Page 123 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 123

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – GOL

POSTAL ADDRESS: PostnetSuite 252, Private Bag

Gold Fields Ltd. X30500, Houghton, 2041

GOL EMAIL: investors@goldfields.com

ISIN: ZAE000018123 WEBSITE: www.goldfields.com

SHORT: GFIELDS TELEPHONE: 011-562-9700

CODE: GFI

REG NO: 1968/004880/06 COMPANY SECRETARY: Anré Weststrate

FOUNDED: 1998 TRANSFER SECRETARY: Computershare Investor

LISTED: 1998 Services (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa Ltd.

Scan the QR code to AUDITORS: PwC Inc.

NATURE OF BUSINESS: visit our website

BANKERS: Standard Bank of SA Ltd.

Gold Fields is a globally di- SEGMENTAL REPORTING as at 31 Dec 23 (asa%of Revenue)

versified gold producer with Australia 45.78%

nine operating mines in Ghana 30.35%

Australia, South Africa, Ghana, Chile and Peru and one project South Africa 13.84%

10.03%

Peru

in Canada. We have total attributable annual gold-equivalent

production of 2.30Moz, proved and probable gold Mineral CALENDAR Expected Status

Reserves of 46.1Moz, measured and indicated gold Mineral Next Interim Results Aug 2024 Unconfirmed

Resources of 31.1Moz (excluding Mineral Reserves) and Next Final Results Feb 2025 Unconfirmed

inferred Gold Mineral Resources of 11.2Moz (excluding Annual General Meeting May 2025 Unconfirmed

Mineral Reserves). Our shares are listed on the Johannesburg

CAPITAL STRUCTURE AUTHORISED ISSUED

Stock Exchange (JSE) and our American depositary shares GFI Ords 50c ea 1 000 000 000 895 024 247

trade on the New York Exchange (NYSE).

DISTRIBUTIONS [ZARc]

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin Ords 50c ea Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2024 Interim No 100 10 Sep 24 16 Sep 24 300.00

Public Investment Corporation (Pretoria) 16.08% Final No 99 12 Mar 24 18 Mar 24 420.00

VanEck Global (New York) 4.85% Interim No 98 5 Sep 23 11 Sep 23 325.00

Vanguard Group (Philadelphia) 4.05% Final No 97 14 Mar 23 20 Mar 23 445.00

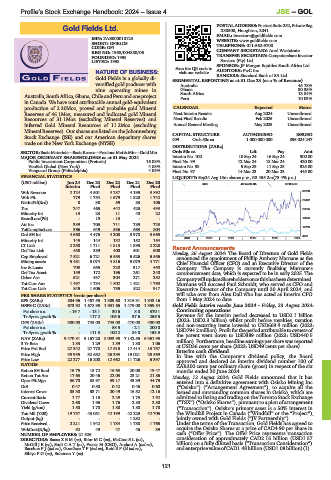

FINANCIAL STATISTICS LIQUIDITY: Sep24 Avg 13m shares p.w., R3 455.2m(73.4% p.a.)

(USD million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final MINI 40 Week MA GFIELDS

Wrk Revenue 2 124 4 501 4 287 4 195 3 892 35750

Wrk Pft 779 1 754 1 679 1 820 1 742

NetIntPd(Rcd) 8 38 59 83 106 29492

Tax 247 465 442 425 433

23234

Minority Int 13 23 11 40 22

ExordLoss(Pft) - 19 - 13 - - 16976

Att Inc 389 703 711 789 723

TotCompIncLoss 396 649 536 663 804 10719

Ord SH Int 4 660 4 476 4 208 3 978 3 665

4461

Minority Int 145 144 132 152 164 2019 | 2020 | 2021 | 2022 | 2023 | 2024

LT Liab 2 258 1 711 1 813 1 895 2 228 Recent Announcements

Def Tax Liab 458 389 400 501 500

Cap Employed 7 521 6 721 6 553 6 526 6 556 Monday, 26 August 2024: The Board of Directors of Gold Fields

announced the appointment of Phillip Anthony Murnane as the

Mining assets 5 481 5 074 4 816 5 079 4 771 Chief Financial Officer (CFO) and an Executive Director of the

Inv & Loans 708 655 220 317 450 Company. The Company is currently finalising Murnane’s

Def Tax Asset 159 172 196 261 240 commencement date, which is expected to be in early 2025. The

Other Ass 521 437 304 271 252 CompanywillupdateShareholdersoncethishasbeendetermined.

