Page 177 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 177

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – RED

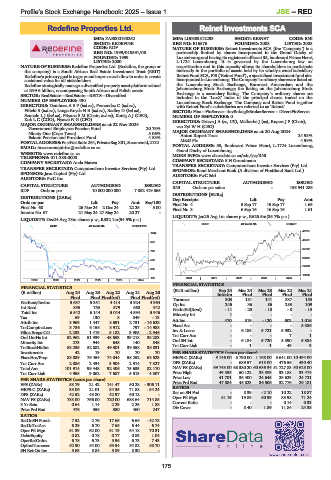

Redefine Properties Ltd. Reinet Investments SCA

RED REI

ISIN: ZAE000190252 ISIN: LU0383812293 SHORT: REINET CODE: RNI

SHORT: REDEFINE REG NO: B16576 FOUNDED: 2008 LISTED: 2008

CODE: RDF NATURE OF BUSINESS: Reinet Investments SCA (the ‘Company’) is a

REG NO: 1999/018591/06 partnership limited by shares incorporated in the Grand Duchy of

FOUNDED: 1999 Luxembourg and having its registered office at 35, boulevard Prince Henri,

LISTED: 2000 L-1724 Luxembourg. It is governed by the Luxembourg law on

NATURE OF BUSINESS: Redefine Properties Ltd. (Redefine, the group or securitisation and in this capacity allows its shareholders to participate

the company) is a South African Real Estate Investment Trust (REIT). indirectly in the portfolio of assets held by its wholly-owned subsidiary

Redefine’s primary goal is to grow and improve cash flow in order to create Reinet Fund SCA, FIS (‘Reinet Fund’), a specialised investment fund also

sustained value for all stakeholders incorporated in Luxembourg. The Company’s ordinary shares are listed on

Redefine strategically manage a diversified property asset platform valued the Luxembourg Stock Exchange, Euronext Amsterdam and the

at R99.6 billion, encompassing South African and Polish assets. Johannesburg Stock Exchange; the listing on the Johannesburg Stock

SECTOR: RealEstate—RealEstate—REITS—Diversified Exchange is a secondary listing. The Company’s ordinary shares are

included in the ‘LuxX’ index of the principal shares traded on the

NUMBER OF EMPLOYEES: 430 Luxembourg Stock Exchange. The Company and Reinet Fund together

DIRECTORS: DambuzaASP(ind ne), Fernandez C (ind ne), with Reinet Fund’s subsidiaries are referred to as ‘Reinet’.

Fifield S (ind ne), Langa-RoydsNB(ind ne), Radley D (ind ne), SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

SenneloLJ(ind ne), Pityana S M (Chair, ind ne), Konig A J (CEO), NUMBER OF EMPLOYEES: 0

Kok L C (COO), Nyawo N G (CFO) DIRECTORS: GrieveJA(ne, UK), Malherbe J (ne), Rupert J P (Chair),

MAJOR ORDINARY SHAREHOLDERS as at 22 Nov 2024 van Zyl W H (CEO)

Government Employees Pension Fund 20.75%

Ninety One (Cape Town) 5.06% MAJOR ORDINARY SHAREHOLDERS as at 20 Aug 2024

Eskom Pension and Provident Fund 4.53% Anton Rupert Trust 24.93%

M&G Plc

4.99%

POSTAL ADDRESS:PostNetSuite264, PrivateBagX31,Saxonwold,2132

EMAIL: investorenquiries@redefine.co.za POSTAL ADDRESS: 35, Boulevard Prince Henri, L-1724 Luxembourg,

Grand Duchy of Luxembourg

WEBSITE: www.redefine.co.za MORE INFO: www.sharedata.co.za/sdo/jse/RNI

TELEPHONE: 011-283-0000

COMPANY SECRETARY: Anda Matwa COMPANY SECRETARY: S H Grundmann

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: PwC Inc. AUDITORS: PwC Sàrl

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED RNI Ords no par value - 195 941 286

RDF Ords no par 10 000 000 000 7 052 419 865

DISTRIBUTIONS [EURc]

DISTRIBUTIONS [ZARc] Dep Receipts Ldt Pay Amt

Ords no par Ldt Pay Amt Scr/100

Final No 68 26 Nov 24 2 Dec 24 22.25 5.00 Final No 4 5 Sep 17 15 Sep 17 1.65

Interim No 67 21 May 24 27 May 24 20.27 - Final No 3 6 Sep 16 16 Sep 16 1.61

LIQUIDITY: Jan25 Avg 1m shares p.w., R626.5m(35.7% p.a.)

