Page 167 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 167

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – PIC

AUDITORS: Ernst & Young Inc.

Pick n Pay Stores Ltd. BANKERS: Absa Bank Ltd., First National Bank of SA Ltd.

SEGMENTAL REPORTING as at 25 Aug 24 (asa%ofTurnover)

PIC

South Africa 96.6%

Rest of Africa 3.4%

CALENDAR Expected Status

Next Final Results May 2025 Unconfirmed

Annual General Meeting Aug 2025 Unconfirmed

Next Interim Results Oct 2025 Unconfirmed

ISIN: ZAE000005443 SHORT: PICKNPAY CODE: PIK

REG NO: 1968/008034/06 FOUNDED: 1967 LISTED: 1968 CAPITAL STRUCTURE AUTHORISED ISSUED

PIK Ords no par value 828 500 000 745 657 130

NATURE OF BUSINESS: PIK Bs no par value 361 500 000 325 426 164

Pick n Pay Stores Ltd. is an investment holding company that DISTRIBUTIONS [ZARc]

is domiciled and incorporated in the Republic of South Africa Ords no par value Ldt Pay Amt

and listed on the JSE and A2X, the recognised securities Final No 110 30 May 23 5 Jun 23 140.30

exchanges in South Africa. The Group comprises subsidiaries Interim No 109 29 Nov 22 5 Dec 22 44.85

and an associate that retail food, clothing, general merchan- Final No 108 31 May 22 6 Jun 22 185.35

dise, and liquor throughout Africa, both on an owned and Interim No 107 30 Nov 21 6 Dec 21 35.80

franchise basis. The Group also acquires and develops LIQUIDITY: Dec24 Avg 15m shares p.w., R367.7m(104.3% p.a.)

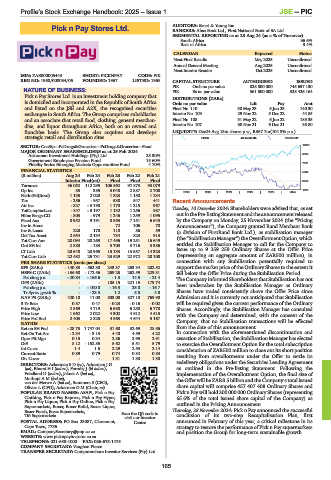

strategic retail and distribution sites. FOOR 40 Week MA PICKNPAY

10851

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

MAJOR ORDINARY SHAREHOLDERS as at 25 Feb 2024

Ackerman Investment Holdings (Pty) Ltd. 25.30% 9016

Government Employees Pension Fund 15.60%

Fidelity Series Emerging Markets Opportunities Fund 4.70% 7181

FINANCIAL STATISTICS 5345

(R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Interim Final(rst) Final Final Final 3510

Turnover 56 052 112 295 106 562 97 873 93 079

Op Inc 83 385 3 048 2 887 2 708 2019 | 2020 | 2021 | 2022 | 2023 | 2024 1675

NetIntPd(Rcvd) 1 135 2 020 1 323 1 150 1 234

Tax - 256 - 957 538 547 441 Recent Announcements

Att Inc - 827 - 3 190 1 170 1 215 967 Tuesday, 10 December 2024: Shareholders were advised that, as set

TotCompIncLoss - 847 - 3 197 1 132 1 256 987 out in the Pre-listing Statement and the announcementreleased

Hline Erngs-CO - 803 - 979 1 246 1 259 1 095

Fixed Ass 8 952 9 191 8 893 7 151 6 643 by the Company on Monday, 25 November 2024 (the “Pricing

Inv in Assoc - - 72 106 70 Announcement”), the Company granted Rand Merchant Bank

Inv & Loans 220 170 118 86 59 (a division of FirstRand Bank Ltd.), as stabilisation manager

Def Tax Asset 2 654 2 134 734 823 913 (the “StabilisationManager”)the OverallotmentOption, which

Tot Curr Ass 20 094 20 269 17 496 19 251 16 649 entitled the Stabilisation Manager to call for the Company to

Ord SH Int 2 880 - 183 3 703 3 716 3 386

LT Liab 20 648 20 965 15 133 13 657 14 323 issue up to 9 259 259 Ordinary Shares at the Offer Price

Tot Curr Liab 22 482 25 731 23 529 22 972 20 108 (representing an aggregate amount of ZAR500 million), in

connection with any Stabilisation potentially required to

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 140.83 - 562.30 243.37 253.34 202.52 support the market price of the Ordinary Shares to the extent it

HEPS-C (ZARc) - 136.60 - 172.56 259.25 262.59 229.31 fell below the Offer Price during the Stabilisation Period.

