Page 200 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 200

JSE – STE Profile’s Stock Exchange Handbook: 2024 – Issue 4

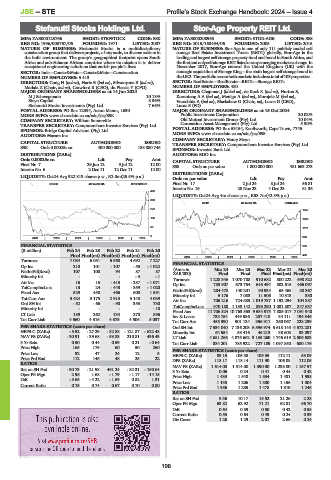

Stefanutti Stocks Holdings Ltd. Stor-Age Property REIT Ltd.

STE STO

ISIN: ZAE000123766 SHORT: STEFSTOCK CODE: SSK ISIN: ZAE000208963 SHORT: STOR-AGE CODE: SSS

REG NO: 1996/003767/06 FOUNDED: 1971 LISTED: 2007 REG NO: 2015/168454/06 FOUNDED: 2005 LISTED: 2015

NATURE OF BUSINESS: Stefanutti Stocks is a multidisciplinary NATURE OF BUSINESS: Stor-Age is one of only 111 publicly traded self

construction group that delivers projects, of any scale, to diverse sectors in storage Real Estate Investment Trusts (REITs) globally, Stor-Age is the

the built environment. The group’s geographical footprint spans South leading and largest self storage property fund and brand in South Africa, and

Africa and sub-Saharan African countries where its mission is to deliver thefirstandonlyselfstorageREITlistedonanyemergingmarketexchange.In

exceptional engineering solutions that enrich people’s lives. November 2017, Stor-Age entered the United Kingdom (UK) with the

SECTOR: Inds—Constr&Mats—Constr&Mats—Construction strategic acquisition of Storage King – the sixth largest self storage brand in

NUMBER OF EMPLOYEES: 5 413 theUK2.Theportfolioacrossbothmarketsincludesatotalof103properties.

DIRECTORS: Craig H (ind ne), Harie B (ind ne), Silwanyana B (ind ne), SECTOR: RealEstate—RealEstate—REITs—Storage REITs

Matlala Z (Chair, ind ne), Crawford R (CEO), du Plessis Y (CFO) NUMBER OF EMPLOYEES: 480

MAJOR ORDINARY SHAREHOLDERS as at 14 Jun 2024 DIRECTORS: Chapman J (ld ind ne), de Kock K (ind ne), Horton S,

M J Schwegmann 10.18% KorantengAA(ind ne), Menigo A (ind ne), Morojele M (ind ne),

Steyn Capital 8.36% Varachhia A (ind ne), Blackshaw G (Chair, ne), Lucas G (CEO),

Stefanutti Stocks Investments (Pty) Ltd. 7.66% Lucas S (FD)

POSTAL ADDRESS: PO Box 12394, Aston Manor, 1630 MAJOR ORDINARY SHAREHOLDERS as at 15 Oct 2024

MORE INFO: www.sharedata.co.za/sdo/jse/SSK Public Investment Corporation 20.02%

COMPANY SECRETARY: William Somerville Old Mutual Investment Group (Pty) Ltd. 10.04%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Coronation Asset Management (Pty) Ltd. 5.30%

SPONSOR: Bridge Capital Advisors (Pty) Ltd. POSTAL ADDRESS: PO Box 53154, Kenilworth, Cape Town, 7745

AUDITORS: Mazars Inc. MORE INFO: www.sharedata.co.za/sdo/jse/SSS

COMPANY SECRETARY: Henry Steyn

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SSK Ords 0.00025c ea 400 000 000 188 080 746

SPONSOR: Investec Bank Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: BDO Inc.

Ords 0.00025c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 7 29 Jun 12 9 Jul 12 12.00 SSS Ords no par value 1 000 000 000 481 663 273

Interim No 6 2 Dec 11 12 Dec 11 12.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Oct24 Avg 922 813 shares p.w., R2.0m(25.5% p.a.) Ords no par value Ldt Pay Amt

CONM 40 Week MA STEFSTOCK FinalNo 17 2 Jul24 8 Jul24 56.81

Interim No 16 28 Nov 23 4 Dec 23 61.36

459

LIQUIDITY: Oct24 Avg 4m shares p.w., R53.7m(42.3% p.a.)

