Page 183 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 183

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – SAB

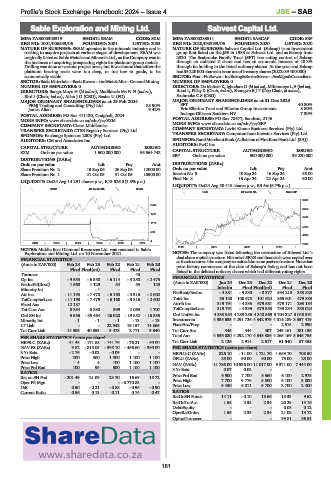

Sable Exploration and Mining Ltd. Sabvest Capital Ltd.

SAB SAB

ISIN: ZAE000303319 SHORT: SEAM CODE: SXM ISIN: ZAE000283511 SHORT: SABCAP CODE: SBP

REG NO: 2001/006539/06 FOUNDED: 2001 LISTED: 2005 REG NO: 2020/030059/06 FOUNDED: 2020 LISTED: 2020

NATURE OF BUSINESS: SEAM operates in the minerals industry and is NATURE OF BUSINESS: Sabvest Capital Ltd. (Sabcap) is an investment

seeking to acquire projects at various stages of development. SEAM was group first listed on the JSE in 1988 as Sabvest Ltd. and as Sabcap from

originally listed as Sable Metals and Minerals Ltd., as the Company was in 2020. The Seabrooke Family Trust (SFT) has voting control of Sabcap

the business of acquiring prospecting rights for platinum group metals. through an unlisted Z share and has an economic interest of 40.8%

Drilling was done on various project areas, but it was found that either the through its holding in the listed ordinary shares. At the year-end Sabcap

platinum bearing reefs were too deep, or too low in grade, to be had39220 000 sharesinissuenetoftreasuryshares(2022: 39400 000).

economically viable. SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 0 DIRECTORS: De Matteis K, Ighodaro O (ld ind ne), Mthimunye L E (ind ne),

DIRECTORS: Bango-Moyo H (ld ind ne), Madikizela MsNN(ind ne), Rood L, Pillay K (Chair, ind ne), Shongwe B J T (Dep Chair, ld ind ne),

Bird I (Chair, ind ne), Allan J G (CEO), Bester U (FD) Seabrooke C S (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

PBNJ Trading and Consulting (Pty) Ltd. 85.90% SFT 40.80%

James Allan 9.42% Eric Ellerine Trust and Ellerine Group Investments 8.80%

POSTAL ADDRESS: PO Box 411130, Craighall, 2024 InsingerGilissen Bankiers NV 7.30%

MORE INFO: www.sharedata.co.za/sdo/jse/SXM POSTAL ADDRESS: PO Box 78677, Sandton, 2146

COMPANY SECRETARY: Claire Middlemiss MORE INFO: www.sharedata.co.za/sdo/jse/SBP

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. COMPANY SECRETARY: Levitt Kirson Business Services (Pty) Ltd.

SPONSOR: Exchange Sponsors 2008 (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: CM and Associates Inc. SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

SXM Ords no par value 1 500 000 000 56 564 742 CAPITAL STRUCTURE AUTHORISED ISSUED

SBP Ords no par value 500 000 000 39 220 000

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt DISTRIBUTIONS [ZARc]

Share Premium No 2 15 Sep 06 26 Sep 06 12000.00 Ords no par value Ldt Pay Amt

Share Premium No 1 21 Oct 05 31 Oct 05 10500.00 Interim No 9 10 Sep 24 16 Sep 24 35.00

Final No 8 16 Apr 24 22 Apr 24 60.00

LIQUIDITY: Oct24 Avg 14 291 shares p.w., R13 526.8(1.3% p.a.)

LIQUIDITY: Oct24 Avg 50 418 shares p.w., R3.5m(6.7% p.a.)