Pct chng p.a. - 20.84 - 166.6 - 1.3 14.5 - 21.4 The Company informed Shareholders that Stabilisation has not

DPS (ZARc) - - 185.15 221.15 179.74 been undertaken by the Stabilisation Manager as Ordinary

Pct chng p.a. - - 100.0 - 16.3 23.0 - 16.7 Shares have traded consistently above the Offer Price since

Tr 5yr av grwth % - - 23.3 1.2 5.8 4.8

NAV PS (ZARc) 420.10 11.00 803.00 827.10 769.90 Admission and it is currently not anticipated that Stabilisation

3 Yr Beta 0.57 0.47 - 0.23 - 0.16 - 0.02 will be required given the current performance of the Ordinary

Price High 2 869 4 719 6 688 6 250 6 778 Shares. Accordingly, the Stabilisation Manager has consulted

Price Low 1 662 2 022 4 302 4 612 4 515 with the Company and determined, with the consent of the

Price Prd End 2 403 2 325 4 563 4 644 5 167 Company, that no Stabilisation transactions will be effected

RATIOS

Ret on SH Fnd - 28.73 1 747.04 31.60 32.69 28.56 from the date of this announcement.

Ret On Tot Ass - 2.34 - 3.13 4.40 4.59 4.22 In connection with the aforementioned discontinuation and

Oper Pft Mgn 0.15 0.34 2.86 2.95 2.91 cessation of Stabilisation, the Stabilisation Manager has elected

D:E 8.12 - 152.85 5.62 5.51 5.79 to exercise the Overallotment Option for the total subscription

Int Cover 1.4 1.6 2.29 2.53 2.14 consideration of ZAR500 million to close out its short position

Current Ratio 0.89 0.79 0.74 0.84 0.83 resulting from overallotments under the Offer to settle its

Div Cover - - 1.31 1.30 1.30

DIRECTORS: Ackerman S D (ne), Ackerman J G redelivery obligations under the Securities Lending Agreement

(ne), Bhorat H I (ind ne), Formby J (ld ind ne), as outlined in the Pre-listing Statement. Following the

Friedland D (ind ne), Jakoet A (ind ne), implementation of the Overallotment Option, the final size of

Mothupi A M (ind ne), the Offer will be ZAR8.5 billion and the Company’s total issued

van der Merwe A (ind ne), Summers S (CEO), share capital will comprise 457 407 408 Ordinary Shares and

Olivier L (CFO), Ackerman G M (Chair, ne)

POPULAR BRAND NAMES: ASAP!, Pick n Pay Pick n Pay will hold 300 000 000 Ordinary Shares (representing

Clothing, Pick n Pay Express, Pick n Pay Hyper, 65.6% of the total issued share capital of the Company) as

Pick n Pay Liquor, Pick n Pay Online, Pick n Pay outlined in the Pricing Announcement.

Supermarkets, Boxer, Boxer Build, Boxer Liquor,

Boxer Punch, Boxer Supermarkets, Scan the QR code to Thursday, 28 November 2024: Pick n Pay announced the successful

TM Supermarkets visit our Investor conclusion of its two-step Recapitalisation Plan, first

POSTAL ADDRESS: PO Box 23087, Claremont, Centre announced in February of this year, a critical milestone in its

Cape Town, 7735 strategy to restore the performance of Pick n Pay supermarkets

EMAIL: CompanySecretary@pnp.co.za and position the Group for long-term sustainable growth.

WEBSITE: www.picknpayinvestor.co.za

TELEPHONE: 021-658-1000 FAX: 086-675-1475

COMPANY SECRETARY: Vaughan Pierce

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

165