Page 190 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 190

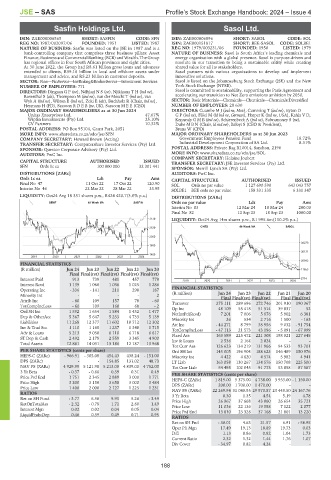

JSE – SAS Profile’s Stock Exchange Handbook: 2024 – Issue 4

Sasfin Holdings Ltd. Sasol Ltd.

SAS SAS

ISIN: ZAE000006565 SHORT: SASFIN CODE: SFN ISIN: ZAE000006896 SHORT: SASOL CODE: SOL

REG NO: 1987/002097/06 FOUNDED: 1951 LISTED: 1987 ISIN: ZAE000151817 SHORT: BEE-SASOL CODE: SOLBE1

NATURE OF BUSINESS: Sasfin was listed on the JSE in 1987 and is a REG NO: 1979/003231/06 FOUNDED: 1950 LISTED: 1979

bank-controlling company that comprises three business pillars: Asset NATURE OF BUSINESS: Sasol is South Africa’s leading chemicals and

Finance,BusinessandCommercial Banking(BCB)andWealth. The Group energy organisation with a global presence. Sasol is purpose-driven and

has regional offices in four South African provinces and eight cities. resolute in our transition to being a sustainable entity while creating

At 30 June 2022, the Group had R8.61 billion gross loans and advances shared value for all its stakeholders.

extended to clients, R59.16 billion in local and offshore assets under Sasol partners with various organisations to develop and implement

management and advice, and R5.23 billion in customer deposits. innovative solutions.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services Sasol is listed on the Johannesburg Stock Exchange (JSE) and the New

NUMBER OF EMPLOYEES: 771 York Stock Exchange (NYSE).

DIRECTORS: Dingaan G P (ne), Ndhlazi N S (ne), Njikizana T H (ind ne), Sasol is committed to sustainability, supporting the Paris Agreement and

Rosenthal S (alt), Thompson M (ind ne), van derMeschtT(ind ne), van accelerating our transition to Net Zero emissions ambition by 2050.

Wyk A (ind ne), Wilton E (ind ne), Zeki E (alt), Buchholz R (Chair, ind ne), SECTOR: Basic Materials—Chemicals—Chemicals—Chemicals:Diversified

Heymans H (FD), Sassoon R D E B (ne, UK), Sassoon M E E (CEO) NUMBER OF EMPLOYEES: 28 630

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 DIRECTORS: Cuambe M J (ind ne, Moz), Cumming T (ind ne), Eyton D

Unitas Enterprises Ltd. 47.67% GP(ind ne), Flöel M (ld ind ne, German), Harper K (ind ne, USA), Kahla V D,

Wipfin Investments (Pty) Ltd. 25.10% Kennealy G M B (ind ne), Schierenbeck A (ind ne), Subramoney S (ne),

CV Partners 10.32% Dube M B N (Chair, ld ind ne), Baloyi S (CEO & President),

POSTAL ADDRESS: PO Box 95104, Grant Park, 2051 Bruns W (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/SFN MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

COMPANY SECRETARY: Howard Brown (Acting) Government Employees Pension Fund 18.72%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Industrial Development Corporation of SA Ltd. 8.31%

SPONSOR: Questco Corporate Advisory (Pty) Ltd. POSTAL ADDRESS: Private Bag X10014, Sandton, 2196

AUDITORS: PwC Inc. MORE INFO: www.sharedata.co.za/sdo/jse/SOL

COMPANY SECRETARY: Helaine Joubert

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SFN Ords 1c ea 100 000 000 32 301 441

SPONSOR: Merrill Lynch SA (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: PwC Inc.

Ords 1c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 47 11 Oct 22 17 Oct 22 120.90 SOL Ords no par value 1 127 690 590 643 043 757

Interim No 46 22 Mar 22 28 Mar 22 33.95

SOLBE1 BEE ords no par value 158 331 335 6 331 347

LIQUIDITY: Oct24 Avg 18 351 shares p.w., R424 420.7(3.0% p.a.)

