Page 97 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 97

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – CAS

EMAIL: mkeyter@kris.co.za

Cashbuild Ltd. WEBSITE: www.cashbuild.co.za

CAS TELEPHONE: 011-248-1500 FAX: 086-666-3291

COMPANY SECRETARY: Takalani Nengovhela

TRANSFER SECRETARY: JSE Investor Services

(Pty) Ltd.

SPONSORS: Nedbank Corporate and Investment

Banking, a division of Nedbank Ltd.

AUDITORS: Deloitte & Touche

Scan the QR code to BANKERS: First National Bank, Nedbank Ltd.,

visit our website Standard Bank of SA Ltd.

ISIN: ZAE000028320 SHORT: CASHBIL CODE: CSB

REG NO: 1986/001503/06 FOUNDED: 1978 LISTED: 1986

CALENDAR Expected Status

NATURE OF BUSINESS: Annual General Meeting Nov 2024 Unconfirmed

Cashbuild is southern Africa’s leading retailer of quality Next Interim Results Mar 2025 Unconfirmed

building materials and associated products, selling direct to a Next Final Results Sep 2025 Unconfirmed

predominantly cash-paying customer base through our chain

of stores 322 stores at the end of the financial year. Cashbuild CAPITAL STRUCTURE AUTHORISED ISSUED

carries an in-depth quality product range tailored to the CSB Ords 1c ea 35 000 000 23 694 712

specific needs of the communities we serve. Our customers DISTRIBUTIONS [ZARc]

are typically home-builders and improvers, contractors, Ords 1c ea Ldt Pay Amt

farmers, traders, as well as all other customers requiring Final No 63 23 Sep 24 30 Sep 24 236.00

quality building materials at the best value. Interim No 62 18 Mar 24 25 Mar 24 325.00

Final No 61 19 Sep 23 26 Sep 23 332.00

Cashbuild has built its credibility and reputation by consis- Interim No 60 20 Mar 23 27 Mar 23 400.00

tently offering its customers quality building materials at the

best value through a purchasing and inventory policy that LIQUIDITY: Sep24 Avg 81 077 shares p.w., R12.5m(17.8% p.a.)

ensures customers’ requirements are always met. GERE 40 Week MA CASHBIL

33432

SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 29090

Allan Gray (Pty) Ltd. 15.53%

Public Investment Corporation (SOC) Ltd. 13.72% 24748

Cashbuild Empowerment Trust 7.45%

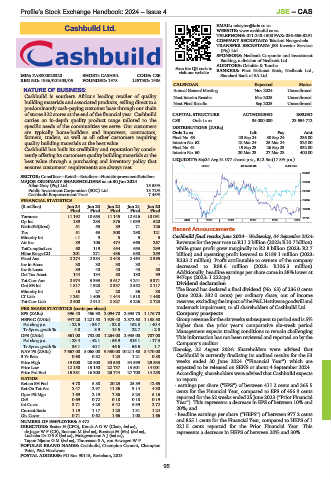

FINANCIAL STATISTICS 20405

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final Final Final Final 16063

Turnover 11 192 10 653 11 145 12 616 10 091

11721

Op Inc 189 233 876 1 039 520 2019 | 2020 | 2021 | 2022 | 2023 | 2024

NetIntPd(Rcvd) 51 55 89 71 126 Recent Announcements

Tax 51 63 308 298 121

Minority Int - 1 9 5 5 5 Cashbuild final results June 2024 - Wednesday, 04 September 2024:

Att Inc 89 106 474 665 267 Revenue for the year rose to R11.2 billion (2023: R10.7 billion)

TotCompIncLoss 68 119 454 653 299 while gross profit grew marginally to R2.8 billion (2023: R2.7

Hline Erngs-CO 201 271 436 650 259 billion) and operating profit lowered to R189.1 million (2023:

Fixed Ass 2 274 2 384 2 443 2 464 2 395 R233.2 million). Profit attributable to owners of the company

Inv in Assoc 30 30 30 30 - decreased to R88.6 million (2023: R106.3 million).

