Page 184 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 184

JSE – RMB Profile’s Stock Exchange Handbook: 2025 – Issue 1

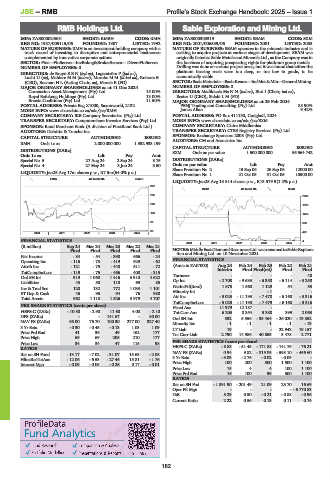

RMB Holdings Ltd. Sable Exploration and Mining Ltd.

RMB SAB

ISIN: ZAE000024501 SHORT: RMBH CODE: RMH ISIN: ZAE000303319 SHORT: SEAM CODE: SXM

REG NO: 1987/005115/06 FOUNDED: 1987 LISTED: 1992 REG NO: 2001/006539/06 FOUNDED: 2001 LISTED: 2005

NATURE OF BUSINESS: RMH is an investment holding company with a NATURE OF BUSINESS: SEAM operates in the minerals industry and is

track record of investing in disruptive and entrepreneurial businesses seeking to acquire projects at various stages of development. SEAM was

complemented by innovative corporate actions. originally listed as Sable Metals and Minerals Ltd., as the Company was in

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs the business of acquiring prospecting rights for platinum group metals.

NUMBER OF EMPLOYEES: 0 Drilling was done on various project areas, but it was found that either the

DIRECTORS: de BruynSEN(ind ne), Lagerström P (ind ne), platinum bearing reefs were too deep, or too low in grade, to be

Lucht U (ne), MahlareMM(ind ne), MorobeMM(ld ind ne), Roberts B economically viable.

(CEO), Bosman H L (Acting Chair, ne), Marais E (FD) SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

MAJOR ORDINARY SHAREHOLDERS as at 11 Dec 2024 NUMBER OF EMPLOYEES: 0

Coronation Asset Management (Pty) Ltd. 15.00% DIRECTORS: Madikizela MsNN(ind ne), Bird I (Chair, ind ne),

Royal Bafokeng Holdings (Pty) Ltd. 13.00% Bester U (CEO), Sidaki L M (FD)

Breede Coalitions (Pty) Ltd. 11.50% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

POSTAL ADDRESS: Private Bag X1000, Saxonworld, 2132 PBNJ Trading and Consulting (Pty) Ltd. 85.90%

MORE INFO: www.sharedata.co.za/sdo/jse/RMH James Allan 9.42%

COMPANY SECRETARY: IKB Company Secretaries (Pty) Ltd. POSTAL ADDRESS: PO Box 411130, Craighall, 2024

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/SXM

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) COMPANY SECRETARY: Claire Middlemiss

AUDITORS: Deloitte & Touche Inc. TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SPONSOR: Exchange Sponsors 2008 (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

RMH Ords 1c ea 2 000 000 000 1 392 933 199 AUDITORS: CM and Associates Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt SXM Ords no par value 1 500 000 000 56 564 742

Special No 5 27 Aug 24 2 Sep 24 3.75 DISTRIBUTIONS [ZARc]

Special No 4 27 May 24 3 Jun 24 3.50 Ords no par value Ldt Pay Amt

Share Premium No 2 15 Sep 06 26 Sep 06 12000.00

LIQUIDITY: Jan25 Avg 17m shares p.w., R7.5m(64.0% p.a.)

Share Premium No 1 21 Oct 05 31 Oct 05 10500.00

FINA 40 Week MA RMBH

LIQUIDITY: Jan25 Avg 13 514 shares p.w., R13 579.9(1.2% p.a.)

347

INDM 40 Week MA SEAM

285 2090

223 1673

160 1255

98 838

36 421

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 4

2020 | 2021 | 2022 | 2023 | 2024 |

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Final Final Final Final Final NOTES:MiddleEastDiamondResourcesLtd.wasrenamedtoSableExplora-

Net Income - 84 - 54 - 390 666 - 24 tion and Mining Ltd. on 10 November 2021.

Operating Inc - 116 - 73 - 419 629 - 62 FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Attrib Inc - 121 - 75 - 440 611 - 72

TotCompIncLoss - 119 - 75 - 466 408 - 315 Interim Final Final(rst) Final Final

Ord SH Int 919 1 068 1 416 3 910 4 622 Turnover - - - - 48

Liabilities 43 50 110 69 85 Op Inc - 2 708 - 9 633 - 6 350 - 6 114 - 3 250

Inv & Trad Sec 120 132 772 1 033 1 101 NetIntPd(Rcvd) 1 875 1 560 1 129 54 53

ST Dep & Cash 46 96 94 76 980 Minority Int - - - 1 - -

Total Assets 962 1 118 1 526 3 979 4 707 Att Inc - 5 023 - 11 193 - 7 478 - 6 168 - 3 316

TotCompIncLoss - 5 023 - 11 193 - 7 479 - 6 168 - 3 316

PER SHARE STATISTICS (cents per share) Fixed Ass 11 979 12 187 - - -

HEPS-C (ZARc) - 10.50 - 2.90 11.60 4.00 - 2.10 Tot Curr Ass 6 203 8 354 5 388 399 2 063

DPS (ZARc) - - 141.67 - 80.00 Ord SH Int 532 5 556 - 35 464 - 26 020 - 19 852

NAV PS (ZARc) 66.00 76.70 100.30 277.00 327.40 Minority Int - 1 - 1 - 1 - 1 - 13

3 Yr Beta - 0.30 - 0.45 - 0.13 1.03 1.09 LT Liab 19 - - 22 942 19 157

Price Prd End 41 36 49 162 177 Tot Curr Liab 2 790 14 986 40 853 3 478 2 771

Price High 69 69 205 210 177

Price Low 34 34 47 115 98 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) - 8.88 - 51.45 - 171.88 - 141.76 - 76.21

Ret on SH Fund - 13.17 - 7.02 - 31.07 15.63 - 2.08 NAV PS (ZARc) 0.94 9.82 - 815.05 - 598.10 - 456.60

HlineRetTotAss - 12.06 - 6.53 - 27.46 15.81 - 1.76 3 Yr Beta - 3.03 - 2.76 - 0.02 - 0.09 -

Interest Mgn - 0.09 - 0.05 - 0.26 0.17 - 0.01 Price High 100 200 500 1 500 1 100

Price Low 15 4 4 100 1 100

Price Prd End 16 100 99 500 1 100

RATIOS

Ret on SH Fnd - 1 891.90 - 201.49 21.09 23.70 16.69

Oper Pft Mgn - - - - - 6 770.83

D:E 5.29 0.50 - 0.21 - 0.88 - 0.96

Current Ratio 2.22 0.56 0.13 0.11 0.74

182