Page 164 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 164

JSE – ORI Profile’s Stock Exchange Handbook: 2025 – Issue 1

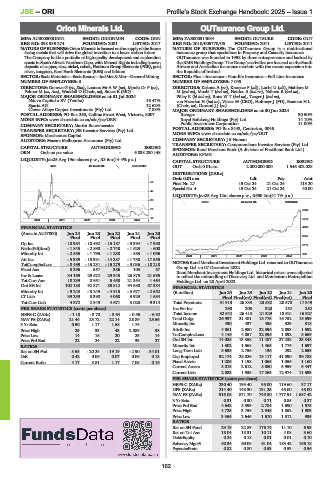

Orion Minerals Ltd. OUTsurance Group Ltd.

ORI OUT

ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN ISIN: ZAE000314084 SHORT: OUTSURE CODE: OUT

REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017 REG NO: 2010/005770/06 FOUNDED: 2011 LISTED: 2011

NATURE OF BUSINESS: OrionMineralsisfocusedonthe supply of the future NATURE OF BUSINESS: The OUTsurance Group is a multinational

facing metals that will drive the global transition to a lower carbon future. insurance group that specialises in Property and Casualty insurance.

The Company holds a portfolio of high-quality development and exploration OUTsurance was founded in 1998 by three entrepreneurs and backed by

assets in South Africa’s Northern Cape, with Mineral Rights including known the RMB Holdings Group. The Group’s activities are focused on the South

deposits of copper, zinc, nickel, cobalt, Platinum Group Elements (PGE), gold, African and Australian insurance markets with the recent expansion into

silver, tungsten, Rare Earth Elements (REE) and lithium. the Republic of Ireland.

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining SECTOR: Fins—Insurance—Non-life Insurance—Full Line Insurance

NUMBER OF EMPLOYEES: 0 NUMBER OF EMPLOYEES: 7 049

DIRECTORS: Gomwe G (ne, Zim), LennoxMrAW(ne), Mpofu Dr P (ne), DIRECTORS: Kekana A (ne), Knoetze F (alt), Lucht U (alt), Mahlare M

PalmerM(ne, Aus), Waddell D (Chair, ne), Smart E (MD) M(ind ne), Moabi T (ind ne), Naidoo S (ind ne), Ndlovu R (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Jul 2024 Pillay K (ld ind ne), RoosWT(ind ne), Teeger J (ind ne),

Ndovu Capital x BV (Tembo) 16.47% van Heerden H (ind ne), Visser M (CEO), Hofmeyr J (FD), Bosman H L

Sparta AG 12.62% (Chair, ne), DurandJJ(ne)

Clover Alloys Copper Investments (Pty) Ltd. 7.88% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007 Remgro 30.50%

MORE INFO: www.sharedata.co.za/sdo/jse/ORN Royal Bafokeng Holdings (Pty) Ltd. 14.10%

COMPANY SECRETARY: Martin Bouwmeester Public Investment Corporation 11.00%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 8443, Centurion, 0046

SPONSOR: Merchantec Capital MORE INFO: www.sharedata.co.za/sdo/jse/OUT

AUDITORS: Mazars Melbourne Assurance (Pty) Ltd. COMPANY SECRETARY: J S Human

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

ORN Ords no par value - 6 838 280 148

AUDITORS: KPMG

LIQUIDITY: Jan25 Avg 19m shares p.w., R3.6m(14.4% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

MINI 40 Week MA ORIONMIN OUT Ords 0.01c ea 2 000 000 000 1 546 402 028

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt

58 Final No 27 15 Oct 24 21 Oct 24 113.20

Special No 4 15 Oct 24 21 Oct 24 40.00

47

LIQUIDITY: Jan25 Avg 12m shares p.w., R650.2m(41.7% p.a.)

