Page 173 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 173

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – PUT

Putprop Ltd. Quantum Foods Holdings Ltd.

PUT QUA

ISIN: ZAE000072310 SHORT: PUTPROP CODE: PPR ISIN: ZAE000193686

REG NO: 1988/001085/06 FOUNDED: 1988 LISTED: 1988 SHORT: QUANTUM

NATURE OF BUSINESS: Putprop is a property investment company who CODE: QFH

listed on the main board of the JSE Ltd. in July 1988, under the real estate REG NO: 2013/208598/06

sector, offering stakeholders the opportunity to invest and own quality FOUNDED: 2013

properties in all segments of the property umbrella. Putprop came into LISTED: 2014

existence after the delisting of the then parent company, Putco Ltd. For NATURE OF BUSINESS: Quantum Foods is a fully integrated, diversified

many years the portfolio consisted only of properties offering facilities to feed, poultry and egg business with four segments:

the bus operator. *Animal Feeds - 671 209 tons of feed supplied

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings *Broiler and layer farming - 82 million day-old chicks produced

NUMBER OF EMPLOYEES: 7 *Eggs - 531 million eggs and egg products sold

DIRECTORS: HartleyHT(ind ne), Styber R (ind ne), van Heerden G (ind *OtherAfricancountries-7%ofGrouprevenuefromotherAfricancountries

The Group provides quality animal feeds and poultry products to South

ne), Torricelli D (Chair, ind ne), Smith J E (CFO), Carleo B C (CEO) Africanandselectedother Africanmarketsandisthe leading producer of eggs

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 in South Africa.

Carleo Enterprises (Pty) Ltd. 66.36% SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers

Heynen Family Trust 7.07%

Cape Investments Property 317 CC 3.28% NUMBER OF EMPLOYEES: 2 425

POSTAL ADDRESS: 22 Impala Road, Chislehurston, Sandton, 2196 DIRECTORS: Burger P F T (ind ne), Fortuin G G (ld ind ne),

Riddle L W (ind ne), Vaughan-Smith G (ne), Hanekom W A (Chair, ne),

MORE INFO: www.sharedata.co.za/sdo/jse/PPR van der Merwe A D (CEO), Muller A H (CFO)

COMPANY SECRETARY: Acorim (Pty) Ltd. MAJOR ORDINARY SHAREHOLDERS as at 27 Sep 2024

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Aristotle Africa S.a.r.l. 34.78%

SPONSOR: Merchantec Capital Braemar Trading Ltd. 30.63%

AUDITORS: HLB CMA (South Africa) Inc. Country Bird Holdings (Pty) Ltd. 17.18%

POSTAL ADDRESS: PO Box 1183, Wellington, 7654

CAPITAL STRUCTURE AUTHORISED ISSUED EMAIL: info@quantumfoods.co.za

PPR Ords no par value 500 000 000 42 405 133

WEBSITE: www.quantumfoods.co.za

DISTRIBUTIONS [ZARc] TELEPHONE: 021-864-8600 FAX: 021-873-5619

Ords no par value Ldt Pay Amt COMPANY SECRETARY: Ziyanda Patience Wakashe

Final No 70 22 Oct 24 28 Oct 24 8.50 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Interim No 69 25 Mar 24 2 Apr 24 6.00 SPONSOR: One Capital Sponsor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc.

LIQUIDITY: Jan25 Avg 27 643 shares p.w., R88 247.2(3.4% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

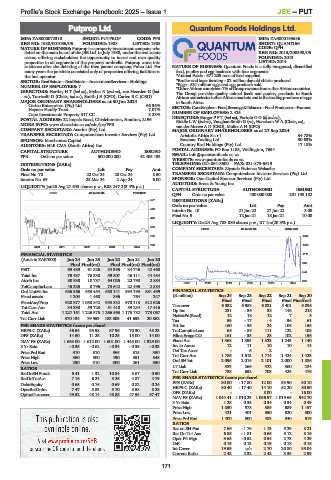

REDS 40 Week MA PUTPROP

QFH Ords no par value 400 000 000 201 198 152

577 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

503

Interim No 10 21 Jun 22 27 Jun 22 8.00

Final No 9 12 Jan 21 18 Jan 21 10.00

429

LIQUIDITY: Dec24 Avg 783 880 shares p.w., R7.1m(20.3% p.a.)

