Page 116 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 116

JSE – EXX Profile’s Stock Exchange Handbook: 2024 – Issue 4

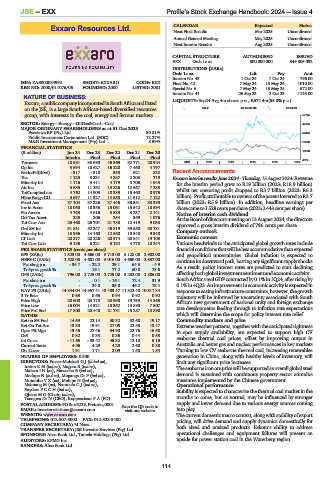

Exxaro Resources Ltd. CALENDAR Expected Status

Next Final Results Mar 2025 Unconfirmed

EXX

Annual General Meeting May 2025 Unconfirmed

Next Interim Results Aug 2025 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 349 305 092

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Interim No 43 1 Oct 24 7 Oct 24 796.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Final No 42 7 May 24 13 May 24 1010.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001

Special No 6 7 May 24 13 May 24 572.00

Interim No 41 26 Sep 23 2 Oct 23 1143.00

NATURE OF BUSINESS:

Exxaro,apubliccompanyincorporatedinSouthAfricaandlisted LIQUIDITY: Sep24 Avg 4m shares p.w., R674.4m(55.8% p.a.)

on the JSE, is a large South African-based diversified resources OILP 40 Week MA EXXARO

group, with interests in the coal, energy and ferrous markets. 57725

SECTOR: Energy—Energy—OilGas&Coal—Coal 47094

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

Eyesizwe RF (Pty) Ltd. 30.81% 36464

Public Investment Corporation Ltd. (SOC) 12.27%

M&G Investment Management (Pty) Ltd. 8.59% 25833

FINANCIAL STATISTICS

15203

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final

4572

Turnover 18 981 38 698 46 369 32 771 28 924 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Op Inc 3 694 10 627 16 220 7 460 4 797

NetIntPd(Rcvd) - 317 - 318 358 621 832 Recent Announcements

Tax 1 125 3 231 4 287 2 203 719 ExxarointerimresultsJune2024-Thursday,15August2024:Revenue

Minority Int 1 116 3 411 4 179 3 706 1 943 for the interim period grew to R19 billion (2023: R18.9 billion)

Att Inc 3 686 11 292 13 826 12 667 7 283 whilst net operating profit dropped to R3.7 billion (2023: R6.3

TotCompIncLoss 4 762 14 903 18 389 15 460 8 975

Hline Erngs-CO 3 697 11 327 14 558 11 512 7 122 billion).ProfitattributabletoownersoftheparentloweredtoR3.7

Fixed Ass 37 104 37 226 37 446 38 351 38 395 billion (2023: R5.9 billion). In addition, headline earnings per

Inv in Assoc 18 060 18 356 15 061 15 542 18 594 sharecameto1528centspershare(2023:2443centpershare).

Fin Assets 4 763 4 616 3 539 3 237 2 141 Notice of interim cash dividend

Def Tax Asset 225 206 254 369 1 076 AttheBoardofdirectorsmeetingon13August2024,thedirectors

Tot Curr Ass 25 468 26 701 21 788 12 419 9 033 approved a gross interim dividend of 796 cents per share.

Ord SH Int 51 851 52 247 46 819 39 550 38 781

Minority Int 13 996 14 160 12 560 10 548 9 340 Company outlook

LT Liab 20 277 20 226 20 574 20 841 19 103 Economic context

Tot Curr Liab 5 136 6 221 5 192 4 778 10 244 Various headwinds to the anticipated global growth rates include

PER SHARE STATISTICS (cents per share) financialconditionsthatwillbelessaccommodativethanexpected

EPS (ZARc) 1 523.00 4 666.00 5 713.00 5 128.00 2 902.00 and geopolitical uncertainties. Global inflation is expected to

HEPS-C (ZARc) 1 528.00 4 681.00 6 016.00 4 660.00 2 837.00 continue its downward path, barring any significant supply shocks.

