Page 121 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 121

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – FRO

Frontier Transport Holdings Ltd. Gemfields Group Ltd.

FRO GEM

ISIN: ZAE000300505 SHORT: FRONTIERT CODE: FTH ISIN: GG00BG0KTL52 SHORT: GEMFIELDS CODE: GML

REG NO: 2015/250356/06 FOUNDED: 2015 LISTED: 2018 REG NO: 47656 FOUNDED: 2007 LISTED: 2008

NATURE OF BUSINESS: The current portfolio is rooted in the commuter NATURE OF BUSINESS: Gemfields is a world-leading responsible miner

bus and luxury coach segments. Through its principal subsidiary Golden and marketer of coloured gemstones. Gemfields is the operator and 75%

Arrow Bus Services, with over 160 years of proven operational expertise. owner of both the Kagem emerald mine in Zambia (believed to be the

The company aims to harness the combined institutional knowledge and world’s single largest producing emerald mine) and the Montepuez ruby

skills sets to pursue further prospects in bus and coach operations and mine in Mozambique (one of the most significant recently discovered ruby

potential entrées into freight, rail and logistics operations. deposits in the world). In addition, Gemfields also holds controlling

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Travel&Tour interests in various other gemstone mining and prospecting licences in

NUMBER OF EMPLOYEES: 0 Zambia, Mozambique, Ethiopia and Madagascar.

DIRECTORS: Govender K (ne), Govender L (ld ind ne), SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Dia&Gem

MaguguMF(ind ne), Mkhwanazi N (ind ne), NicolellaJR(ne), NUMBER OF EMPLOYEES: 3 474

WatsonRD(ind ne), Shaik Y (Chair, ne), Meyer F E (CEO), DIRECTORS: Daly K (ne), Mmela K (ld ind ne), Reilly M (ind ne, UK),

Wilkin M L (CFO) SaccoPE(ne), Scott S (ind ne), Cleaver B (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Gilbertson S (CEO), Lovett D (CFO, UK)

HCI 81.88% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

POSTAL ADDRESS: PO Box 115, Cape Town, 8000 Assore International Holdings Ltd. 29.17%

MORE INFO: www.sharedata.co.za/sdo/jse/FTH Rational Expectations (Pty) Ltd. 13.41%

COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd. Ophorst Van Marwijk Kooy Vermogensbeheer NV 9.79%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 186, Royal Chambers, St. Julian’s Avenue,

St. Peter Port, Guernsey, GY1 4HP

SPONSOR: Investec Bank Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/GML

AUDITORS: BDO Cape Inc.

COMPANY SECRETARY: Toby Hewitt

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

FTH Ords no par val 1 000 000 000 292 653 577 SPONSOR: Investec Bank Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: Ernst & Young LLP

Ords no par val Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 12 11 Jun 24 18 Jun 24 24.20 GML Ords USD0.001c ea - 1 167 362 130

Special No 3 6 Feb 24 12 Feb 24 137.38

DISTRIBUTIONS [USDc]

LIQUIDITY: Oct24 Avg 156 026 shares p.w., R992 364.1(2.8% p.a.) Ords USD0.001c ea Ldt Pay Amt

Final No 3 4 Jun 24 24 Jun 24 0.86

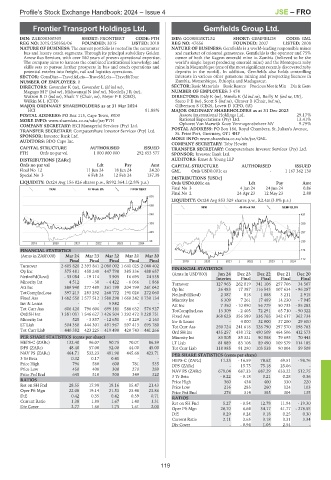

TRAV 40 Week MA FRONTIERT

Final No 2 24 Apr 23 12 May 23 2.88

835

LIQUIDITY: Oct24 Avg 853 329 shares p.w., R2.4m(3.8% p.a.)

