Page 181 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 181

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – RFG

RFG Holdings Ltd. RH Bophelo Ltd.

RFG RHB

ISIN: ZAE000191979 SHORT: RFG CODE: RFG ISIN: ZAE000244737 SHORT: RHBOPHELO CODE: RHB

REG NO: 2012/074392/06 FOUNDED: 2012 LISTED: 2014 REG NO: 2016/533398/06 FOUNDED: 2016 LISTED: 2017

NATURE OF BUSINESS: RFG is a leading producer of convenience meal NATURE OF BUSINESS: RH Bophelo Ltd. (RHB) is a Pan-African

solutions for customers throughout South Africa, sub-Saharan Africa and Johannesburg Stock Exchange (JSE) listed Section 15 Investment Holding

multiple major global markets. Company specialising in investing in the healthcare andhealthcare-related

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products service sectors.

NUMBER OF EMPLOYEES: 3 488 SECTOR: DEVC

DIRECTORS: Leeuw T P (ld ind ne), Maitisa S (ind ne), NaidooS(ind ne), NUMBER OF EMPLOYEES: 742

Njobe B (ind ne), Smart C (ne), Willis G J H (ne), Muthien DIRECTORS: Clarke C W, Makhubela R (ind ne), Makwetla F (ne),

Dr Y G (Chair, ind ne), Hanekom P (CEO), Schoombie C C (CFO) Segooa B (ne), Sekete DrPD(ne), Moraba S (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 02 Oct 2023 Zunga Q (CEO & MD), Metu A Y (CFO)

Capitalworks Private Equity GP (Pty) Ltd. 37.30% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Old Mutual 17.30% Public Investment Corporation 66.00%

PSG Konsult 8.40% Perthpark Properties 12.00%

POSTAL ADDRESS: Private Bag X3040, Paarl, 7620 Dr Mandisa Joyce Gwendoline 3.00%

MORE INFO: www.sharedata.co.za/sdo/jse/RFG POSTAL ADDRESS: Unit 12, 1st floor, 1 Melrose Boulevard,

COMPANY SECRETARY: Zantira Annandakrisnan Melrose Arch, 2191

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/RHB

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) COMPANY SECRETARY: Statucor (Pty) Ltd.

AUDITORS: Ernst & Young TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

RFG Ords no par value 1 800 000 000 262 762 018 AUDITORS: Mazars South Africa

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] RHB Ords no par 10 000 000 000 64 691 298

Ords no par value Ldt Pay Amt

Final No 9 16 Jan 24 22 Jan 24 62.00 DISTRIBUTIONS [ZARc]

Final No 8 17 Jan 23 23 Jan 23 45.80 Ords no par Ldt Pay Amt

Interim No 2 11 Dec 23 18 Dec 23 31.00

LIQUIDITY: Oct24 Avg 700 081 shares p.w., R10.0m(13.9% p.a.)

Final No 1 20 Jul 21 26 Jul 21 15.00

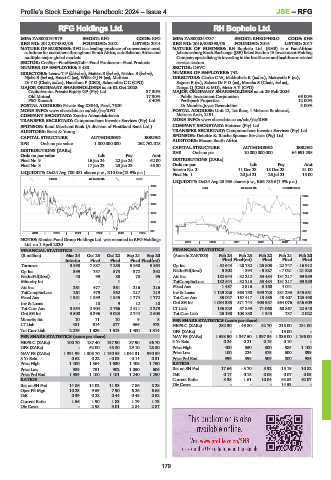

FOOD 40 Week MA RFG

LIQUIDITY: Oct24 Avg 23 935 shares p.w., R66 786.6(1.9% p.a.)

1800

EQII 40 Week MA RHBOPHELO

1604 2434

1408 1987

1213 1540

1017 1094

821 647

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Rhodes Food Group Holdings Ltd. was renamed to RFG Holdings 200

Ltd. on 1 April 2020. 2019 | 2020 | 2021 | 2022 | 2023 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Mar 24 Oct 23 Oct 22 Sep 21 Sep 20 (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Interim Final Final Final Final(rst) Final Final(rst) Final Final Final

Turnover 3 898 7 887 7 255 5 950 5 864 Op Inc - 52 644 - 28 782 - 25 803 - 22 747 - 16 912

Op Inc 399 757 573 372 392 NetIntPd(Rcvd) 5 302 - 394 - 5 827 - 7 021 - 21 323

NetIntPd(Rcvd) 40 99 88 73 95 Att Inc 182 644 - 32 212 53 484 131 217 69 989

Minority Int - - 1 - - TotCompIncLoss 182 644 - 32 213 53 484 131 217 69 989

Att Inc 261 477 361 216 216 Fixed Ass 1 487 2 316 3 160 4 041 -

TotCompIncLoss 261 479 362 217 219 Inv & Loans 1 129 826 863 750 959 723 881 233 545 681

Fixed Ass 1 981 1 899 1 845 1 774 1 772 Tot Curr Ass 85 047 167 417 13 485 40 407 125 498

Inv & Loans - 10 9 12 10 Ord SH Int 1 034 333 871 744 903 957 864 076 646 609

Tot Curr Ass 3 554 2 904 2 766 2 511 2 279 LT Liab 156 829 57 859 71 068 60 867 22 548

Ord SH Int 3 500 3 396 3 023 2 744 2 603 Tot Curr Liab 25 198 103 880 1 343 737 2 022

Minority Int 10 11 10 9 8 PER SHARE STATISTICS (cents per share)

LT Liab 481 614 877 966 973 HEPS-C (ZARc) 282.30 - 49.80 82.70 218.00 131.00

Tot Curr Liab 2 279 1 529 1 513 1 400 1 314 DPS (ZARc) - - - 15.00 -

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 1 598.90 1 347.50 1 397.34 1 336.00 1 156.00

HEPS-C (ZARc) 100.70 187.40 137.90 87.90 86.70 3 Yr Beta 0.24 0.21 0.19 0.10 -

DPS (ZARc) - 62.00 45.80 29.10 28.80 Price High 400 550 800 985 1 100

NAV PS (ZARc) 1 331.99 1 305.70 1 150.55 1 044.31 990.50 Price Low 100 224 375 500 899

3 Yr Beta 0.62 0.22 - 0.03 0.14 0.31 Price Prd End 399 399 509 800 985

Price High 1 400 1 364 1 630 1 408 1 750 RATIOS

Price Low 989 751 902 1 050 606 Ret on SH Fnd 17.66 - 3.70 5.92 15.19 10.82

Price Prd End 1 359 1 100 1 101 1 240 1 290 D:E 0.17 0.18 0.08 0.07 0.03

RATIOS Current Ratio 3.38 1.61 10.04 54.83 62.07

Ret on SH Fnd 14.86 14.02 11.93 7.86 8.28 Div Cover - - - 14.53 -

Oper Pft Mgn 10.23 9.59 7.90 6.26 6.68

D:E 0.39 0.28 0.44 0.48 0.52

Current Ratio 1.56 1.90 1.83 1.79 1.73

Div Cover - 2.95 3.01 2.84 2.87

179