Page 176 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 176

JSE – RAU Profile’s Stock Exchange Handbook: 2025 – Issue 1

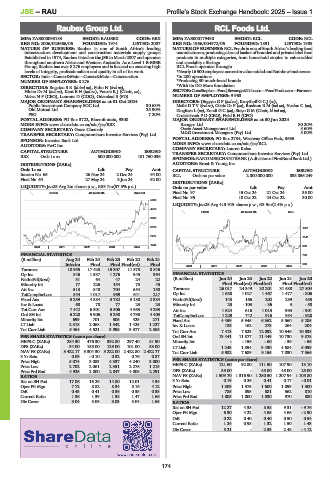

Raubex Group Ltd. RCL Foods Ltd.

RAU RCL

ISIN: ZAE000093183 SHORT: RAUBEX CODE: RBX ISIN: ZAE000179438 SHORT: RCL CODE: RCL

REG NO: 2006/023666/06 FOUNDED: 1974 LISTED: 2007 REG NO: 1966/004972/06 FOUNDED: 1891 LISTED: 1989

NATURE OF BUSINESS: Raubex is one of South Africa’s leading NATURE OF BUSINESS: RCL Foods is one of South Africa’s leading food

infrastructure development and construction materials supply groups. manufacturers, producing a broad basket of branded and private label food

Established in 1974, Raubex listed on the JSE in March 2007 and operates products in multiple categories, from household staples to value-added

throughout southern Africa and Western Australia. As a Level 1 B-BBEE and speciality offerings.

Group, Raubex has over 8 276 employees and is focused on ensuring high RCL Foods operates through:

levels of integrity, professionalism and quality in all of its work. *Nearly16500 employeesacrossitsvalue-addedandRainbowbusinesses

SECTOR: Inds—Constr&Mats—Constr&Mats—Construction *In 200 operations

NUMBER OF EMPLOYEES: 8 276 *Producing 30 much-loved brands

DIRECTORS: BogatsuSR(ld ind ne), Fubu N (ind ne), *With its DO More foundation

Hlobo Dr M (ind ne), KentBH(ind ne), Fourie R J (Chair, ne), SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

Msiza N F (CEO), Lourens D (COO), Odendaal S (FD) NUMBER OF EMPLOYEES: 9 963

MAJOR ORDINARY SHAREHOLDERS as at 01 Oct 2024 DIRECTORS: Dingaan G P (ind ne), Kruythoff G C J (ne),

Public Investment Company SOC Ltd. 30.63% MsibiDTV(ind ne), Osiris Dr P (ne), Rushton R M (ind ne), Vosloo C (ne),

Old Mutual Ltd. 25.90% Zingitwa L (ne), Zondi G C (ne), Steyn G M (Chair, ld ind ne),

PSG 7.20% Cruickshank P D (CEO), Field R H (CFO)

POSTAL ADDRESS: PO Box 3722, Bloemfontein, 9300 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

MORE INFO: www.sharedata.co.za/sdo/jse/RBX Remgro Ltd. 80.20%

COMPANY SECRETARY: Grace Chemaly Oasis Asset Management Ltd. 8.60%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. M&G Investment Managers (Pty) Ltd. 5.00%

SPONSOR: Investec Bank Ltd. POSTAL ADDRESS: PO Box 2734, Westway Office Park, 3635

AUDITORS: PwC Inc. MORE INFO: www.sharedata.co.za/sdo/jse/RCL

COMPANY SECRETARY: Lauren Kelso

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

RBX Ords 1c ea 500 000 000 181 750 036 SPONSOR:RANDMERCHANTBANK(AdivisionofFirstRandBankLtd.)

DISTRIBUTIONS [ZARc] AUDITORS: Ernst & Young Inc.

Ords 1c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Interim No 65 26 Nov 24 2 Dec 24 94.00 RCL Ords no par value 2 000 000 000 893 856 249

Final No 64 27 May 24 3 Jun 24 92.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Jan25 Avg 2m shares p.w., R89.7m(57.5% p.a.) Ords no par value Ldt Pay Amt

CONM 40 Week MA RAUBEX Final No 97 15 Oct 24 21 Oct 24 35.00

Final No 95 18 Oct 22 24 Oct 22 30.00

5600

LIQUIDITY: Jan25 Avg 413 919 shares p.w., R3.9m(2.4% p.a.)