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

GENF 40 Week MA SASFIN

Interim No 83 12 Mar 24 18 Mar 24 200.00

Final No 82 12 Sep 23 18 Sep 23 1000.00

3319 LIQUIDITY: Oct24 Avg 14m shares p.w., R1 995.6m(110.2% p.a.)

2839 CHES 40 Week MA SASOL

2360

39270

1880

30131

1400

2019 | 2020 | 2021 | 2022 | 2023 | 2024

20992

FINANCIAL STATISTICS

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 11853

Final Final(rst) Final(rst) Final(rst) Final(rst)

Interest Paid 913 739 481 457 779 2019 | 2020 | 2021 | 2022 | 2023 | 2024 2714

Interest Rcvd 1 139 1 060 1 036 1 025 1 286

FINANCIAL STATISTICS

Operating Inc - 336 - 141 211 298 187

Minority Int - - - - 2 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final(rst) Final(rst)

Final Final(rst)

Attrib Inc - 60 109 157 78 - 60 Turnover 275 111 289 696 272 746 201 910 190 367

TotCompIncLoss - 60 109 160 68 - 2 Op Inc 48 109 55 418 51 514 39 837 52

Ord SH Int 1 592 1 654 1 584 1 432 1 477 NetIntPd(Rcvd) 7 201 7 006 5 876 5 902 6 381

Dep & OtherAcc 5 367 5 647 5 233 4 733 5 139 Minority Int 26 534 2 716 1 500 - 163

Liabilities 11 268 12 377 11 602 10 712 12 302 Att Inc - 44 271 8 799 38 956 9 032 - 91 754

Inv & Trad Sec 1 110 1 168 1 237 1 348 1 715 TotCompIncLoss - 47 113 21 573 43 196 - 5 091 - 67 999

Adv & Loans 5 213 9 050 8 118 6 718 6 617 Fixed Ass 163 589 225 472 221 308 198 021 227 645

ST Dep & Cash 2 492 2 178 2 559 3 345 4 900 Inv & Loans 2 536 2 164 2 024 - -

Total Assets 12 861 14 031 13 186 12 187 13 968

Tot Curr Ass 126 623 134 219 131 966 94 533 93 701

PER SHARE STATISTICS (cents per share) Ord SH Int 143 005 196 904 188 623 146 489 150 976

HEPS-C (ZARc) - 966.91 - 305.08 454.43 438.24 - 151.00 Minority Int 4 422 4 620 4 574 5 982 4 941

DPS (ZARc) - - 154.85 131.02 48.73 LT Liab 163 058 130 267 134 576 150 708 225 500

NAV PS (ZARc) 4 929.99 5 121.98 5 213.00 4 839.00 4 752.00 Tot Curr Liab 54 495 102 045 91 773 53 858 87 587

3 Yr Beta - 0.37 - 0.66 0.39 0.31 0.49 PER SHARE STATISTICS (cents per share)

Price Prd End 1 751 2 345 2 889 3 000 1 771 HEPS-C (ZARc) 1 819.00 5 375.00 4 758.00 3 953.00 - 1 150.00

Price High 3 200 3 150 3 650 3 000 3 484 DPS (ZARc) 200.00 1 700.00 1 470.00 - -

Price Low 1 400 2 000 2 127 1 225 1 231 NAV PS (ZARc) 22 269.94 31 040.95 29 970.87 23 449.50 24 167.76

RATIOS 3 Yr Beta 0.30 1.35 4.54 5.19 4.78

Ret on SH Fund - 3.77 6.58 9.91 5.26 - 3.49 Price High 26 967 37 668 43 860 26 654 35 721

RetOnTotalAss - 2.32 - 0.78 1.71 2.60 1.49

Price Low 11 036 22 136 19 588 7 122 2 077

Interest Mgn 0.02 0.02 0.04 0.05 0.04 Price Prd End 13 810 23 326 37 168 21 801 13 220

LiquidFnds:Dep 0.46 0.39 0.49 0.71 0.95

RATIOS

Ret on SH Fnd - 30.01 4.63 21.57 6.91 - 58.95

Oper Pft Mgn 17.49 19.13 18.89 19.73 0.03

D:E 1.13 0.86 0.82 1.04 1.73

Current Ratio 2.32 1.32 1.44 1.76 1.07

Div Cover - 34.97 0.82 4.24 - -

188