Page 88 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 88

JSE – BEL Profile’s Stock Exchange Handbook: 2024 – Issue 4

Bell Equipment Ltd. BHP Group Ltd.

BEL BHP

ISIN: ZAE000028304 SHORT: BELL CODE: BEL ISIN: AU000000BHP4 SHORT: BHP CODE: BHG

REG NO: 1968/013656/06 FOUNDED: 1968 LISTED: 1995 REG NO: ABN49004028077 FOUNDED: 1885 LISTED: 2022

NATURE OF BUSINESS: Together the Bell Equipment group of NATURE OF BUSINESS: BHP currently operates across three principal

companies manufacture, distribute, export, and support a wide range of asset divisions:

heavy equipment on a global scale to the mining, construction, quarrying, -The Minerals Australia asset group, which includes operated assets in

agriculture, forestry, and waste handling industries. Western Australia, Queensland, New South Wales and South Australia

SECTOR: Inds—IndsGoods&Services—IndsTransport—CommVehicle&Parts andproducesironore,metallurgicalcoal,copper,nickelandenergycoal.

NUMBER OF EMPLOYEES: 2 969 -The Minerals Americas asset group, which includes projects, operated

DIRECTORS: Geyer M (ind ne), Goordeen A (alt), LawranceDH(ind ne), assets and non-operated joint ventures in Canada, Chile, Peru, the US,

Maharaj U (ind ne), Naidu R (ind ne), Ramathe M (ind ne), Colombia and Brazil, and currently produces copper, iron ore and energy

van der MerweHR(ld ind ne), Bell G W (Chair, ne), Bell A J (CEO), coal.

van Haght K J (Group FD) -The Petroleum unit, which includes conventional assets located in the US

MAJOR ORDINARY SHAREHOLDERS as at 24 Apr 2024 Gulf of Mexico, Australia, Trinidad andTobago, Algeria andMexico. It also

I A Bell and Company (Pty) Ltd. 70.10% has appraisal and exploration options in Trinidad and Tobago, central and

Peregrine 5.00% western Gulf of Mexico, Eastern Canada and Barbados. BHP produces

Clark, IAJ 3.28% crude oil and condensate, gas and natural gas liquids.

POSTAL ADDRESS: Private Bag X20046, Empangeni, 3880 SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

MORE INFO: www.sharedata.co.za/sdo/jse/BEL NUMBER OF EMPLOYEES: 0

COMPANY SECRETARY: D McIlrath DIRECTORS: Broomhead M (ind ne), Clever X (ind ne),

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Goldberg G (snr ind ne), Hinchliffe M, Lindsay D (ne), McEwan R (ne),

SPONSOR: Investec Bank Ltd. O’Reilly C (ind ne), Tanna C (ind ne), Weisler D (ind ne),

AUDITORS: Deloitte & Touche Inc. MacKenzie K (Chair, ind ne), Henry M (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 16 Jul 2024

CAPITAL STRUCTURE AUTHORISED ISSUED HSBC Custody Nominees (Australia) Ltd. 27.32%

BEL Ords no par value 100 000 000 95 629 385 JP Morgan Nominees Australia (Pty) Ltd. 17.94%

Citicorp Nominees (Pty) Ltd. 7.48%

DISTRIBUTIONS [ZARc] MORE INFO: www.sharedata.co.za/sdo/jse/BHG

Ords no par value Ldt Pay Amt COMPANY SECRETARY: Stefanie Wilkinson

Final 18 Apr 23 24 Apr 23 90.00 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Final 19 Apr 22 25 Apr 22 50.00

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Oct24 Avg 508 728 shares p.w., R16.1m(27.7% p.a.)