Pct chng p.a. - 34.7 - 22.2 29.1 64.3 - 4.9 As a result, policy interest rates are predicted to start declining,

Tr 5yr av grwth % - 16.1 77.2 60.8 78.6

DPS (ZARc) 796.00 2 725.00 2 729.00 3 252.00 1 886.00 affectingbothglobalinvestmentsentimentandeconomicactivity.

Pct chng p.a. - - 0.1 - 16.1 72.4 31.9 SouthAfrica’srealGDPcontractedby0.1%in1Q24,afterrisingby

Tr 5yr av grwth % - 24.0 35.0 46.2 78.4 0.1%in4Q23.Animprovementineconomicactivityisexpectedin

NAV PS (ZARc) 14 844.04 14 957.41 13 403.47 11 322.48 10 811.34 responsetoeasinginfrastructureconstraints,however,thegrowth

3 Yr Beta 0.63 0.65 0.94 0.92 0.92 trajectory will be informed by uncertainty associated with South

Price High 20 608 23 173 23 998 19 753 14 865 Africa’s new government of national unity and foreign exchange

Price Low 16 004 14 521 15 362 13 890 7 507 rate developments feeding through to inflation rate expectations

Price Prd End 17 800 20 448 21 731 15 287 13 890

RATIOS which will determine the scope for policy interest rate relief.

Ret on SH Fnd 14.59 22.14 30.32 32.68 19.17 Commodity markets and price

Ret On Tot Ass 13.38 19.91 27.05 22.85 13.47 Extreme weather patterns, together with the anticipated tightness

Oper Pft Mgn 19.46 27.46 34.98 22.76 16.58 in spot supply availability, are expected to support high CV

D:E 0.32 0.33 0.36 0.44 0.53 seaborne thermal coal prices, offset by improving output in

Int Cover - 11.65 - 33.42 45.32 12.10 5.16

Current Ratio 4.96 4.29 4.20 2.60 0.88 Australia and better gas and nuclear performances in key markets.

Div Cover 1.91 1.71 2.09 1.58 1.54 Turning to low CV seaborne thermal coal, increasing renewables

NUMBER OF EMPLOYEES: 8500 generation in China, along with healthy levels of inventory, will

DIRECTORS: Fraser-MoleketiGJ(ld ind ne), limit any significant price increases.

IretonKM(ind ne), Magara B (ind ne), Theseaborneironorepricewillbesupportedasoverallglobalsteel

MalevuIN(ne), Mawasha B (ind ne),

Medupe N (ind ne), Mnganga Dr P (ind ne), demand is sustained with continuous property sector stimulus

MntamboVZ(ne), Molope N (ind ne), measures implemented by the Chinese government.

Msimang M (ne), NxumaloCJ(ind ne), Operational performance

SnydersPCCH(ind ne), Stability is expected to characterisethe thermalcoalmarketinthe

Qhena M G (Chair, ind ne),

Tsengwa Dr N (CEO), Koppeschaar P A (FD) months to come, but as normal, may be influenced by stronger

POSTAL ADDRESS:POBox9229, Pretoria,0001 Scan the QR code to supply and lower demand due to various energy sources coming

EMAIL: investorrelations@exxaro.com visit our website into play.

WEBSITE: www.exxaro.com The current domestic macro context, along with stability of export

TELEPHONE: 012-307-5000 FAX: 012-323-3400 pricing, will drive demand and supply dynamics domestically for

COMPANY SECRETARY: M Nana both sized and unsized products. Eskom’s ability to address

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSORS: Absa Bank Ltd., Tamela Holdings (Pty) Ltd. operational challenges and equipment failures will present an

AUDITORS: KPMG Inc. upside for power station coal in the Waterberg region.

BANKERS: Absa Bank Ltd.

114