Page 192 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 192

JSE – SEB Profile’s Stock Exchange Handbook: 2024 – Issue 4

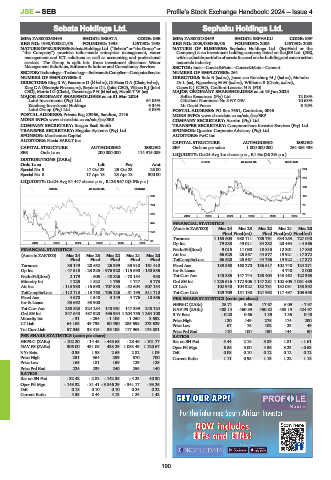

Sebata Holdings Ltd. Sephaku Holdings Ltd.

SEB SEP

ISIN: ZAE000260493 SHORT: SEBATA CODE: SEB ISIN: ZAE000138459 SHORT: SEPHAKU CODE: SEP

REG NO: 1998/003821/06 FOUNDED: 1998 LISTED: 1998 REG NO: 2005/003306/06 FOUNDED: 2005 LISTED: 2009

NATUREOF BUSINESS:SebataHoldingsLtd.(“Sebata”or”theGroup”or NATURE OF BUSINESS: Sephaku Holdings Ltd. (SepHold or the

“the Company”) provides tailor-made enterprise management, water Company) is an investment holding company listed on the JSE Ltd. (JSE),

management and ICT solutions as well as accounting and professional with a valuable portfolio of assetsfocused onthe building andconstruction

services. The Group is split into three investment divisions: Water materials industry.

Management Solutions, Software Solutions and Consultancy Services. SECTOR: Inds—Constr&Mats—Constr&Mats—Cement

SECTOR:Technology—Technology—Software&CompSer—ComputerService NUMBER OF EMPLOYEES: 264

NUMBER OF EMPLOYEES: 0 DIRECTORS: Bulo B (ind ne), Janse van RensburgMJ(ind ne), Mohuba

DIRECTORS: King R W, Passmore D (ld ind ne), Di Siena D A (Chair, ind ne), DrL(ne), NgoashengMM(ind ne), Williams B (Chair, ind ne),

King C A (Strategic Finance, ne), Strydom D L (Joint CEO), Viljoen R J (Joint Capes K J (CEO), Crafford-Lazarus N R (FD)

CEO), Morris I G (Chair), Duvenhage P H (ld ind ne), Hamill T W (ne) MAJOR ORDINARY SHAREHOLDERS as at 19 Jun 2024

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Safika Resources (Pty) Ltd. 12.08%

Laird Investments (Pty) Ltd. 64.05% Citiclient Nominees No 8 NY GW 10.63%

Kamberg Investment Holdings 9.34% Mr David Fraser 6.10%

Laird Group (Pty) Ltd. 8.08% POSTAL ADDRESS: PO Box 7651, Centurion, 0046

POSTAL ADDRESS: Private Bag X9966, Sandton, 2146 MORE INFO: www.sharedata.co.za/sdo/jse/SEP

MORE INFO: www.sharedata.co.za/sdo/jse/SEB COMPANY SECRETARY: Acorim (Pty) Ltd.

COMPANY SECRETARY: Reegan Basil Smith TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Singular Systems (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

SPONSOR: Merchantec Capital AUDITORS: PwC Inc.

AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED SEP Ords no par value 1 000 000 000 254 486 436

SEB Ords 1c ea 200 000 000 114 915 089

LIQUIDITY: Oct24 Avg 1m shares p.w., R1.6m(26.2% p.a.)

DISTRIBUTIONS [ZARc]

CONM 40 Week MA SEPHAKU

Ords 1c ea Ldt Pay Amt

Special No 9 17 Oct 23 23 Oct 23 25.00 264

Special No 8 17 Apr 18 23 Apr 18 300.00

216

LIQUIDITY: Oct24 Avg 84 447 shares p.w., R126 967.0(3.8% p.a.)

168

SCOM 40 Week MA SEBATA

969 121

794 73

619 25

2019 | 2020 | 2021 | 2022 | 2023 | 2024

445 FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

270

Final Final(rst) Final Final(rst) Final(rst)

Turnover 1 163 603 980 711 785 791 634 253 727 040

95

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Op Inc 79 838 49 011 34 232 20 464 - 4 566

FINANCIAL STATISTICS NetIntPd(Rcvd) 9 015 11 090 10 815 12 301 17 830

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 Att Inc 66 625 25 567 44 577 19 921 - 17 372

Final Final Final Final Final TotCompIncLoss 66 625 25 567 44 756 19 922 - 17 372

Turnover 33 149 28 652 25 399 33 910 161 410 Fixed Ass 189 868 160 270 136 617 102 748 124 271

Op Inc - 47 510 - 23 325 - 976 920 - 115 690 - 150 536 Inv & Loans - - - 4 740 2 000

NetIntPd(Rcvd) 2 179 - 505 - 40 826 - 78 154 938 Tot Curr Ass 143 385 147 744 138 404 143 462 122 363

Minority Int 1 225 1 822 1 765 1 747 3 773 Ord SH Int 1 225 616 1 172 906 1 147 281 1 102 405 1 081 485

Att Inc - 113 938 - 15 590 - 707 583 - 52 604 507 134 LT Liab 102 940 104 322 132 731 132 081 133 392

TotCompIncLoss - 112 713 - 13 768 - 706 126 - 51 195 511 710 Tot Curr Liab 129 709 151 138 121 992 117 497 103 598

Fixed Ass 4 678 1 548 3 149 4 776 18 586 PER SHARE STATISTICS (cents per share)

Inv & Loans 33 692 33 900 - - - HEPS-C (ZARc) 25.71 9.66 17.67 6.09 - 7.97

Tot Curr Ass 258 523 324 284 148 961 147 339 248 124 NAV PS (ZARc) 488.14 460.89 450.82 433.19 424.97

Ord SH Int 347 643 487 928 496 934 1 204 755 1 264 108 3 Yr Beta - 0.20 0.66 1.39 1.35 0.40

Minority Int - 31 - 254 - 1 105 - 1 250 3 692 Price High 120 149 275 174 200

LT Liab 64 163 49 735 50 490 285 698 273 629 Price Low 67 75 102 23 49

Tot Curr Liab 57 045 38 415 36 108 117 963 174 881 Price Prd End 110 100 150 144 50

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 102.20 - 14.48 - 443.68 - 28.46 - 101.77 Ret on SH Fnd 5.44 2.18 3.89 1.81 - 1.61

NAV PS (ZARc) 306.00 431.08 438.29 1 083.49 1 120.67 Oper Pft Mgn 6.86 5.00 4.36 3.23 - 0.63

3 Yr Beta 0.35 1.98 2.69 2.82 1.09 D:E 0.08 0.10 0.12 0.12 0.12

Price High 251 364 299 570 700 Current Ratio 1.11 0.98 1.13 1.22 1.18

Price Low 165 181 159 129 125

Price Prd End 224 239 240 255 140

RATIOS

Ret on SH Fnd - 32.42 - 2.82 - 142.35 - 4.23 40.30

Oper Pft Mgn - 143.32 - 81.41 - 3 846.29 - 341.17 - 93.26

D:E 0.18 0.10 0.10 0.24 0.22

Current Ratio 4.53 8.44 4.13 1.25 1.42

190