Page 174 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 174

JSE – QUI Profile’s Stock Exchange Handbook: 2025 – Issue 1

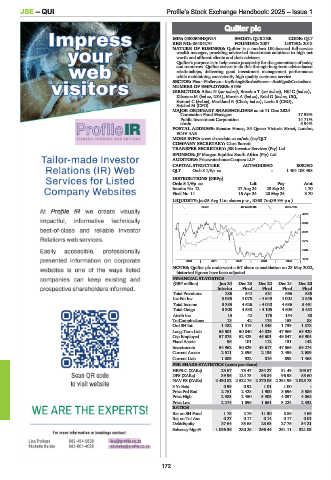

Quilter plc

QUI

ISIN: GB00BNHSJN34 SHORT: QUILTER CODE: QLT

REG NO: 06404270 FOUNDED: 2007 LISTED: 2018

NATURE OF BUSINESS: Quilter is a modern UK-focused full-service

wealth manager, providing advice-led investment solutions to high net

worth and affluent clients and their advisers.

Quilter’s purpose is to help create prosperity for the generations of today

and tomorrow. Quilter strives to do this through long-term advice-based

relationships, delivering good investment management performance

while maintaining consistently high quality customer service.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

NUMBER OF EMPLOYEES: 3 036

DIRECTORS: Atkar N (snr ind ne), Breedon T (snr ind ne), Hill C (ind ne),

Kilcoyne M (ind ne, USA), Morris A (ind ne), Reid G (ind ne, UK),

Samuel C (ind ne), Markland R (Chair, ind ne), Levin S (CEO),

Satchel M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 11 Dec 2024

Coronation Fund Managers 17.99%

Public Investment Corporation 14.71%

abrdn 5.94%

POSTAL ADDRESS: Senator House, 85 Queen Victoria Street, London,

EC4V 4AB

MORE INFO: www.sharedata.co.za/sdo/jse/QLT

COMPANY SECRETARY: Clare Barrett

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

AUDITORS: PricewaterhouseCoopers LLP

CAPITAL STRUCTURE AUTHORISED ISSUED

QLT Ords 8 1/6p ea - 1 404 105 498

DISTRIBUTIONS [GBPp]

Ords 8 1/6p ea Ldt Pay Amt

Interim No 12 27 Aug 24 23 Sep 24 1.70

Final No 11 16 Apr 24 28 May 24 3.70

LIQUIDITY: Jan25 Avg 11m shares p.w., R333.7m(39.9% p.a.)

GENF 40 Week MA QUILTER

4378

3845

3311

2777

2244

1710

2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Quilter plc underwent a 6:7 share consolidation on 23 May 2022,

historical figures have been adjusted

FINANCIAL STATISTICS

(GBP million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final

Total Premiums 286 542 581 666 585

Inc Fm Inv 3 085 4 075 - 4 649 4 002 2 856

Total Income 3 385 4 626 - 4 040 4 686 3 461

Total Outgo 3 308 4 538 - 4 105 4 603 3 452

Attrib Inc 13 42 175 154 88

TotCompIncLoss 13 42 175 153 88

Ord SH Int 1 482 1 519 1 548 1 739 1 878

Long-Term Liab 55 501 50 840 44 029 47 969 63 920

Cap Employed 57 075 52 423 45 601 49 847 65 904

Fixed Assets 96 101 112 131 142

Investments 54 962 50 329 43 617 47 565 63 274

Current Assets 2 511 2 396 2 135 2 459 2 689

Current Liab 1 003 922 816 893 1 468

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 23.67 73.47 254.27 91.49 109.67

DPS (ZARc) 39.96 124.73 96.84 96.98 85.60

NAV PS (ZARc) 2 430.82 2 522.76 2 270.05 2 291.99 2 025.75

3 Yr Beta 0.99 0.92 1.01 1.00 -

Price Prd End 2 761 2 428 1 900 3 696 3 586

Price High 2 983 2 450 3 903 4 057 4 068

Price Low 2 274 1 696 1 661 3 224 2 332

RATIOS

Ret on SH Fund 1.75 2.76 11.30 8.86 4.69

Ret on Tot Ass 0.27 0.17 0.14 0.17 0.01

Debt:Equity 37.64 33.65 28.63 27.76 34.21

Solvency Mgn% 1 036.36 280.26 266.44 261.11 321.03

172