.58

Price High 265 270 245 200 250 3 Yr Beta 3.19 - - - -

Price Low 167 187 125 70 101 Price Prd End 15 600 12 000 2 428 1 605 -

Price Prd End 229 217 198 140 140 Price High 15 600 12 000 2 428 29 300 -

RATIOS Price Low 12 000 2 428 1 605 1 605 -

Ret on SH Fnd 5.43 7.59 7.41 7.87 - 8.84 RATIOS

Oper Pft Mgn 7.12 8.55 8.33 8.14 3.75 RetOnSH Funds 5.61 - 57.20 11.74 19.53 -

D:E 0.63 0.70 0.61 0.70 0.86 RetOnTotAss 5.46 5.20 4.94 4.84 -

Current Ratio 1.98 1.81 1.42 1.54 1.04 Debt:Equity 1.85 2.05 1.26 1.32 1.32

OperRetOnInv 5.75 4.88 4.60 4.86 -

Div Cover 2.31 3.10 3.17 2.60 -

OpInc:Turnover 67.12 60.52 63.78 65.79 71.01

105