Page 91 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 91

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – BRA

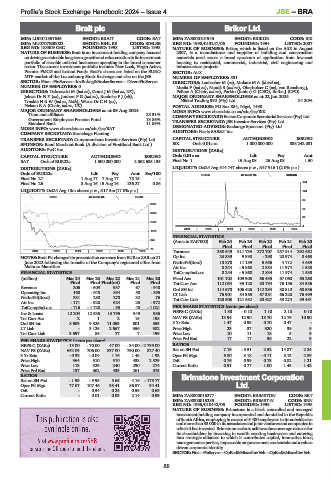

Brait plc Brikor Ltd.

BRA BRI

ISIN: LU0011857645 SHORT: BRAIT CODE: BAT ISIN: ZAE000101945 SHORT: BRIKOR CODE: BIK

ISIN: MU0707E00002 SHORT: BIHL EB CODE: BIHLEB REG NO: 1998/013247/06 FOUNDED: 1994 LISTED: 2007

REG NO: 183309 GBC FOUNDED: 1998 LISTED: 1998 NATURE OF BUSINESS: Brikor, which is listed on the AltX in August

NATURE OF BUSINESS: Brait is an investment holding company focused 2007, is a manufacturer and supplier of building and construction

ondrivingsustainablelong-termgrowthandvaluecreationinitsinvestment materials used across a broad spectrum of application from low-cost

portfolio of sizeable unlisted businesses operating in the broad consumer housing to residential, commercial, industrial, civil engineering and

sector. The current investment portfolio includes New Look, Virgin Active, infrastructure projects.

Premier FMCG and Iceland Foods. Brait’s shares are listed on the EURO SECTOR: AltX

MTF market of the Luxembourg Stock Exchange and also on the JSE. NUMBER OF EMPLOYEES: 581

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs DIRECTORS: Laubscher M (ne), MokateMA(ld ind ne),

NUMBER OF EMPLOYEES: 0 Mtsila F (ind ne), Naudè S (ind ne), Oberholzer C (ne), van Rensburg J,

DIRECTORS: Dabrowski M (ind ne), GrantJM(ind ne, UK), Pellow A (Chair, ind ne), Parkin (Junior) G (CEO), Botha J (CFO)

Jekwa DrNY(ne), JoubertPG(ind ne), RoelofsePJ(alt), MAJOR ORDINARY SHAREHOLDERS as at 22 Jan 2024

TroskieHRW(ind ne, Neth), Wiese DrCH(ne), Nikkel Trading 392 (Pty) Ltd. 84.20%

Nelson R A (Chair, ind ne, UK) POSTAL ADDRESS: PO Box 884, Nigel, 1490

MAJOR ORDINARY SHAREHOLDERS as at 08 Aug 2024 MORE INFO: www.sharedata.co.za/sdo/jse/BIK

Titan and affiliates 25.31% COMPANY SECRETARY: FusionCorporateSecretarialServices(Pty)Ltd.

Government Employees Pension Fund 13.86% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Standard Bank 11.89%

MORE INFO: www.sharedata.co.za/sdo/jse/BAT DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd.

COMPANY SECRETARY: Stonehage Fleming AUDITORS: Nexia SAB&T Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) BIK Ords 0.01c ea 1 000 000 000 838 242 031

AUDITORS: PwC Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords 0.01c ea Ldt Pay Amt

BAT Ords of EUR22c 1 500 000 000 3 862 685 135 Final No 1 15 Aug 08 25 Aug 08 1.50

DISTRIBUTIONS [ZARc] LIQUIDITY: Oct24 Avg 314 747 shares p.w., R47 916.1(2.0% p.a.)

