Page 115 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 115

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – EUR

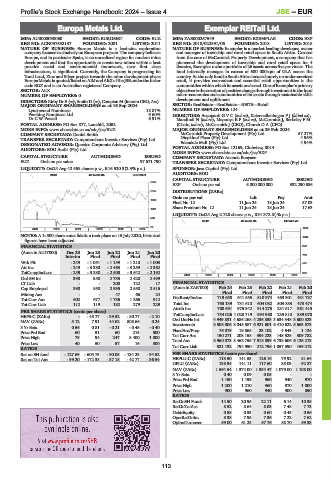

Europa Metals Ltd. Exemplar REITail Ltd.

EUR EXE

ISIN: AU0000090060 SHORT: EUROMET CODE: EUZ ISIN: ZAE000257549 SHORT: EXEMPLAR CODE: EXP

REG NO: ACN097532137 FOUNDED: 2001 LISTED: 2011 REG NO: 2018/022591/06 FOUNDED: 2018 LISTED: 2018

NATURE OF BUSINESS: Europa Metals is a lead-zinc exploration NATURE OF BUSINESS: Exemplar is a market leading developer, owner

company focused exclusively on European projects. The company believes and manager of township and rural retail space in South Africa. Created

Europe, and in particular Spain, is an unrealised region for modern mine from the core of McCormick Property Development, a company that has

development and that the opportunity to create new mines within a best pioneered the development of township and rural retail space for 4

practice social and environmental framework, near first class decades, Exemplar owns a portfolio of 26 assets across five provinces. The

infrastructure, is significant. Currently, the Company is progressing its fund internally manages in excess of 600 000sqm of GLA across the

Toral Lead, Zinc and Silver project towards the mine development phase. country. As the only fund in South Africa focused purely on under-serviced

Europa Metals is quoted/listed on AIM and AltX of the JSE under the ticker retail, it provides convenient and essential retail opportunities to the

code EUZ and is an Australian registered Company. communities within which its assetsare based. One of Exemplar’s primary

SECTOR: AltX objectivesisthecreationofpositivechangethrough investmentinthelocal

NUMBER OF EMPLOYEES: 0 micro-economies and communities of its assets through sustainable skills

DIRECTORS: Kirby Dr E (ne), Smith D (ne), Campion M (Interim CEO, Aus) development and upliftment.

MAJOR ORDINARY SHAREHOLDERS as at 16 Sep 2024 SECTOR: RealEstate—RealEstate—REITS—Retail

Lynchwood Nominees 18.87% NUMBER OF EMPLOYEES: 124

Pershing Nominees Ltd. 9.60% DIRECTORS: AzzopardiGVC(ind ne), KatzenellenbogenPJ(ld ind ne),

Dr C W Powell 6.91% Mandindi N (ind ne), MaponyaEP(ind ne), McCormick J, Berkeley F M

POSTAL ADDRESS: PO Box 877, Lonehill, 2062 (Chair, ind ne), McCormick J (CEO), Church D A (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/EUZ MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

COMPANY SECRETARY: Daniel Smith McCormick Property Development (Pty) Ltd. 57.27%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Diepkloof Plaza (Pty) Ltd. 4.95%

4.94%

Edendale Mall (Pty) Ltd.

DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd. POSTAL ADDRESS: PO Box 12169, Clubview, 0014

AUDITORS: BDO Audit (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/EXP

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Ananda Booysen

EUZ Ords no par value - 97 671 790 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

LIQUIDITY: Oct24 Avg 42 558 shares p.w., R16 520.3(2.3% p.a.) SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: BDO

INDM 40 Week MA EUROMET

CAPITAL STRUCTURE AUTHORISED ISSUED

2665

EXP Ords no par val 5 000 000 000 332 290 686

2137 DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

1609 Final No 12 11 Jun 24 18 Jun 24 57.03

Share Premium No 12 11 Jun 24 18 Jun 24 17.63

1081

LIQUIDITY: Oct24 Avg 2 728 shares p.w., R31 372.8(-% p.a.)

553

REIV 40 Week MA EXEMPLAR

25 1210

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: A 1: 500 share consolidation took place on 15 July 2020, historical 1044

figures have been adjusted.

FINANCIAL STATISTICS 878

(Amts in AUD’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final Final Final 713

Wrk Pft - 249 - 1 051 - 1 159 - 1 210 - 1 003

547

Att Inc - 249 - 3 380 - 2 463 - 3 259 - 2 362

TotCompIncLoss - 249 - 3 380 - 2 503 - 3 642 - 2 192 381

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Ord SH Int 390 558 2 735 2 428 2 499

LT Liab - - 200 122 17 FINANCIAL STATISTICS

Cap Employed 390 558 2 935 2 550 2 516 (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Mining Ass - - 47 66 24 Final Final Final Final Final

Tot Curr Ass 502 677 1 736 1 266 912 NetRent/InvInc 719 658 641 555 510 974 463 301 431 737

Tot Curr Liab 112 119 182 279 229 Total Inc 763 139 731 610 604 082 503 883 473 474

Attrib Inc 708 691 975 342 914 275 231 517 361 415

PER SHARE STATISTICS (cents per share) TotCompIncLoss 754 026 1 028 719 994 960 235 810 389 078

HEPS-C (ZARc) - - 45.77 - 39.52 - 80.77 - 2.10 Ord UntHs Int 4 949 831 4 686 268 4 236 853 3 634 348 3 600 523

NAV (ZARc) 5.12 7.91 44.62 808.66 0.24 Investments 8 508 006 8 045 587 6 921 601 6 410 622 5 663 873

3 Yr Beta 0.56 0.81 - 0.21 - 0.45 - 0.40 FixedAss/Prop 76 879 19 865 23 102 4 543 1 124

Price Prd End 60 51 60 215 500 Tot Curr Ass 150 271 208 158 394 223 148 525 309 782

Price High 79 94 247 8 400 1 000 Total Ass 8 960 073 8 463 755 7 518 899 6 738 606 6 126 213

Price Low 40 50 57 16 500 Tot Curr Liab 521 132 794 950 212 796 1 057 390 169 212

RATIOS

Ret on SH fund - 127.69 - 605.73 - 90.05 - 134.23 - 94.52 PER SHARE STATISTICS (cents per share)

Ret on Tot Ass - 99.20 - 172.38 - 37.18 - 42.77 - 36.54 HEPLU-C (ZARc) 113.50 141.53 126.16 79.92 81.64

DPLU (ZARc) 138.94 141.11 117.60 85.03 92.27

NAV (ZARc) 1 564.54 1 374.00 1 354.47 1 079.00 1 108.00

3 Yr Beta 0.40 0.09 0.05 - -

Price Prd End 1 150 1 199 960 940 970

Price High 1 200 1 210 960 970 1 000

Price Low 900 960 940 900 850

RATIOS

RetOnSH Funds 14.50 20.95 22.11 6.14 10.35

RetOnTotAss 8.52 8.64 8.03 7.48 7.73

Debt:Equity 0.58 0.53 0.60 0.45 0.56

OperRetOnInv 8.38 7.95 7.36 7.22 7.62

OpInc:Turnover 59.00 61.25 57.76 58.70 59.33

113