688

MINI 40 Week MA GEMFIELDS

540 421

393 359

245 297

98 235

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 174

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final Final Final Final 2019 | 2020 | 2021 | 2022 | 2023 | 2024 112

Turnover 2 605 820 2 393 841 2 080 002 1 641 025 2 048 402 FINANCIAL STATISTICS

Op Inc 575 481 458 248 447 798 385 336 488 657

(Amts in USD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

NetIntPd(Rcvd) - 33 084 - 19 114 3 905 16 695 24 538 Interim Final Final Final Final

Minority Int 4 512 - 30 - 4 422 - 6 066 1 868 Turnover 127 963 262 019 341 106 257 706 34 567

Att Inc 389 940 277 489 261 199 204 799 261 042 Op Inc 26 483 17 387 116 543 107 634 - 96 287

TotCompIncLoss 397 213 283 292 260 772 191 026 272 060 NetIntPd(Rcvd) 2 387 818 1 888 3 211 2 915

Fixed Ass 1 682 550 1 577 512 1 588 298 1 660 242 1 730 134

Minority Int 6 309 7 261 17 489 14 230 - 7 945

Inv & Loans - - 5 882 - - Att Inc 7 350 - 10 090 56 779 50 733 - 85 282

Tot Curr Ass 606 420 796 606 699 181 588 632 576 927 TotCompIncLoss 13 309 - 2 405 72 291 65 710 - 90 322

Ord SH Int 1 381 031 1 546 627 1 426 504 1 292 472 1 228 751 Fixed Ass 368 623 356 589 336 765 342 617 362 734

Minority Int 525 - 3 857 - 12 651 - 8 229 - 2 163 Inv & Loans - 4 000 32 000 37 200 29 600

LT Liab 504 350 444 301 491 967 597 413 695 780 Tot Curr Ass 250 724 241 618 328 790 297 570 198 783

Tot Curr Liab 440 382 423 225 419 490 420 743 441 266

Ord SH Int 435 257 438 172 490 509 464 506 412 573

PER SHARE STATISTICS (cents per share) Minority Int 83 505 85 321 90 588 79 695 70 443

HEPS-C (ZARc) 132.40 96.07 90.75 70.01 86.39 LT Liab 81 889 83 108 89 490 109 579 114 185

DPS (ZARc) 48.40 57.00 52.00 44.00 45.00 Tot Curr Liab 118 985 91 290 103 538 90 004 59 509

NAV PS (ZARc) 464.71 532.23 491.90 445.68 423.71 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.32 0.17 0.41 - - HEPS-C (ZARc) 11.23 - 16.59 78.62 69.51 - 98.76

Price High 796 580 600 781 535 DPS (ZARc) - 15.75 75.18 25.06 -

Price Low 450 408 300 270 289 NAV PS (ZARc) 679.04 687.33 687.29 633.22 512.75

Price Prd End 645 510 500 349 320 3 Yr Beta - 0.22 - 0.18 0.21 0.28 0.36

RATIOS Price High 360 434 400 330 220

Ret on SH Fnd 28.55 17.98 18.16 15.47 21.43 Price Low 216 285 260 124 103

Oper Pft Mgn 22.08 19.14 21.53 23.48 23.86 Price Prd End 276 314 385 304 135

D:E 0.42 0.35 0.42 0.59 0.71 RATIOS

Current Ratio 1.38 1.88 1.67 1.40 1.31 Ret on SH Fnd 5.27 - 0.54 12.78 11.94 - 19.30

Div Cover 2.77 1.68 1.73 1.61 2.00

Oper Pft Mgn 20.70 6.64 34.17 41.77 - 278.55

D:E 0.29 0.24 0.18 0.25 0.30

Current Ratio 2.11 2.65 3.18 3.31 3.34

Div Cover - - 0.94 1.05 2.54 -

119