Page 181 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 181

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – REU

EMAIL: invest@reunert.co.za

Reunert Ltd. WEBSITE: www.reunert.co.za

TELEPHONE: 011-517-9000

REU

FAX: 011-517-9035

COMPANY SECRETARY: Reunert Management

Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services

(Pty) Ltd.

SPONSOR: One Capital

AUDITORS: KPMG Inc.

Scan the QR code to BANKERS: Nedbank Ltd., Rand Merchant Bank,

visit our website

Standard Bank

SEGMENTAL REPORTING as at 30 Sep 24 (asa%of Liabilities)

Electrical Engineering 34.80%

ISIN: ZAE000057428 SHORT: REUNERT CODE: RLO Information Communication Technologies 27.52%

REG NO: 1913/004355/06 FOUNDED: 1888 LISTED: 1948 Applied Electronics 20.22%

Other 17.49%

NATURE OF BUSINESS: CALENDAR Expected Status

Reunert is a leading industrial group operating a diversified Annual General Meeting 25 Feb 2025 Confirmed

portfolio of business units organised into its Electrical Engineer- Next Interim Results May 2025 Unconfirmed

ing, ICT and Applied Electronics Segments.

It was established in 1888 and listed on the Johannesburg Stock Next Final Results Nov 2025 Unconfirmed

Exchange in 1948. Reunert is a constituent of the JSE industrial CAPITAL STRUCTURE AUTHORISED ISSUED

goodsandservices(electronicandelectricalequipment)sector. RLO Ords no par value 235 000 000 182 665 316

Reunert is rated AA in the Morgan Stanley Capital International DISTRIBUTIONS [ZARc]

(MSCI)ESGratingsreport.ThisratingacknowledgesReunertas Ords no par value Ldt Pay Amt

anindustryleadermanagingthemostsignificantenvironmental, Final No 197 21 Jan 25 27 Jan 25 276.00

social and governance risks and opportunities. Interim No 196 18 Jun 24 24 Jun 24 90.00

Final No 195 23 Jan 24 29 Jan 24 249.00

SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components Interim No 194 20 Jun 23 26 Jun 23 83.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024 LIQUIDITY: Dec24 Avg 1m shares p.w., R98.0m(39.3% p.a.)

Public Investment Corporation (SOC) Ltd. 13.50%

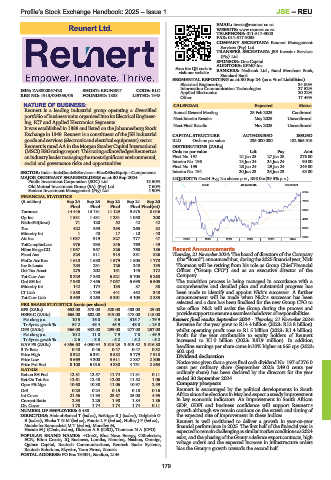

Old Mutual Investment Group (SA) (Pty) Ltd. 7.60% ELEE 40 Week MA REUNERT

Sanlam Investment Management (Pty) Ltd. 4.90% 8194

FINANCIAL STATISTICS

(R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20 7126

Final Final Final Final Final(rst)

6058

Turnover 14 446 13 781 11 129 9 575 8 046

Op Inc 1 531 1 431 1 231 1 050 208

4991

NetIntPd(Rcvd) 71 120 52 42 42

Tax 422 359 293 265 82 3923

Minority Int 1 40 17 - 10 - 40

2855

Att Inc 1 037 919 827 777 47 2019 | 2020 | 2021 | 2022 | 2023 | 2024

TotCompIncLoss 976 933 846 769 - 49

Hline Erngs-CO 1 057 957 826 768 186 Recent Announcements

Fixed Ass 823 811 913 881 826 Thursday, 21 November 2024: The board of directors of the Company

FinCo Acc Rec 1 610 1 688 1 579 1 803 1 778 (the“Board”)announcedthat,duringthe2025financialyear,Nick

Inv & Loans 283 231 126 240 135 Thomson will be retiring from his role as Group Chief Financial

Def Tax Asset 275 202 151 145 172 Officer (“Group CFO”) and as an executive director of the

Tot Curr Ass 8 329 7 358 6 521 5 703 5 260 Company.