Tot Curr Ass 1 497 1 734 1 802 1 421 1 760 Murnane will succeed Paul Schmidt, who served as CFO and

Tot Curr Liab 845 1 506 785 822 917 Executive Director of the Company until 30 April 2024, and

PER SHARE STATISTICS (cents per share) will take over from Alex Dall who has acted as Interim CFO

EPS (ZARc) 804.96 1 457.55 1 309.60 1 316.31 1 343.16 from 1 May 2024 to date.

HEPS-C (ZARc) 673.92 1 678.95 1 931.66 1 479.00 1 359.54 Gold Fields interim results June 2024 - Friday, 23 August 2024:

Pct chng p.a. - 19.7 - 13.1 30.6 8.8 370.1 Continuing operations

Tr 5yr av grwth % - 117.2 105.6 97.6 256.5 Revenuefor theinterim period decreasedtoUSD2.1billion

DPS (ZARc) 300.00 745.00 745.00 470.00 480.00 (2023: USD2.3 billion) whilst profit before royalties, taxation

Pct chng p.a. - - 58.5 - 2.1 200.0 and non-recurring items lowered to USD669.4 million (2023:

Tr 5yr av grwth % - 111.3 100.2 84.8 153.3 USD794.2million).Profitfortheperiodattributabletoownersof

NAV (ZARc) 9 470.81 9 167.20 8 033.95 7 142.55 6 361.95 the parent went down to USD389 million (2023: USD440.5

3 Yr Beta 1.33 1.29 1.39 1.30 1.06 million). Furthermore, headline earnings per share was reported

Price Prd End 27 342 27 778 17 615 17 414 13 757 at USD36 cents per share (2023: USD49 cents per share).

Interim cash dividend

Price High 35 955 32 652 26 293 19 021 25 569 In line with the Company’s dividend policy, the Board

Price Low 22 277 16 200 12 662 11 726 6 397 approved and declared an interim dividend number 100 of

RATIOS ZAR300 cents per ordinary share (gross) in respect of the six

Ret on SH fund 16.75 15.72 16.63 20.08 19.47 months ended 30 June 2024.

Ret on Tot Ass 17.63 20.46 22.03 23.21 21.86 Monday, 12 August 2024: Gold Fields announcedthatithas

Oper Pft Mgn 36.70 38.97 39.17 43.39 44.75 entered into a definitive agreement with Osisko Mining Inc.

D:E 0.47 0.50 0.42 0.46 0.60 (“Osisko”) (“Arrangement Agreement”), to acquire all the

Interest Cover 85.30 33.71 20.49 16.52 12.16 issued and outstanding common shares in Osisko, which are

Current Ratio 1.77 1.15 2.29 1.73 1.92 admitted to listing and trading on the Toronto Stock Exchange

Dividend Cover 2.68 1.96 1.76 2.80 2.80 (“TSX”) (“Osisko Shares”), pursuant to a plan of arrangement

Yield (g/ton) 1.50 1.70 1.80 1.80 1.70 (“Transaction”). Osisko’s primary asset is a 50% interest in

Ton Mll (‘000) 19 757 43 051 42 199 42 229 42 706 the Windfall Project in Canada (“Windfall” or the “Project”),

Output (kg) - - - 1 282 - jointly owned with Gold Fields (“JV Partnership”).

Price Received 2 211 1 942 1 784 1 788 1 765 Under the terms of the Transaction, Gold Fields has agreed to

WrkCost(R/kg) 52 49 47 46 39 acquire the Osisko Shares at a price of CAD4.90 per share in

NUMBER OF EMPLOYEES: 21 526 cash (“Offer Price”). The Offer Price represents transaction

DIRECTORS: BassaZBM(ne), BitarMC(ne), McCraeSL(ne), consideration of approximately CAD2.16 billion (USD1.57

McGillJE(ne), SmitCAT(ne), Fraser M (CEO), Andani A (ind ne), billion) on a fully diluted basis (“Transaction Consideration”)

BacchusPJ(ind ne), GoodlaceTP(ind ne), ReidSP(ld ind ne), and enterprise value ofCAD1.48 billion(USD1.08 billion)(1).

SibiyaPG(ne), Suleman Y (ne)

121