4769

FOOD 40 Week MA RCL

3938

3108 1321

2277 1141

1446 960

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 780

(R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Interim Final Final Final(rst) Final 600

2020 | 2021 | 2022 | 2023 | 2024 |

Turnover 10 955 17 425 15 307 11 578 8 846

Op Inc 846 1 537 1 276 945 364 FINANCIAL STATISTICS

NetIntPd(Rcvd) 31 64 47 24 22 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Minority Int 77 226 154 73 45 Final Final(rst) Final(rst) Final Final(rst)

Att Inc 513 848 704 554 158 Turnover 26 017 24 349 32 201 31 688 27 804

TotCompIncLoss 544 1 017 969 641 217 Op Inc 1 638 1 027 1 467 1 477 - 806

Fixed Ass 5 259 4 884 3 782 3 188 2 384 NetIntPd(Rcvd) 143 166 202 289 455

Inv & Loans 68 78 77 23 23 Minority Int 25 - 103 - 36 3 - 58

Tot Curr Ass 7 442 6 301 5 506 4 953 4 293 Att Inc 1 624 616 1 013 993 - 901

Ord SH Int 6 220 5 906 5 298 4 798 4 403 TotCompIncLoss 1 229 742 916 984 - 928

Minority Int 699 701 505 425 271 Fixed Ass 4 459 5 945 6 362 5 560 5 285

LT Liab 2 318 2 068 1 542 1 425 1 227 Inv & Loans 126 162 273 264 204

Tot Curr Liab 5 464 4 521 3 998 3 377 2 586 Tot Curr Ass 7 413 7 523 12 092 10 546 10 838

PER SHARE STATISTICS (cents per share) Ord SH Int 13 441 11 877 11 449 10 730 9 878

HEPS-C (ZARc) 284.30 476.30 392.80 297.40 81.90 Minority Int - - 156 - 60 - 36 - 56

DPS (ZARc) 94.00 155.00 129.00 101.00 53.00 LT Liab 1 243 1 894 3 430 4 684 5 099

NAV PS (ZARc) 3 422.17 3 304.30 3 222.00 2 422.80 2 422.77 Tot Curr Liab 5 982 7 689 9 155 7 030 7 566

3 Yr Beta 0.09 - 0.10 0.32 0.76 0.87

Price High 5 074 3 083 4 337 4 240 3 000 PER SHARE STATISTICS (cents per share)

Price Low 2 702 2 061 2 351 2 276 1 215 HEPS-C (ZARc) 121.60 92.80 111.50 107.90 13.10

Price Prd End 4 925 2 800 2 847 4 008 2 291 DPS (ZARc) 35.00 - 45.00 45.00 25.00

RATIOS NAV PS (ZARc) 1 509.70 1 316.90 1 280.50 1 207.94 1 105.80

Ret on SH Fnd 17.06 16.26 14.80 12.01 4.34 3 Yr Beta 0.19 0.26 0.41 0.17 - 0.01

Oper Pft Mgn 7.72 8.82 8.34 8.16 4.12 Price High 1 309 1 375 1 600 1 099 1 300

D:E 0.43 0.41 0.36 0.35 0.35 Price Low 785 895 881 562 810

Current Ratio 1.36 1.39 1.38 1.47 1.66 Price Prd End 1 005 1 000 1 030 970 880

Div Cover 3.04 3.05 3.03 3.04 1.65 RATIOS

Ret on SH Fnd 12.27 4.38 8.58 9.31 - 9.76

Oper Pft Mgn 6.30 4.22 4.55 4.66 - 2.90

D:E 0.22 0.40 0.40 0.50 0.54

Current Ratio 1.24 0.98 1.32 1.50 1.43

Div Cover 5.21 - 2.53 2.48 - 4.12

174