Page 95 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 95

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – CAP

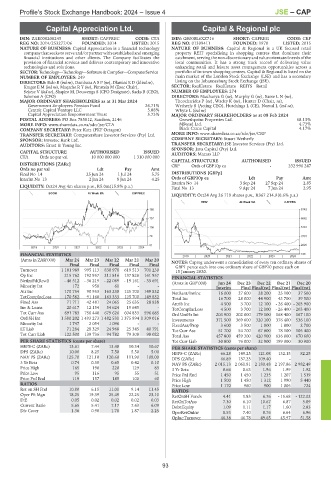

Capital Appreciation Ltd. Capital & Regional plc

CAP CAP

ISIN: ZAE000208245 SHORT: CAPPREC CODE: CTA ISIN: GB00BL6XZ716 SHORT: CAPREG CODE: CRP

REG NO: 2014/253277/06 FOUNDED: 2014 LISTED: 2015 REG NO: 01399411 FOUNDED: 1978 LISTED: 2015

NATURE OF BUSINESS: Capital Appreciation is a financial technology NATURE OF BUSINESS: Capital & Regional is a UK focused retail

company that seeks to serve and/or partner with established and emerging property REIT specialising in shopping centres that dominate their

financial institutions and other clients. The Company facilitates the catchment, servingthenon-discretionaryandvalueorientatedneedsofthe

provision of financial services and delivers contemporary and innovative local communities. It has a strong track record of delivering value

technologies and solutions. enhancing retail and leisure asset management opportunities across a

SECTOR:Technology—Technology—Software&CompSer—ComputerService portfolio of in-town shopping centres. Capital & Regional is listed on the

NUMBER OF EMPLOYEES: 249 main market of the London Stock Exchange (LSE) and has a secondary

DIRECTORS: Bulo B (ind ne), Dambuza A S P (ne), Dlamini K D (ld ind ne), listing on the Johannesburg Stock Exchange (JSE).

Kruger E M (ind ne), Maqache R T (ne), Pimstein M (Exec Chair), SECTOR: RealEstate—RealEstate—REITS—Retail

Sekese V (ind ne), Shapiro M, Douwenga S (CFO Designate), Sacks B (CEO), NUMBER OF EMPLOYEES: 274

Salomon A (CFO) DIRECTORS: Muchanya G (ne), Murphy G (ne), SasseLN(ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Theocharides P (ne), Wadey K (ne), Hunter D (Chair, ne),

Government Employees Pension Fund 26.71% Wetherly S (Acting CEO), Hutchings L (CE), Norval L (ind ne),

Centric Capital Venture LLC 5.88% Whyte L (ind ne)

Capital Appreciation Empowerment Trust 5.73% MAJOR ORDINARY SHAREHOLDERS as at 08 Feb 2024

POSTAL ADDRESS: PO Box 785812, Sandton, 2146 Growthpoint Properties Ltd. 68.13%

MORE INFO: www.sharedata.co.za/sdo/jse/CTA MStead Ltd. 4.73%

COMPANY SECRETARY: Peter Katz (PKF Octagon) Black Crane Capital 4.17%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/CRP

SPONSOR: Investec Bank Ltd. COMPANY SECRETARY: Stuart Wetherly

AUDITORS: Ernst & Young Inc. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Mazars LLP

CTA Ords no par val 10 000 000 000 1 310 000 000

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] CRP Ords of GBP10p ea - 232 996 247

Ords no par val Ldt Pay Amt

Final No 14 25 Jun 24 1 Jul 24 5.75 DISTRIBUTIONS [GBPp]

Interim No 13 2 Jan 24 8 Jan 24 4.25 Ords of GBP10p ea Ldt Pay Amt

Interim No 14 3 Sep 24 27 Sep 24 2.85

LIQUIDITY: Oct24 Avg 4m shares p.w., R5.0m(15.8% p.a.)