Ords of EUR22c Ldt Pay Amt Scr/100 CONM 40 Week MA BRIKOR

Final No 27 1 Aug 17 7 Aug 17 78.15 -

Final No 26 8 Aug 16 15 Aug 16 136.27 0.86 154

LIQUIDITY: Oct24 Avg 13m shares p.w., R17.5m(17.0% p.a.) 124

GENF 40 Week MA BRAIT

94

3807

64

3062

34

2316

4

2019 | 2020 | 2021 | 2022 | 2023 | 2024

1570

FINANCIAL STATISTICS

825 (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final Final Final Final

79

2019 | 2020 | 2021 | 2022 | 2023 | 2024 Turnover 350 549 311 733 272 707 257 914 292 682

NOTES: Brait Plc changed its presentation currency from EUR to ZAR on 21 Op Inc 23 839 9 898 - 298 20 974 8 463

June 2022 following the transfer of the Company’s registered office from NetIntPd(Rcvd) 13 878 11 189 5 656 4 712 4 689

Malta to Mauritius. Att Inc 8 244 - 5 868 2 834 11 974 1 538

FINANCIAL STATISTICS TotCompIncLoss 8 244 - 5 868 2 834 11 974 1 538

(million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 Fixed Ass 101 102 109 908 66 435 67 060 65 260

Final Final Final(rst) Final Final Tot Curr Ass 112 054 93 120 80 794 76 156 84 536

Revenue 206 - 603 937 67 - 948 Ord SH Int 114 670 106 426 112 294 80 510 68 536

Operating Inc 160 - 648 894 58 - 895 LT Liab 76 901 84 365 67 381 66 228 76 499

NetIntPd(Rcvd) 331 280 270 32 76 Tot Curr Liab 123 503 121 552 80 627 53 274 59 451

Att Inc - 171 - 928 624 25 - 972

TotCompIncLoss - 716 - 1 728 - 35 48 - 1 021 PER SHARE STATISTICS (cents per share)

Inv & Loans 12 204 12 535 13 795 949 936 HEPS-C (ZARc) 1.30 - 0.10 1.10 2.10 0.10

Tot Curr Ass 2 1 2 15 198 NAV PS (ZARc) 13.94 12.90 13.70 12.79 10.90

Ord SH Int 8 609 9 325 11 053 601 553 3 Yr Beta 1.47 0.99 0.70 0.47 -

LT Liab - 3 125 2 667 356 382 Price High 23 37 320 39 9

Tot Curr Liab 3 597 86 77 7 199 Price Low 10 11 18 5 9

PER SHARE STATISTICS (cents per share) Price Prd End 17 17 36 22 9

HEPS-C (ZARc) - 13.00 - 70.00 47.00 34.00 - 2 799.00 RATIOS

NAV PS (ZARc) 652.05 706.00 837.00 790.00 827.40 Ret on SH Fnd 7.19 - 5.51 2.52 14.87 2.24

3 Yr Beta - 0.38 - 0.04 1.16 1.48 1.93 Oper Pft Mgn 6.80 3.18 - 0.11 8.13 2.89

Price High 364 510 510 438 2 529 D:E 0.76 0.99 0.73 0.82 1.21

Price Low 113 329 240 230 274 Current Ratio 0.91 0.77 1.00 1.43 1.42

Price Prd End 137 362 435 261 375

RATIOS

Ret on SH Fnd - 1.99 - 9.95 5.65 4.16 - 175.77 Brimstone Investment Corporation

Oper Pft Mgn 77.67 107.46 95.41 86.57 94.41 Ltd.

D:E - 0.34 0.24 0.59 0.69

BRI

Current Ratio - 0.01 0.03 2.14 0.99 ISIN: ZAE000015277 SHORT: BRIMSTON CODE: BRT

ISIN: ZAE000015285 SHORT: BRIMST-N CODE: BRN

REG NO: 1995/010442/06 FOUNDED: 1995 LISTED: 1998

NATURE OF BUSINESS: Brimstone is a black controlled and managed

investment holding company incorporated and domiciled in the Republic

of South Africa, employing in excess of 5 400 employees in its subsidiaries

and more than 33 000 in its associates and joint ventures and companies in

which it hasinvested.Brimstoneseeks toachieve above average returnsfor

its shareholders by investing in wealth creating businesses and entering

into strategic alliances to which it contributes capital, innovative ideas,

managementexpertise,impeccable empowermentcredentialsandavalues

driven corporate identity.

SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

89