Ord SH Int 7 958 7 456 7 057 6 695 6 505 The transition process is being managed in accordance with a

Minority Int 142 174 133 87 38 comprehensive and detailed plan and substantial progress has

LT Liab 1 858 1 739 441 452 348 been made to identify and appoint Nick’s successor. A further

Tot Curr Liab 3 569 3 263 3 301 3 103 2 835 announcement will be made when Nick’s successor has been

PER SHARE STATISTICS (cents per share) selected and a date has been finalised for the new Group CFO to

EPS (ZARc) 652.00 578.00 520.00 483.00 29.00 take office. Nick will assist the Group during the process and

HEPS-C (ZARc) 665.00 602.00 519.00 478.00 115.00 providesupporttoensureaseamlesshandoverofresponsibilities.

Pct chng p.a. 10.5 16.0 8.6 315.7 - 79.9 Reunert final results September 2024 - Thursday, 21 November 2024:

Tr 5yr av grwth % 54.2 48.4 45.9 48.0 - 15.8 Revenue for the year grew to R14.4 billion (2023: R13.8 billion)

DPS (ZARc) 366.00 332.00 299.00 277.00 257.00 whilst operating profit rose to R1.5 billion (2023: R1.4 billion).

Pct chng p.a. 10.2 11.0 7.9 7.8 - 49.9 Profit for the year attributable to equity holders of Reunert

Tr 5yr av grwth% -2.6 -3.8 -5.2 -5.2 -5.2 increased to R1.0 billion (2023: R919 million). In addition,

NAV PS (ZARc) 4 356.60 4 030.94 3 815.23 3 619.52 3 516.80 headline earnings per share came in10% higher at 665 cps (2023:

3 Yr Beta 0.40 0.46 0.47 0.47 0.32 602 cps).

Price High 8 322 6 391 5 582 5 779 7 918 Dividend declaration

Price Low 5 669 4 300 3 611 2 887 2 806 Notice was given that a gross final cash dividend No. 197 of 276.0

Price Prd End 8 100 6 016 4 330 4 751 2 863

RATIOS cents per ordinary share (September 2023: 249.0 cents per

ordinary share) has been declared by the directors for the year

Ret on SH Fnd 12.81 12.57 11.74 11.31 0.11

Ret On Tot Ass 12.61 12.48 12.00 11.52 1.06 ended 30 September 2024.

Oper Pft Mgn 10.60 10.38 11.06 10.97 2.59 Company prospects

D:E 0.23 0.24 0.15 0.18 0.16 Reunert is encouraged by the political developments in South

Int Cover 21.56 11.93 23.67 25.00 4.95 Africa since the elections in May and expect a steady improvement

Current Ratio 2.33 2.25 1.98 1.84 1.86 in key economic indicators. An improvement in South African

Div Cover 1.78 1.74 1.74 1.74 0.11 GDP, GDFI and business confidence will support Reunert’s

NUMBER OF EMPLOYEES: 6 488 growth although we remain cautious on the extent and timing of

DIRECTORS: Abdool-Samad T (ind ne), BoëttgerRJ(ind ne), Dalgleish G the expected rate of improvement in these indices.

B(ind ne), EbokaTNM(ind ne), FourieLP(ind ne), HulleyJP(ind ne), Reunert is well positioned to deliver a growth in year-on-year

Matshoba-RamuedzisiMT(ind ne), Moodley M, financial performance in 2025. The first half of the financial year is

Husain M J (Chair, ind ne), Dickson A E (CEO), Thomson N A (CFO) expectedtoremainchallengingassimilarmarketconditionsas2024

POPULAR BRAND NAMES: +OneX, Blue Nova Energy, CBI-electric, exist, and the phasing of the Group’s defence export contracts, high

ECN, Etion Create, IQ Business, Lumika, Nanoteq, Nashua, Omnigo,

Quince Capital, Reutech Communications, Reutech Radar Systems, voltage orders and the expected increase in infrastructure orders

Reutech Solutions, Skywire, Terra Firma, Zamefa bias the Group’s growth towards the second half.

POSTAL ADDRESS: PO Box 784391, Sandton, 2146

179