Inv & Loans 39 40 40 43 58 Additionally, headline earnings per share came in 38% lower at

Def Tax Asset 144 134 80 130 99 947cps (2023: 1 222cps)

Tot Curr Ass 2 974 3 393 3 617 4 241 3 371 Dividend declaration

Ord SH Int 1 817 1 928 2 337 2 552 2 117

Minority Int 16 27 28 36 38 The Board has declared a final dividend (No. 63) of 236.0 cents

LT Liab 1 261 1 405 1 444 1 518 1 468 (June 2023: 332.0 cents) per ordinary share, out of income

Tot Curr Liab 2 500 2 912 2 827 3 226 2 723 reserves,excludingtheimpactoftheP&LHardwaregoodwilland

PER SHARE STATISTICS (cents per share) trademark impairment, to all shareholders of Cashbuild Ltd.

EPS (ZARc) 396.40 456.90 2 094.70 2 935.70 1 176.70 Company prospects

HEPS-C (ZARc) 947.20 1 221.50 1 929.40 2 872.60 1 138.50 Group revenue for the six weeks subsequent to period end is 5%

Pct chng p.a. - 22.5 - 36.7 - 32.8 152.3 - 40.4 higher than the prior year’s comparative six-week period.

Tr 5yr av grwth % 4.0 8.9 14.5 22.7 - 2.8 Management expects trading conditions to remain challenging.

DPS (ZARc) 561.00 732.00 1 264.00 2 935.00 707.00 This information has not been reviewed and reported on by the

Pct chng p.a. - 23.4 - 42.1 - 56.9 315.1 - 17.3 Company’s auditor.

Tr 5yr av grwth % 35.1 40.1 46.6 56.6 1.7

NAV PS (ZARc) 7 667.00 8 068.00 9 350.00 10 211.60 8 470.00 Thursday, 22 August 2024: Shareholders were advised that

3 Yr Beta 0.60 0.82 1.23 1.21 0.88 Cashbuild is currently finalising its audited results for the 53

Price High 19 000 28 500 30 550 34 599 29 533 weeks ended 30 June 2024 (“Financial Year”) which are

Price Low 12 150 15 150 22 737 13 501 14 001 expected to be released on SENS or about 4 September 2024.

Price Prd End 15 381 16 300 25 744 27 700 14 258 Accordingly, shareholders were advised that Cashbuild expects

RATIOS to report:

Ret on SH Fnd 4.78 5.88 20.25 25.89 12.65 - earnings per share (“EPS”) of between 411.2 cents and 365.5

Ret On Tot Ass 2.47 2.97 11.86 9.14 4.30 cents for the Financial Year, compared to EPS of 456.9 cents

Oper Pft Mgn 1.69 2.19 7.86 8.23 5.16 reported for the 52 weeks ended 25 June 2023 (“Prior Financial

D:E 0.69 0.72 0.18 0.18 0.19 Year”). This represents a decrease in EPS of between 10% and

Int Cover 3.71 4.23 5.42 6.39 2.72

Current Ratio 1.19 1.17 1.28 1.31 1.24 20%; and

Div Cover 0.71 0.62 1.66 1.00 1.66 - headline earnings per share (“HEPS”) of between 977.2 cents

NUMBER OF EMPLOYEES: 5 472 and 855.1 cents for the Financial Year, compared to HEPS of 1

DIRECTORS: Bester H (CFO), KnockAGW (Chair, ind ne), 221.5 cents reported for the Prior Financial Year. This

de Jager W F (CE), Bosman M (ind ne), Bosman M (Ms) (ind ne), represents a decrease in HEPS of between 20% and 30%.

Lushaba DrDSS(ind ne), MokgwatsaneAJ(ind ne),

Tapon NjamoGM(ind ne), Thoresson S A, van Aswegen W P

POPULAR BRAND NAMES: Cashbuild, Champion Cement, Champion

Paint, P&L Hardware

POSTAL ADDRESS: PO Box 90115, Bertsham, 2013

95