INDM 40 Week MA SEAM

EQII 40 Week MA SABCAP

9400

2346

8052

1761

6704

1175

5356

590

4008

4

2019 | 2020 | 2021 | 2022 | 2023 | 2024 2660

2020 | 2021 | 2022 | 2023 |

NOTES: Middle East Diamond Resources Ltd. was renamed to Sable

Exploration and Mining Ltd. on 10 November 2021. NOTES: The company was listed following the restructure of Sabvest Ltd.’s

dual share capital structure. Historical SENS and financials were copied over

FINANCIAL STATISTICS asthestructureofthecompanyremainedthesamepostrestructure.Notethat

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 price history commences at the date of Sabcap’s listing and has not been

Final Final(rst) Final Final Final linked to the delisted ordinary shares which had different voting rights.

Turnover - - - 48 - FINANCIAL STATISTICS

Op Inc - 9 633 - 6 350 - 6 114 - 3 250 - 2 473

NetIntPd(Rcvd) 1 560 1 129 54 53 129 (Amts in ZAR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Minority Int - - 1 - - - Interim Final Final(rst) Final Final

Att Inc - 11 193 - 7 478 - 6 168 - 3 316 - 2 602 NetRent/InvInc - 4 881 - 9 330 - 8 377 594 210 353 823

TotCompIncLoss - 11 193 - 7 479 - 6 168 - 3 316 - 2 602 Total Inc 35 120 100 673 101 624 865 601 479 883

Fixed Ass 12 187 - - - - Attrib Inc 319 791 - 4 335 679 581 679 171 293 184

Tot Curr Ass 8 354 5 388 399 2 063 1 707 TotCompIncLoss 319 791 - 4 335 679 553 735 234 338 024

Ord SH Int 5 556 - 35 464 - 26 020 - 19 852 - 16 535 Ord UntHs Int 4 533 954 4 289 256 4 340 869 3 704 327 3 048 991

Minority Int - 1 - 1 - 1 - 13 - 13 Investments 4 535 635 4 291 726 4 342 979 4 016 189 3 357 419

LT Liab - - 22 942 19 157 14 865 FixedAss/Prop - - - 2 515 2 990

Tot Curr Liab 14 986 40 853 3 478 2 771 3 640 Tot Curr Ass 445 444 407 243 161 281 136

PER SHARE STATISTICS (cents per share) Total Ass 4 536 080 4 292 170 4 343 386 4 265 169 3 645 755

HEPS-C (ZARc) - 51.45 - 171.88 - 141.76 - 76.21 - 60.00 Tot Curr Liab 2 126 2 914 2 517 61 540 87 458

NAV PS (ZARc) 9.82 - 815.05 - 598.10 - 456.60 - 380.00 PER SHARE STATISTICS (cents per share)

3 Yr Beta - 2.76 - 0.02 - 0.09 - - HEPLU-C (ZARc) 826.10 - 11.00 1 721.70 1 689.70 708.50

Price High 200 500 1 500 1 100 1 100 DPLU (ZARc) 35.00 90.00 90.00 75.00 25.00

Price Low 4 4 100 1 100 1 100 NAV (ZARc) 11 786.00 10 936.00 11 017.00 9 371.00 7 444.00

Price Prd End 100 99 500 1 100 1 100

RATIOS 3 Yr Beta 0.07 0.02 - - -

Ret on SH Fnd - 201.49 21.09 23.70 16.69 15.72 Price Prd End 6 900 7 700 8 360 6 100 2 975

Oper Pft Mgn - - - - 6 770.83 - Price High 7 700 9 779 8 500 6 100 3 800

D:E 0.50 - 0.21 - 0.88 - 0.96 - 0.90 Price Low 6 450 6 011 5 700 2 700 2 400

Current Ratio 0.56 0.13 0.11 0.74 0.47 RATIOS

RetOnSH Funds 14.11 - 0.10 15.66 18.33 9.62

RetOnTotAss 1.55 2.35 2.34 20.29 13.16

Debt:Equity - - - 0.08 0.12

OperRetOnInv 1.55 2.35 2.34 21.08 13.72

OpInc:Turnover - - - 99.81 96.51

181