Page 196 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 196

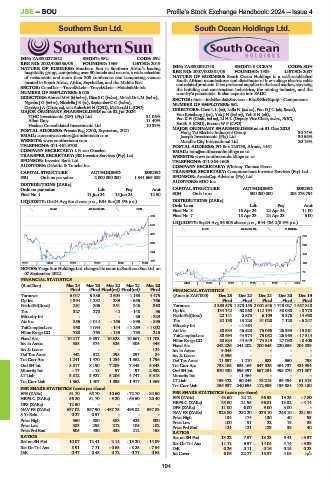

JSE – SOU Profile’s Stock Exchange Handbook: 2024 – Issue 4

Southern Sun Ltd. South Ocean Holdings Ltd.

SOU SOU

ISIN: ZAE000272522 SHORT: SSU CODE: SSU

REG NO: 2002/006356/06 FOUNDED: 1969 LISTED: 2019

CODE: SOH

NATURE OF BUSINESS: Southern Sun is Southern Africa’s leading ISIN: ZAE000092748 SHORT: S.OCEAN LISTED: 2007

REG NO: 2007/002381/06

FOUNDED: 1989

hospitality group, comprising over 90 hotels and resorts, a wide selection NATURE OF BUSINESS: South Ocean Holdings is a well-established

of restaurants and more than 300 conference and banqueting venues

located in South Africa, Africa, Seychelles, and the Middle East. South African manufacturer and distributor of low-voltage electric cable

andrelated products. It is a preferred supplier in the local market, servicing

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Hotels&Motels the building and construction industries, the mining industry, and the

NUMBER OF EMPLOYEES: 6 025 country’s parastatals. It also exports into SADC.

DIRECTORS: Ahmed M H (ld ind ne), GinaSC(ind ne), Molefi Dr L M (ind ne), SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components

Ngcobo JG(ind ne), Nicolella J R (ne), SeptemberCC(ind ne), NUMBER OF EMPLOYEES: 552

CopelynJA(Chair, ne), von Aulock M N (CEO), McDonald L (CFO) DIRECTORS: Chen LL(ne), Lalla N (ind ne), Pan D J C (alt, Brazil),

MAJOR ORDINARY SHAREHOLDERS as at 02 Jul 2024 Van Rensburg J (ne), Yeh J H (ind ne), Yeh S N (alt),

TIHC Investments (RF) (Pty) Ltd. 31.06% PonKH(Chair, ind ne), Li H L (Deputy Vice Chair, ind ne, ROC),

Allan Gray 11.40% Smith A (CEO), Basson W P (CFO)

Hosken Consolidated Investments Ltd. 10.39%

POSTAL ADDRESS: Private Bag X200, Bryanston, 2021 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 30.74%

Hong Tai Electric Industrial Group

EMAIL: companysecretary@southernsun.com Joseph Investments (Pty) Ltd. 30.56%

WEBSITE: www.southernsun.com Metallic City International Ltd. 20.19%

TELEPHONE: 011-461-9700 POSTAL ADDRESS: PO Box 123738, Alrode, 1451

COMPANY SECRETARY: L R van Onselen EMAIL: info@southoceanholdings.co.za

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. WEBSITE: www.southoceanholdings.co.za

SPONSOR: Investec Bank Ltd. TELEPHONE: 011-864-1606

AUDITORS: Deloitte & Touche Inc. COMPANY SECRETARY: Whitney Thomas Green

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

SSU Ords no par value 2 000 000 000 1 341 669 389 SPONSOR: AcaciaCap Advisors (Pty) Ltd.

AUDITORS: BDO Inc.

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 1 11 Jun 24 18 Jun 24 12.50 SOH Ords 1c ea 500 000 000 203 276 794

DISTRIBUTIONS [ZARc]

LIQUIDITY: Oct24 Avg 6m shares p.w., R34.8m(23.5% p.a.)

Ords 1c ea Ldt Pay Amt

TRAV 40 Week MA SSU Final No 8 16 Apr 24 22 Apr 24 11.00

690 Final No 7 18 Apr 23 24 Apr 23 6.00

LIQUIDITY: Sep24 Avg 36 305 shares p.w., R44 486.2(0.9% p.a.)