356

FOOD 40 Week MA QUANTUM

282 1649

208 1380

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 1111

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final(rst) Final Final(rst) Final(rst) 843

PBIT 69 489 61 826 54 395 34 746 42 468

574

Total Inc 75 437 76 338 59 507 46 111 44 484

Attrib Inc 38 938 10 787 64 025 22 790 2 884 305

2019 | 2020 | 2021 | 2022 | 2023 | 2024

TotCompIncLoss 45 325 8 796 73 642 22 496 2 884

Ord UntHs Int 686 866 653 454 658 141 594 193 581 499 FINANCIAL STATISTICS

Fixed assets 1 204 1 468 896 764 247 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

FixedAss/Prop 928 877 1 058 842 953 332 970 113 512 626 Final Final Final Final Final(rst)

Tot Curr Ass 34 330 59 723 51 418 59 234 17 416 Turnover 6 332 6 953 6 021 5 401 5 095

148

Op Inc

231

- 36

33

218

Total Ass 1 227 161 1 226 575 1 266 563 1 175 782 773 067 NetIntPd(Rcvd) 12 18 12 7 3

Tot Curr Liab 370 134 79 953 183 303 41 653 20 862

Tax 59 - 17 - 4 36 61

PER SHARE STATISTICS (cents per share) Att Inc 160 - 36 24 106 155

HEPS-C (ZARc) 46.54 93.98 87.96 70.30 48.23 TotCompIncLoss 65 - 89 111 122 108

DPS (ZARc) 14.50 11.25 10.25 15.00 14.00 Hline Erngs-CO 161 - 35 28 102 156

NAV PS (ZARc) 1 668.00 1 612.00 1 601.00 1 445.00 1 329.00 Fixed Ass 1 368 1 353 1 323 1 243 1 140

3 Yr Beta - 0.35 - 0.62 - 0.34 - 0.35 - 0.33 Inv in Assoc 12 11 10 10 14

Price Prd End 310 310 365 315 350 Def Tax Asset - 6 2 - -

Price High 360 500 490 351 548 Tot Curr Ass 1 786 1 513 1 714 1 424 1 423

Price Low 290 310 300 261 350 Ord SH Int 2 095 2 016 2 101 2 000 1 886

RATIOS LT Liab 383 266 322 360 284

RetOnSH Funds 6.41 1.32 10.84 3.67 0.50 Tot Curr Liab 738 652 708 425 476

RetOnTotAss 7.16 6.24 5.26 4.87 4.79 PER SHARE STATISTICS (cents per share)

Debt:Equity 0.65 0.76 0.69 0.82 0.24 EPS (ZARc) 80.00 - 17.80 12.00 53.90 80.10

OperRetOnInv 7.47 5.83 5.70 3.58 8.28 HEPS-C (ZARc) 80.40 - 17.40 14.10 52.20 80.50

OpInc:Turnover 49.52 48.14 48.86 47.55 57.47 DPS (ZARc) - - 8.00 - 16.00

NAV PS (ZARc) 1 044.41 1 010.23 1 056.97 1 019.65 942.70

3 Yr Beta 1.28 0.35 0.34 0.34 0.49

Price High 1 850 578 589 689 1 157

Price Low 421 401 350 520 300

Price Prd End 1 400 500 483 540 619

RATIOS

Ret on SH Fnd 7.66 - 1.76 1.13 5.29 8.21

Ret On Tot Ass 6.86 - 1.81 0.65 5.12 8.16

Oper Pft Mgn 3.65 - 0.52 0.54 2.73 4.29

D:E 0.15 0.13 0.19 0.18 0.15

Int Cover 19.59 n/a 2.70 20.80 85.04

Current Ratio 2.42 2.32 2.42 3.35 2.99

171