36

GENF 40 Week MA OUTSURE

26 6900

15 5719

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 4538

(Amts in AUD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final Final Final Final 3357

Op Inc - 10 984 - 10 492 - 15 187 - 9 394 - 7 980

2177

NetIntPd(Rcvd) - 1 845 - 2 890 - 2 748 - 1 629 - 600

Minority Int - 2 555 - 1 795 - 1 238 - 885 - 1 096 996

2020 | 2021 | 2022 | 2023 | 2024 |

Att Inc - 5 389 - 15 331 - 14 287 - 1 758 - 17 555

TotCompIncLoss - 8 439 - 15 231 - 15 279 - 3 036 - 18 218 NOTES: Rand Merchant Investment Holdings Ltd. renamed to OUTsurance

Group Ltd. on 07 December 2022.

Fixed Ass 5 296 557 386 103 57 Rand Merchant Investment Holdings Ltd. historical prices were adjusted

Inv & Loans 34 169 29 672 29 345 26 875 21 595 to reflect the unbundling of Discovery Ltd. and Momentum Metropolitan

Tot Curr Ass 18 239 8 951 5 458 21 354 1 464 Holdings Ltd. on 20 April 2022.

Ord SH Int 102 183 92 871 85 812 94 680 57 384 FINANCIAL STATISTICS

Minority Int - 9 243 - 8 245 - 4 915 - 3 677 - 2 552 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

LT Liab 39 289 5 390 4 068 3 929 1 684 Final Final(rst) Final(rst) Final(rst) Final

Tot Curr Liab 4 372 2 349 4 671 3 028 9 314 Total Premiums 31 913 26 833 23 532 20 570 17 349

PER SHARE STATISTICS (cents per share) Inc Fm Inv 290 208 320 152 252

HEPS-C (ZARc) - 1.10 - 3.70 - 3.64 - 0.56 - 6.92 Total Income 32 642 26 413 21 329 18 621 16 927

NAV PS (ZARc) 21.44 23.72 22.14 28.89 25.56 Total Outgo 26 937 21 481 18 775 16 752 15 399

3 Yr Beta 0.50 1.17 1.68 1.74 - Minority Int 430 437 495 329 318

Price High 29 33 43 2 889 38 Attrib Inc 4 061 2 980 22 396 2 893 1 592

Price Low 14 16 20 25 14 TotCompIncLoss 4 145 4 057 22 395 1 892 3 669

Price Prd End 22 24 22 39 27 Ord SH Int 14 085 13 358 11 487 27 238 25 848

RATIOS Minority Int 1 302 1 568 1 465 1 776 1 697

Ret on SH Fnd - 8.55 - 20.24 - 19.19 - 2.90 - 34.01 Long-Term Liab 3 698 2 756 136 292 2 653

D:E 0.42 0.06 0.07 0.06 0.18 Cap Employed 32 174 28 026 13 117 41 090 39 788

Current Ratio 4.17 3.81 1.17 7.05 0.16 Fixed Assets 1 205 1 198 1 065 1 056 1 160

Current Assets 3 015 2 612 8 050 6 959 6 447

Current Liab 2 083 1 535 17 263 12 974 11 593

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 230.40 193.40 95.00 119.60 37.17

DPS (ZARc) 214.40 143.30 131.25 45.00 45.00

NAV PS (ZARc) 916.08 871.70 749.80 1 777.94 1 687.42

3 Yr Beta 0.31 0.30 0.71 0.85 0.87

Price Prd End 4 642 3 399 2 784 1 690 1 575

Price High 4 725 3 759 2 948 1 852 1 903

Price Low 3 356 2 645 1 610 1 512 935

RATIOS

Ret on SH Fund 29.19 22.89 176.74 11.10 6.93

Ret on Tot Ass 18.04 18.31 10.11 4.08 3.60

Debt:Equity 0.24 0.18 0.01 0.01 0.10

Solvency Mgn% 50.34 60.08 61.04 153.42 166.18

Payouts:Prem 0.82 0.80 0.53 0.53 0.56

162