Page 166 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 166

JSE – PEP Profile’s Stock Exchange Handbook: 2025 – Issue 1

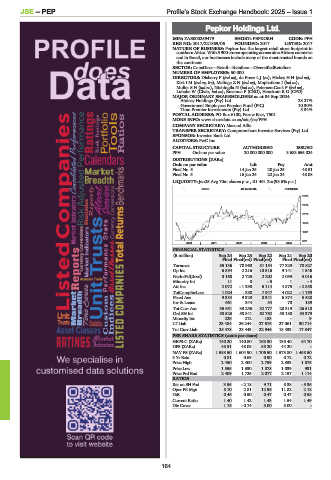

Pepkor Holdings Ltd.

PEP

ISIN: ZAE000259479 SHORT: PEPKORH CODE: PPH

REG NO: 2017/221869/06 FOUNDED: 2017 LISTED: 2017

NATURE OF BUSINESS: Pepkor has the largest retail store footprint in

southern Africa. With 5 900 stores operating across nine African countries

and in Brazil, our businesses include many of the most trusted brands on

the continent.

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers

NUMBER OF EMPLOYEES: 50 000

DIRECTORS: Disberry P (ind ne), du PreezLJ(ne), HickeyHH(ind ne),

KirkIM(ind ne, Ire), MalingaZN(ind ne), Mophatlane I (ind ne),

MullerSH(ind ne), Ntshingila N (ind ne), Petersen-Cook F (ind ne),

Luhabe W (Chair, ind ne), Erasmus P (CEO), Hanekom R G (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 04 Sep 2024

Ainlsey Holdings (Pty) Ltd. 28.27%

Government Employees Pension Fund (PIC) 10.30%

Titan Premier Investments (Pty) Ltd. 5.34%

POSTAL ADDRESS: PO Box 6100, Parow East, 7501

MORE INFO: www.sharedata.co.za/sdo/jse/PPH

COMPANY SECRETARY: Masood Allie

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

PPH Ords no par value 20 000 000 000 3 683 655 024

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 6 14 Jan 25 20 Jan 25 48.51

Final No 5 16 Jan 24 22 Jan 24 48.08

LIQUIDITY: Jan25 Avg 70m shares p.w., R1 461.2m(98.6% p.a.)

GERE 40 Week MA PEPKORH

2978

2574

2170

1765

1361

957

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

(R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Final Final(rst) Final(rst) Final Final(rst)

Turnover 85 136 78 960 81 154 77 329 70 827

Op Inc 6 894 2 216 10 516 9 141 1 546

NetIntPd(Rcvd) 3 168 2 725 2 202 2 059 3 016

Minority Int 11 8 - 5 1 - 4

Att Inc 2 072 - 1 298 6 114 4 875 - 2 858

TotCompIncLoss 1 024 - 388 7 947 4 022 - 1 759

Fixed Ass 9 384 9 329 8 341 6 874 5 528

Inv & Loans 661 344 54 70 189

Tot Curr Ass 35 651 33 256 32 777 28 319 26 510

Ord SH Int 58 523 58 841 62 762 58 188 53 379

Minority Int 226 212 183 - 9

LT Liab 23 484 26 244 27 676 27 061 30 714

Tot Curr Liab 25 478 23 443 22 946 18 433 17 847

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 140.20 140.80 163.30 135.40 64.70

DPS (ZARc) 48.51 48.08 55.20 44.20 -

NAV PS (ZARc) 1 588.50 1 604.90 1 706.50 1 573.80 1 458.50

3 Yr Beta 0.81 0.69 0.90 0.72 0.72

Price High 2 450 2 400 2 759 2 333 1 875

Price Low 1 555 1 330 1 878 1 039 931

Price Prd End 2 409 1 725 2 077 2 157 1 114

RATIOS

Ret on SH Fnd 3.55 - 2.18 9.71 8.38 - 5.36

Oper Pft Mgn 8.10 2.81 12.96 11.82 2.18

D:E 0.46 0.50 0.47 0.47 0.58

Current Ratio 1.40 1.42 1.43 1.54 1.49

Div Cover 1.16 - 0.74 3.00 3.00 -

164