BHG Ords no par val - 5 073 901 188

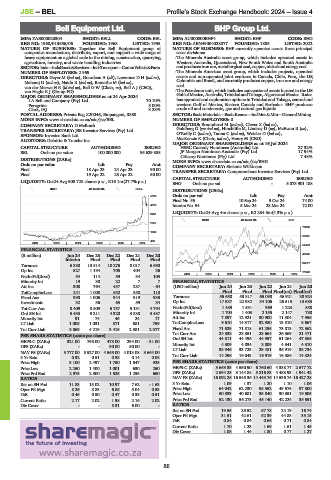

INDT 40 Week MA BELL

DISTRIBUTIONS [USDc]

5130 Ords no par val Ldt Pay Amt

Final No 55 10 Sep 24 3 Oct 24 74.00

4196 Interim No 54 5 Mar 24 28 Mar 24 72.00

3261 LIQUIDITY: Oct24 Avg 4m shares p.w., R2 234.5m(4.3% p.a.)

INDM 40 Week MA BHP

2327

76069

1392

65121

458

2019 | 2020 | 2021 | 2022 | 2023 | 2024

54173

FINANCIAL STATISTICS

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 43225

Interim Final Final Final Final

32277

Turnover 6 380 13 514 10 276 8 017 6 690

Op Inc 527 1 194 705 404 36 21329

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NetIntPd(Rcvd) 54 114 59 34 103

Minority Int 19 30 22 7 7 FINANCIAL STATISTICS

Att Inc 308 764 457 287 - 64 (USD million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

TotCompIncLoss 241 1 008 552 358 110 Final Final Final Final(rst) Final(rst)

Fixed Ass 998 1 006 944 919 935 Turnover 55 658 53 817 65 098 56 921 38 924

Investments 32 36 63 59 34 Op Inc 17 537 22 932 34 106 25 515 13 683

Tot Curr Ass 8 409 8 509 6 757 5 131 4 794 NetIntPd(Rcvd) 1 489 1 531 969 1 223 858

Ord SH Int 5 433 5 211 4 320 3 838 3 487 Minority Int 1 704 1 403 2 155 2 147 780

Minority Int 91 74 45 24 17 Att Inc 7 897 12 921 30 900 11 304 7 956

LT Liab 1 005 1 031 871 681 759 TotCompIncLoss 9 610 14 317 32 980 13 510 8 667

Tot Curr Liab 3 869 4 219 3 415 2 381 2 377 Fixed Ass 71 629 71 818 61 295 73 813 72 362

Tot Curr Ass 24 338 23 351 28 664 26 369 21 471

PER SHARE STATISTICS (cents per share) Ord SH Int 44 811 44 496 44 957 51 264 47 865

HEPS-C (ZARc) 321.00 798.00 473.00 294.00 - 31.00

DPS (ZARc) - - 90.00 50.00 - Minority Int 4 309 4 034 3 809 4 341 4 310

NAV PS (ZARc) 5 777.00 5 527.00 4 565.00 4 013.08 3 664.00 LT Liab 38 946 33 723 29 481 36 919 38 734

Tot Curr Liab

14 824

16 919

19 043

14 296

16 386

3 Yr Beta 0.32 0.51 0.38 0.14 0.08

Price High 3 100 2 497 1 750 1 547 925 PER SHARE STATISTICS (cents per share)

Price Low 2 250 1 400 1 001 630 250 HEPS-C (ZARc) 3 663.33 4 550.90 6 760.60 4 388.77 2 677.72

Price Prd End 2 975 2 300 1 525 1 235 650 DPS (ZARc) 2 694.25 3 144.88 5 216.83 4 483.93 1 941.42

RATIOS NAV PS (ZARc) 16 092.26 16 545.36 14 443.76 14 536.74 16 427.28

Ret on SH Fnd 11.83 15.02 10.97 7.62 - 1.63 3 Yr Beta 1.09 1.37 1.20 1.10 1.06

Oper Pft Mgn 8.26 8.83 6.86 5.04 0.53 Price High 64 042 62 230 58 352 49 575 37 300

D:E 0.45 0.50 0.47 0.35 0.51 Price Low 50 333 40 681 35 840 30 351 19 505

Current Ratio 2.17 2.02 1.98 2.16 2.02 Price Prd End 52 130 56 273 45 140 42 224 35 551

Div Cover - - 5.31 6.00 - RATIOS

Ret on SH Fnd 19.55 29.52 67.78 24.19 16.74

Oper Pft Mgn 31.51 42.61 52.39 44.83 35.15

D:E 0.84 0.84 0.66 0.71 0.84

Current Ratio 1.70 1.23 1.69 1.61 1.45

Div Cover 1.08 1.44 1.80 0.77 1.27

86