LIQUIDITY: Dec24 Avg 78m shares p.w., R332.1m(54.5% p.a.)

GENF 40 Week MA REINET

REIV 40 Week MA REDEFINE

49781

1042

43501

872

37222

702

30942

532

24663

362

18383

192 2020 | 2021 | 2022 | 2023 | 2024 |

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

FINANCIAL STATISTICS

Sep 24

(R million) Aug 24 Aug 23 Aug 22 Aug 21 Aug 20 (EUR million) Interim Mar 24 Mar 23 Mar 22 Mar 21

Final

Final

Final

Final

Final Final Final(rst) Final Final(rst) Turnover 303 181 141 337 153

NetRent/InvInc 5 637 5 351 4 414 3 924 4 964 Op Inc 246 36 86 283 109

Int Recd 895 753 579 660 942

Total Inc 6 542 6 144 5 044 4 594 5 946 NetIntPd(Rcvd) - 11 -25 - 18 -8 -13

Tax 69 130 8 849 - 13 Minority Int 470 1 519 - - 120 - 602 - 1 016 -

Att Inc

Attrib Inc 3 969 1 447 8 691 2 731 - 16 628 Fixed Ass - - - - 5 386

TotCompIncLoss 3 736 6 155 8 912 797 - 14 988 Inv & Loans - 6 185 5 721 5 932 -

Hline Erngs-CO 2 233 1 419 5 182 3 905 - 2 946 Tot Curr Ass - - - 7 1

Ord UntHs Int 52 962 51 939 48 653 39 218 38 283

Minority Int 273 944 648 140 548 Ord SH Int - 6 184 5 720 5 890 5 384

TotStockHldInt 53 235 52 882 49 301 39 358 38 831 Tot Curr Liab - 1 1 49 3

Investments 42 19 70 70 70 PER SHARE STATISTICS (cents per share)

FixedAss/Prop 83 089 79 454 74 044 58 252 63 523 HEPS-C (ZARc) 5 146.00 5 790.00 1 168.00 5 641.00 10 494.00

Tot Curr Ass 2 086 2 434 3 904 2 914 7 327 DPS (ZARc) - 689.57 618.00 476.56 430.40

Total Ass 101 914 99 448 92 406 75 635 82 170 NAV PS (ZARc) 69 748.00 68 380.20 60 686.34 51 727.83 50 628.00

Tot Curr Liab 4 958 9 062 7 687 5 513 4 307 Price High 49 855 50 122 38 589 33 188 33 474

Price Low 41 701 36 400 24 645 25 623 24 721

PER SHARE STATISTICS (cents per share) Price Prd End 47 884 45 823 36 506 32 776 29 181

EPS (ZARc) 58.79 21.42 141.47 50.28 - 306.11 RATIOS

HEPS-C (ZARc) 33.06 21.01 84.35 71.88 - 54.24 Ret on SH Fnd - 8.39 - 2.10 10.22 18.87

DPS (ZARc) 42.52 43.80 42.97 60.12 - Oper Pft Mgn 81.19 19.89 60.99 83.98 71.24

NAV PS (ZARc) 788.00 766.00 720.00 688.64 714.85

3 Yr Beta 0.64 1.14 2.29 2.25 1.88 Current Ratio - - - 0.14 0.33

Price Prd End 476 358 380 460 247 Div Cover - 8.40 1.89 11.84 24.38

RATIOS

RetOnSH Funds 7.52 2.76 17.65 6.66 - 42.78

RetOnTotAss 6.29 6.70 7.65 6.44 6.74

Oper Pft Mgn 61.39 62.00 61.19 64.18 70.31

Debt:Equity 0.82 0.78 0.77 0.83 1.04

OperRetOnInv 6.78 6.73 5.96 6.73 7.43

OpInc:Turnover 52.90 54.00 53.54 54.82 58.70

SH Ret On Inv 5.63 5.84 5.89 8.30 -

175