573

ELEE 40 Week MA S.OCEAN

457

270

340

220

224

170

107

2019 | 2020 | 2021 | 2022 | 2023 | 2024 120

NOTES: Tsogo Sun Holdings Ltd. changed its name to Southern Sun Ltd. on

07 September 2022. 70

FINANCIAL STATISTICS 20

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final Final(rst) Final(rst) Final FINANCIAL STATISTICS

Turnover 6 047 5 386 2 604 1 163 4 475 (Amts in ZAR’000) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

Op Inc 1 394 1 292 239 - 656 - 766 Final Final Final Final Final

NetIntPd(Rcvd) 291 306 351 346 360 Turnover 2 363 575 1 873 155 2 001 546 1 743 027 1 557 318

Tax 327 270 - 2 - 148 96 Op Inc 134 142 60 860 112 194 38 088 - 8 778

Minority Int - - - - 86 - 329 NetIntPd(Rcvd) 22 141 2 673 6 109 9 376 14 690

Att Inc 856 1 014 - 156 - 896 - 896 Tax 32 130 13 223 31 020 7 128 - 6 247

TotCompIncLoss 938 1 054 - 144 - 1 269 - 1 002 Minority Int 88 634 - - 1 464 75 065 - 26 939 - - 15 861 -

Att Inc

46 428

Hline Erngs-CO 780 763 - 135 - 783 216 TotCompIncLoss 88 694 44 974 75 082 26 963 - 17 514

Fixed Ass 10 217 9 897 10 328 10 667 11 703 Hline Erngs-CO 88 634 44 649 74 819 27 080 - 8 406

Inv in Assoc 385 374 325 305 446 Fixed Ass 242 226 244 202 200 645 220 358 204 839

Inv & Loans - - - - 124 Inv in Assoc 9 045 - - - -

Def Tax Asset 442 312 298 297 84 Inv & Loans 6 596 - - - -

Tot Curr Ass 1 241 1 470 1 254 1 362 1 796 Def Tax Asset 11 897 1 210 583 550 798

Ord SH Int 8 517 8 190 7 209 7 343 6 343 Tot Curr Ass 738 165 635 166 547 926 464 737 484 994

Minority Int - 17 - 18 97 97 2 352 Ord SH Int 670 430 595 397 567 254 498 270 471 307

LT Liab 3 812 3 927 5 206 4 747 5 318 Minority Int - - 1 464 - - -

Tot Curr Liab 1 362 1 407 1 095 1 917 1 369 LT Liab 159 472 50 846 75 215 59 494 61 315

Tot Curr Liab 255 937 240 694 112 989 136 584 173 180

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 61.70 68.70 - 10.60 - 72.70 - 84.50 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 56.20 51.70 - 9.20 - 63.50 20.40 EPS (ZARc) 43.60 22.12 36.93 13.25 - 7.80

DPS (ZARc) 12.50 - - - - HEPS-C (ZARc) 43.60 21.96 36.81 13.32 - 4.14

NAV PS (ZARc) 637.02 557.90 487.75 496.82 597.83 DPS (ZARc) 11.00 6.00 9.00 3.00 -

3 Yr Beta 0.27 0.97 - - - NAV PS (ZARc) 329.80 292.20 279.10 245.10 231.90

Price High 550 580 388 325 500 Price High 134 174 130 40 93

22

Price Low

91

35

19

100

Price Low 383 295 212 105 102 Price Prd End 124 121 129 39 40

Price Prd End 505 430 338 212 158 RATIOS

RATIOS Ret on SH Fnd 13.22 7.57 13.23 5.41 - 3.37

Ret on SH Fnd 10.07 12.41 - 2.14 - 13.20 - 14.09 Ret On Tot Ass 11.12 6.57 14.04 4.14 - 3.33

Ret On Tot Ass 8.91 7.71 - 0.65 - 8.25 - 7.54 D:E 0.26 0.11 0.16 0.15 0.23

D:E 0.47 0.48 0.72 0.77 0.68 Int Cover 6.06 22.77 18.37 4.06 n/a

194