Final No 13 9 Apr 24 7 Jun 24 2.95

SCOM 40 Week MA CAPPREC

LIQUIDITY: Oct24 Avg 26 719 shares p.w., R367 214.9(0.6% p.a.)

REIV 40 Week MA CAPREG

166 8142

137 6662

108 5181

79 3701

51 2220

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 2019 | 2020 | 2021 | 2022 | 2023 | 2024 740

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 NOTES: Capreg underwent a consolidation of every ten ordinary shares of

Final Final Final Final Final GBP1 pence each into one ordinary share of GBP10 pence each on

Turnover 1 181 989 995 113 830 978 619 513 701 230 15 January 2020.

Op Inc 215 762 192 957 211 816 137 828 161 957 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 46 512 - 36 219 - 22 069 - 19 161 - 35 691 (Amts in GBP’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Minority Int 172 958 61 - - Interim Final Final(rst) Final(rst) Final(rst)

Att Inc 170 754 90 953 163 230 125 700 149 832 NetRent/InvInc 16 000 27 600 28 200 25 100 37 500

TotCompIncLoss 170 582 91 160 163 333 125 700 149 832 Total Inc 16 700 28 000 44 900 43 700 39 500

Fixed Ass 71 711 42 481 24 065 25 635 28 838 Attrib Inc 4 500 3 700 12 100 - 26 400 - 203 900

Inv & Loans 20 617 12 154 54 624 19 645 - TotCompIncLoss 4 500 3 700 12 100 - 26 400 - 203 400

Tot Curr Ass 691 783 756 440 679 626 604 833 596 685 Ord UntHs Int 203 900 202 000 179 100 168 400 167 100

Ord SH Int 1 580 202 1 493 273 1 482 531 1 375 894 1 309 016 Investments 371 500 369 600 320 100 376 400 536 100

Minority Int 1 747 2 054 1 096 - - FixedAss/Prop 3 600 3 500 1 800 1 800 2 700

LT Liab 71 284 28 329 24 968 25 345 40 791 Tot Curr Ass 51 700 54 700 67 800 78 100 105 400

Tot Curr Liab 122 500 139 736 94 782 79 308 98 022 Total Ass 457 800 459 300 420 900 636 000 670 600

PER SHARE STATISTICS (cents per share) Tot Curr Liab 30 800 76 000 32 900 199 000 30 900

HEPS-C (ZARc) 13.61 7.44 13.40 10.34 10.67 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 10.00 8.25 7.50 5.50 5.00 HEPS-C (ZARc) 66.28 149.25 121.08 132.15 82.25

NAV PS (ZARc) 125.70 121.10 120.60 111.90 109.00 DPS (ZARc) 66.89 137.23 109.40 - -

3 Yr Beta 0.74 0.38 0.65 0.42 0.10 NAV PS (ZARc) 2 015.13 2 061.81 2 180.48 2 197.86 2 982.49

Price High 165 190 220 129 83 3 Yr Beta 0.66 0.63 1.96 1.99 1.92

Price Low 95 116 95 55 51 Price Prd End 1 450 1 450 1 235 1 207 1 519

Price Prd End 119 157 185 100 60 Price High 1 500 1 450 1 312 1 990 5 440

RATIOS Price Low 1 170 960 900 1 005 724

Ret on SH Fnd 10.80 6.15 11.01 9.14 11.45 RATIOS

Oper Pft Mgn 18.25 19.39 25.49 22.25 23.10 RetOnSH Funds 4.41 1.83 6.76 - 15.68 - 122.02

D:E 0.05 0.02 0.02 0.02 0.03 RetOnTotAss 7.30 6.10 10.67 6.87 5.89

Current Ratio 5.65 5.41 7.17 7.63 6.09

Debt:Equity 1.09 1.11 1.17 1.60 2.83

Div Cover 1.36 0.90 1.78 1.87 2.25 OperRetOnInv 8.53 7.40 8.76 6.64 6.96

OpInc:Turnover 46.38 46.78 49.65 45.97 51.58

93