Page 100 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 100

JSE – CIL Profile’s Stock Exchange Handbook: 2024 – Issue 4

Cilo Cybin Holdings Ltd. City Lodge Hotels Ltd.

CIL CIT

ISIN: ZAE000310397 SHORT: CILOCYBIN CODE: CCC ISIN: ZAE000117792 SHORT: CITYLDG CODE: CLH

REG NO: 2022/320351/06 FOUNDED: 2022 LISTED: 2024 REG NO: 1986/002864/06 FOUNDED: 1985 LISTED: 1992

NATURE OF BUSINESS: Cilo Cybin Holdings Ltd. will combine NATURE OF BUSINESS: The group owns and operates high-quality,

businesses within the Biohacking, Biotech and Pharmaceutical affordablehotelstargetedatthebusinesscommunityandleisuretraveller.

methodologies through an Artificial Intelligence (AI) platform to deliver a SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Hotels&Motels

holistic and legalised solution that will enable its customers insights into NUMBER OF EMPLOYEES: 2 028

enhanced diagnosis and customised treatment plans to promote their DIRECTORS: Enderle S (ne), HuysamerGG(ind ne), Lapping A (ind ne),

health, performance, and longevity. Marutlulle DrSM(ind ne), MokokaMG(ind ne), Ngcuka B T (Chair,

SECTOR: AltX ind ne), KilbournFWJ (Dep Chair, ind ne), Widegger A C (CEO),

NUMBER OF EMPLOYEES: 0 Nathoo D (CFO), Sangweni-Siddo L (COO)

DIRECTORS: Tham Dr S K (Non-Executive, ne), Baduza S (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 23 Sep 2024

ChewYL(ne), LowWS(ind ne), Mohd RazefBA(ind ne), Moodley Enderle SA (Pty) Ltd. 8.91%

Theron J (ne), Teoh L (ne), Theron G (CEO), Ledwaba R M (CFO) Entertainment Holdings 8.20%

POSTAL ADDRESS: 7 Sterling Street, The Point Office Park, Unit C1, Allan Gray 7.93%

Samrand, 0157 POSTAL ADDRESS: PO Box 97, Cramerview, 2060

MORE INFO: www.sharedata.co.za/sdo/jse/CCC MORE INFO: www.sharedata.co.za/sdo/jse/CLH

COMPANY SECRETARY: Acorim (Pty) Ltd. COMPANY SECRETARY: Melanie van Heerden

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: DEA-RU (Pty) Ltd. SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: Nexia SAB&T Inc. AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

CCC Ords no par value 2 000 000 000 71 017 906 CLH Ords 10c ea - 598 146 832

LIQUIDITY: Oct24 Avg 45 168 shares p.w., R296 880.2(3.3% p.a.) DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt

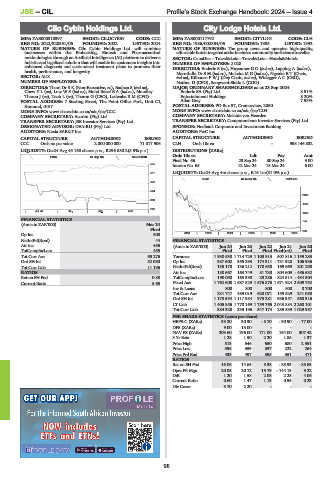

FINA 80 Day MA CILOCYBIN

Final No 66 23 Sep 24 30 Sep 24 9.00

958 Interim No 65 12 Mar 24 18 Mar 24 6.00

LIQUIDITY: Oct24 Avg 4m shares p.w., R16.1m(31.0% p.a.)

817

TRAV 40 Week MA CITYLDG

676

534

2298

393

1783

252

| Jul 24 | Aug | Sep | Oct |

1269

FINANCIAL STATISTICS

754

(Amts in ZAR’000) Mar 24

Final

Op Inc 500 2019 | 2020 | 2021 | 2022 | 2023 | 2024 239

NetIntPd(Rcvd) 44 FINANCIAL STATISTICS

Att Inc 456 (Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

TotCompIncLoss 455 Final Final Final Final(rst) Final

Tot Curr Ass 63 276 Turnover 1 930 538 1 714 729 1 103 913 507 816 1 159 283

Ord SH Int 52 080 Op Inc 387 602 355 293 174 311 - 731 928 106 936

Tot Curr Liab 11 196 NetIntPd(Rcvd) 133 178 136 212 178 658 169 669 201 298

RATIOS Att Inc 188 667 163 749 81 730 - 804 609 - 486 632

RetonSHFnd 0.88 TotCompIncLoss 190 050 163 390 29 286 - 824 514 - 434 504

Current Ratio 5.65 Fixed Ass 1 762 608 1 687 829 1 576 876 1 671 924 2 509 752

Inv & Loans 800 800 800 800 8 700

Tot Curr Ass 231 747 489 019 620 071 159 529 241 088

Ord SH Int 1 173 594 1 117 984 975 281 936 357 568 316

LT Liab 1 405 856 1 770 169 1 759 765 2 043 884 2 260 101

Tot Curr Liab 384 328 333 196 547 174 289 539 1 029 987

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 33.20 30.30 - 8.70 - 90.90 - 77.00

DPS (ZARc) 9.00 13.00 - - -

NAV PS (ZARc) 209.60 196.00 171.00 164.00 307.42

3 Yr Beta 1.28 1.50 2.20 1.85 1.37

Price High 513 546 650 680 2 351

Price Low 395 359 337 222 264

Price Prd End 433 497 395 351 471

RATIOS

Ret on SH Fnd 16.08 14.65 8.38 - 85.93 - 85.63

Oper Pft Mgn 20.08 20.72 15.79 - 144.13 9.22

D:E 1.20 1.58 2.08 2.28 4.06

Current Ratio 0.60 1.47 1.13 0.55 0.23

Div Cover 3.70 2.20 - - -

98