Page 171 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 171

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – PRO

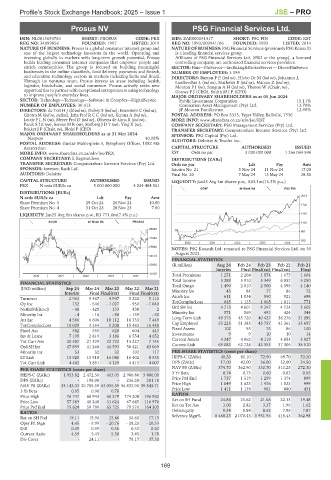

Prosus NV PSG Financial Services Ltd.

PRO PSG

ISIN: NL0013654783 SHORT: PROSUS CODE: PRX ISIN: ZAE000191417 SHORT: PSG FIN CODE: KST

REG NO: 34099856 FOUNDED: 1997 LISTED: 2019 REG NO: 1993/003941/06 FOUNDED: 1993 LISTED: 2014

NATURE OF BUSINESS: Prosus is a global consumer internet group and NATURE OF BUSINESS: PSG Financial Services (previously PSG Konsult)

one of the largest technology investors in the world. Operating and is a leading financial services group.

investing globally in markets with long-term growth potential, Prosus Affiliates of PSG Financial Services Ltd. (PSG or the group), a licensed

builds leading consumer internet companies that empower people and controlling company, are authorised financial services providers.

enrich communities. The group is focused on building meaningful SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

businesses in the online classifieds, food delivery, payments and fintech, NUMBER OF EMPLOYEES: 3 199

and education technology sectors in markets including India and Brazil. DIRECTORS: BurtonPE(ind ne), Hlobo Dr M (ind ne), Johannes J,

Through its ventures team, Prosus invests in areas including health, Lambrechts L (ind ne), Mathews B (ind ne), Matsau Z (ind ne),

logistics, blockchain, and social commerce. Prosus actively seeks new MoutonPJ(ne), SangquAH(ind ne), Theron W (Chair, ne),

opportunities to partner with exceptional entrepreneurs using technology Gouws F J (CEO), SmithMIF (CFO)

to improve people’s everyday lives. MAJOR ORDINARY SHAREHOLDERS as at 05 Jun 2024

SECTOR: Technology—Technology—Software & CompSer—DigitalService Public Investment Corporation 15.11%

NUMBER OF EMPLOYEES: 30 413 Coronation Asset Management (Pty) Ltd. 13.70%

DIRECTORS: du Toit H J (ld ind ne), Dubey S (ind ne), Enenstein C (ind ne), JF Mouton Familietrust 12.90%

Girotra M (ind ne, Indian), Jafta Prof R C C (ind ne), Kemna A (ind ne), POSTAL ADDRESS: PO Box 3335, Tyger Valley, Bellville, 7536

Letele F L N (ne), Meyer Prof D (ind ne), Oliveira de Lima R (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/KST

Pacak S J Z (ne), Sorour M R (ne), Stofberg J D T (ne), Ying X (ne), COMPANY SECRETARY: PSG Management Services (Pty) Ltd.

Bekker J P (Chair, ne), Bloisi F (CEO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 SPONSOR: PSG Capital (Pty) Ltd.

Naspers 40.08%

POSTAL ADDRESS: Gustav Mahlerplein 5, Symphony Offices, 1082 MS AUDITORS: Deloitte & Touche Inc.

Amsterdam CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/PRX KST Ords no par 3 000 000 000 1 266 064 596

COMPANY SECRETARY: L Bagwandeen DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par Ldt Pay Amt

SPONSOR: Investec Bank Ltd. Interim No 21 5 Nov 24 11 Nov 24 17.00

AUDITORS: Deloitte Final No 20 7 May 24 13 May 24 28.50

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan25 Avg 4m shares p.w., R63.1m(15.3% p.a.)

