Page 188 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 188

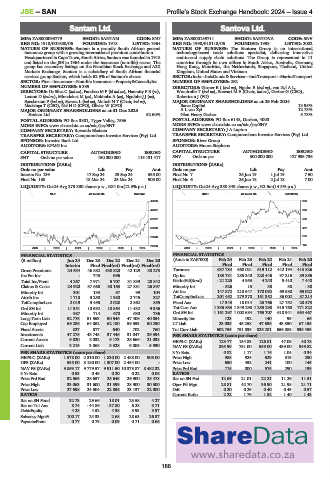

JSE – SAN Profile’s Stock Exchange Handbook: 2024 – Issue 4

Santam Ltd. Santova Ltd.

SAN SAN

ISIN: ZAE000093779 SHORT: SANTAM CODE: SNT ISIN: ZAE000159711 SHORT: SANTOVA CODE: SNV

REG NO: 1918/001680/06 FOUNDED: 1918 LISTED: 1964 REG NO: 1998/018118/06 FOUNDED: 1998 LISTED: 2002

NATURE OF BUSINESS: Santam is a proudly South African general NATURE OF BUSINESS: The Santova Group is an international,

insurance group with a growing international premium contribution. technology-based trade solutions specialist, delivering innovative

Headquartered in Cape Town, South Africa, Santam was founded in 1918 end-to-end supply chain solutions. The Group is represented in 11

and listed on the JSE in 1964 under the insurance (non-life) sector. The countries through its own offices in South Africa, Australia, Germany,

group has secondary listings on the Namibian Stock Exchange and A2X Hong Kong, Mauritius, the Netherlands, Singapore, Thailand, United

Markets Exchange. Santam is a subsidiary of South African financial Kingdom, United States and Vietnam.

services group Sanlam, which holds 62.3% of Santam’s shares. SECTOR:Inds—IndsGoods&Services—IndsTransport—MarineTransport

SECTOR: Fins—Insurance—Non-life Insurance—Property&CasualtyIns NUMBER OF EMPLOYEES: 262

NUMBER OF EMPLOYEES: 6 339 DIRECTORS: GarnerE((ind ne), Ngubo E (ind ne), van Zyl A L,

DIRECTORS: Da Silva C (ind ne), Fandeso M P (ld ind ne), Hanratty P B (ne), Woodroffe T (ind ne), Stewart M E (Chair, ind ne), Gerber G (CEO),

Loxton D (ind ne), Mlondolozi M (ne), Mukhuba A (ne), Ngulube J J (ne), Robertson J (FD)

Speckmann P (ind ne), Swartz L (ind ne), Moholi N T (Chair, ind ne), MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Madzinga T (CEO), Nel H D (CFO), Olivier W (CFO) Barca Capital 13.95%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 A L van Zyl 12.73%

Sanlam Ltd. 62.60% Glen Henry Gerber 5.73%

POSTAL ADDRESS: PO Box 3881, Tyger Valley, 7536 POSTAL ADDRESS: PO Box 6148, Durban, 4000

MORE INFO: www.sharedata.co.za/sdo/jse/SNT MORE INFO: www.sharedata.co.za/sdo/jse/SNV

COMPANY SECRETARY: Ruwaida Eksteen COMPANY SECRETARY: J A Lupton

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. SPONSOR: River Group

AUDITORS: KPMG Inc. AUDITORS: Moore Stephens

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

SNT Ords no par value 150 000 000 115 131 417 SNV Ords no par 300 000 000 127 995 736

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Ords no par Ldt Pay Amt

Interim No 139 17 Sep 24 23 Sep 24 535.00 Final No 7 25 Jun 19 1 Jul 19 7.50

Final No 138 18 Mar 24 25 Mar 24 905.00 Final No 6 26 Jun 18 2 Jul 18 7.00

LIQUIDITY: Oct24 Avg 273 300 shares p.w., R84.0m(12.3% p.a.) LIQUIDITY: Oct24 Avg 350 849 shares p.w., R2.6m(14.3% p.a.)

NLIF 40 Week MA SANTAM INDT 40 Week MA SANTOVA

49386 980

44047 809

38707 638

33368 467

28028 296

22689 125

2019 | 2020 | 2021 | 2022 | 2023 | 2024 2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Interim Final Final(rst) Final(rst) Final(rst) Final Final Final Final Final

Gross Premiums 24 634 46 882 430 820 42 129 38 273 Turnover 637 784 668 021 619 112 442 194 413 826

Inc Fm Inv - 745 696 - - Op Inc 183 731 285 240 228 446 97 216 89 856

Total Inc/Prem 4 267 7 971 5 707 31 839 28 842 NetIntPd(Rcvd) - 21 225 4 953 4 240 5 410 7 440

Claims & Costs 24 920 37 668 30 163 27 881 26 897 Minority Int - 526 15 38 38 - 30

Minority Int 301 133 97 99 104 Att Inc 147 872 210 647 170 092 69 680 65 022

Attrib Inc 1 718 3 250 1 980 2 745 327 TotCompIncLoss 201 452 279 370 161 352 86 002 87 214

TotCompIncLoss 2 019 3 455 2 020 2 862 855 Fixed Ass 17 343 18 014 25 766 27 752 28 573

Ord SH Int 11 351 10 692 10 864 11 432 9 356 Tot Curr Ass 1 335 633 1 349 298 1 255 298 915 760 771 822

Minority Int 987 714 670 630 736 Ord SH Int 1 161 297 1 002 684 765 707 618 941 564 467

Long-Term Liab 52 776 51 553 50 546 47 406 40 054 Minority Int 123 192 140 99 66

Cap Employed 66 286 64 062 62 180 59 553 50 250 LT Liab 23 035 45 258 47 636 43 350 67 195

Fixed Assets 827 877 640 702 760 Tot Curr Liab 602 755 751 835 825 281 656 385 538 453

Investments 47 278 43 748 37 446 31 047 29 394 PER SHARE STATISTICS (cents per share)

Current Assets 9 020 8 032 9 173 28 666 21 038 HEPS-C (ZARc) 123.77 154.83 126.81 47.08 40.78

Current Liab 3 215 3 068 3 328 6 005 5 930 NAV PS (ZARc) 895.99 751.00 559.00 439.00 349.82

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.82 1.17 1.16 1.04 0.34

HEPS-C (ZARc) 1 578.00 2 310.00 1 830.00 2 488.00 905.00 Price High 985 924 629 319 290

DPS (ZARc) 535.00 3 180.00 1 307.00 2 454.00 - Price Low 650 452 241 100 145

NAV PS (ZARc) 9 859.17 9 779.57 9 911.50 10 373.87 8 482.32 Price Prd End 715 800 575 290 199

3 Yr Beta 0.53 0.49 0.20 0.22 0.06 RATIOS

Price Prd End 32 569 28 657 25 645 26 900 25 478 Ret on SH Fnd 12.69 21.01 22.21 11.26 11.51

Price High 33 063 31 600 31 599 28 900 30 500 Oper Pft Mgn 28.81 42.70 36.90 21.98 21.71

Price Low 27 698 24 504 22 856 23 137 22 000 D:E 0.20 0.29 0.40 0.43 0.57

RATIOS Current Ratio 2.22 1.79 1.52 1.40 1.43

Ret on SH Fund 32.73 29.66 18.01 23.58 4.27

Ret on Tot Ass 8.74 - 44.86 - 37.80 6.28 3.71

Debt:Equity 4.28 4.52 4.38 3.93 3.97

Solvency Mgn% 100.17 24.33 2.68 28.63 26.37

Payouts:Prem 0.77 0.79 0.09 0.71 0.66

186