369

REIV 40 Week MA STOR-AGE

279

1557

188 1339

98 1121

8 903

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 686

(R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final(rst) Final(rst) Final(rst) Final(rst) 2019 | 2020 | 2021 | 2022 | 2023 | 2024 468

Turnover 7 084 6 051 5 968 4 692 7 227

FINANCIAL STATISTICS

Op Inc 210 101 - 107 - 55 - 1 022

NetIntPd(Rcvd) 107 100 94 87 87 (Amts in Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final

Final Final(rst) Final(rst)

Final

ZAR’000)

Minority Int - - - - 3 - 1 Turnover 1 228 346 1 070 788 910 682 800 222 698 822

Att Inc 16 15 - 415 - 287 - 1 071 Op Inc 783 907 673 764 648 494 502 615 466 097

TotCompIncLoss 13 24 - 443 - 359 - 1 020

Fixed Ass 529 458 466 608 1 591 NetIntPd(Rcvd) 204 478 140 201 90 934 63 468 58 367

10 313

11 506

Minority Int

330

7 083

5 176

Tot Curr Ass 3 424 3 175 2 913 3 148 4 039 Att Inc 706 216 724 583 1 019 737 1 192 294 104 887

Ord SH Int - 52 - 66 - 90 353 730 TotCompIncLoss 970 188 1 133 142 893 290 1 081 807 347 637

Minority Int - - - - - 18 Fixed Ass 11 706 324 10 763 563 9 554 975 7 885 017 7 091 940

LT Liab 189 262 134 270 896 Inv & Loans 733 754 449 586 257 418 34 111 194 346

Tot Curr Liab 4 560 4 316 4 375 4 506 5 037

Tot Curr Ass 455 390 501 124 356 911 260 067 228 239

PER SHARE STATISTICS (cents per share) Ord SH Int 7 534 040 7 136 203 6 596 974 5 618 145 4 572 281

HEPS-C (ZARc) - 5.52 - 27.29 - 82.88 - 121.87 - 622.48 Minority Int 64 554 58 416 46 213 38 608 33 097

NAV PS (ZARc) - 30.91 - 39.68 - 53.83 210.81 436.43 LT Liab 4 681 266 4 075 662 3 135 260 1 746 619 2 506 683

3 Yr Beta 0.50 0.44 0.59 0.21 - 0.64 Tot Curr Liab 834 201 785 922 727 189 1 097 850 580 176

Price High 165 175 60 50 260 PER SHARE STATISTICS (cents per share)

Price Low 92 47 24 12 5 HEPS-C (ZARc) 89.15 105.38 109.35 112.11 53.09

Price Prd End 112 146 48 25 22 DPS (ZARc) 118.17 118.14 111.90 106.08 112.05

RATIOS NAV PS (ZARc) 1 614.00 1 514.00 1 390.00 1 298.00 1 157.57

Ret on SH Fnd - 30.73 - 21.98 461.24 - 82.31 - 150.64 3 Yr Beta 0.06 0.24 0.41 0.44 0.42

Oper Pft Mgn 2.96 1.68 - 1.79 - 1.17 - 14.15 Price High 1 433 1 548 1 534 1 481 1 598

D:E - 3.65 - 4.22 - 1.69 0.82 1.31

Price Low 1 135 1 206 1 300 1 156 1 004

Current Ratio 0.75 0.74 0.67 0.70 0.80

Price Prd End 1 356 1 285 1 478 1 310 1 245

RATIOS

Ret on SH Fnd 9.36 10.17 15.52 21.26 2.28

Oper Pft Mgn 63.82 62.92 71.21 62.81 66.70

D:E 0.64 0.59 0.50 0.42 0.58

Current Ratio 0.55 0.64 0.49 0.24 0.39

Div Cover 1.26 1.29 2.07 2.66 0.24

198