PRX N ords EUR5c ea 5 000 000 000 4 034 484 561

GENF 40 Week MA PSG FIN

DISTRIBUTIONS [EURc]

2013

N ords EUR5c ea Ldt Pay Amt

Share Premium No 5 29 Oct 24 26 Nov 24 10.00

1726

Share Premium No 4 31 Oct 23 28 Nov 23 7.00

LIQUIDITY: Jan25 Avg 6m shares p.w., R3 771.6m(7.4% p.a.) 1440

SCOM 40 Week MA PROSUS 1153

88904

867

77444

580

2020 | 2021 | 2022 | 2023 | 2024 |

65984

NOTES: PSG Konsult Ltd. renamed to PSG Financial Services Ltd. on 30

August 2023.

54524

FINANCIAL STATISTICS

43064 (R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Interim Final Final(rst) Final(rst) Final

31603 Total Premiums 1 271 2 264 1 874 1 675 1 604

2020 | 2021 | 2022 | 2023 | 2024 |

Total Income 3 289 5 910 5 349 6 032 5 250

FINANCIAL STATISTICS Total Outgo 1 490 2 810 2 500 4 598 4 140

(USD million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Interim Final Final(rst) Final Final(rst) Minority Int 45 84 77 86 72

Turnover 2 963 5 467 4 947 5 220 5 116 Attrib Inc 611 1 034 950 921 698

Op Inc 132 - 546 - 1 027 - 950 - 1 040 TotCompIncLoss 645 1 125 1 065 1 011 771

NetIntPd(Rcvd) - 48 - 428 133 438 2 Ord SH Int 4 713 4 601 4 247 4 124 3 605

Minority Int - 4 - 16 - 90 - 139 - 50 Minority Int 571 569 493 424 344

Att Inc 4 586 6 606 10 112 18 733 7 449 Long-Term Liab 49 373 45 720 40 427 36 276 31 095

Cap Employed 55 225 51 385 45 757 41 361 35 697

TotCompIncLoss 10 029 3 364 5 208 15 483 16 448

Fixed Ass 582 555 620 604 443 Fixed Assets 102 93 75 86 100

Inv & Loans 7 199 2 819 3 186 6 554 4 652 Investments 9 9 10 10 14

Tot Curr Ass 20 587 21 129 22 722 15 227 7 145 Current Assets 4 247 4 062 4 119 4 054 3 927

Ord SH Int 47 899 41 260 44 593 50 421 43 069 Current Liab 69 082 62 724 42 353 37 305 38 510

Minority Int 53 32 32 102 117 PER SHARE STATISTICS (cents per share)

LT Liab 15 928 15 910 16 048 16 402 8 535 HEPS-C (ZARc) 48.20 81.10 72.90 69.70 52.20

Tot Curr Liab 4 482 3 891 4 129 4 413 4 007 DPS (ZARc) 17.00 42.00 36.00 32.00 24.50

NAV PS (ZARc) 374.70 362.90 330.70 313.25 272.30

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 1 953.82 2 472.36 463.05 2 986.86 5 886.00 3 Yr Beta 0.74 0.73 0.60 0.82 0.55

DPS (ZARc) - 198.08 - 236.28 201.18 Price Prd End 1 737 1 519 1 299 1 374 899

NAV PS (ZARc) 33 142.33 30 785.59 63 055.59 36 837.90 39 843.71 Price High 1 849 1 623 1 476 1 523 999

3 Yr Beta 0.95 0.90 0.70 - - Price Low 1 411 1 138 981 880 431

Price High 76 747 66 943 68 279 174 208 196 982 RATIOS

Price Low 57 389 48 240 31 624 67 645 116 976 Ret on SH Fund 24.84 21.62 21.68 22.13 19.48

Price Prd End 75 624 59 799 63 725 79 576 164 300 Ret on Tot Ass 3.00 2.82 3.37 1.96 1.62

RATIOS Debt:Equity 9.34 8.84 8.53 7.98 7.87

Ret on SH Fnd 19.11 15.96 22.46 36.80 17.13 Solvency Mgn% 8 460.25 2 070.43 1 931.96 418.43 362.98

Oper Pft Mgn 4.45 - 9.99 - 20.76 - 18.20 - 20.33

D:E 0.35 0.39 0.36 0.33 0.20

Current Ratio 4.59 5.43 5.50 3.45 1.78

Div Cover - 24.11 - 78.17 37.30

169