Page 176 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 176

JSE – REM Profile’s Stock Exchange Handbook: 2024 – Issue 4

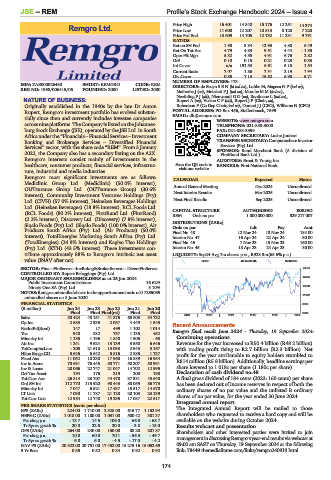

Price High 16 401 14 840 15 176 12 251 14 374

Remgro Ltd. Price Low 11 600 12 207 10 513 8 128 7 220

Price Prd End 13 609 14 705 12 732 11 231 9 791

REM

RATIOS

Ret on SH Fnd 1.98 8.84 12.93 4.88 6.49

Ret On Tot Ass 4.79 4.83 9.51 4.44 - 1.35

Oper Pft Mgn 5.32 4.85 4.91 6.76 2.82

D:E 0.10 0.15 0.21 0.23 0.33

Int Cover n/a 191.53 6.61 5.15 1.54

Current Ratio 2.07 1.86 2.31 2.19 1.94

Div Cover 0.85 7.13 15.52 6.98 5.71

NUMBER OF EMPLOYEES: 173

ISIN: ZAE000026480 SHORT: REMGRO CODE: REM DIRECTORS: de Bruyn S E N (ld ind ne), Lubbe M, Mageza N P (ind ne),

REG NO: 1968/006415/06 FOUNDED: 2000 LISTED: 2000 Malherbe J (ne), Moleketi P J (ind ne), Morobe M M (ind ne),

Neethling P J (alt), Nieuwoudt G G (ne), Rantloane L (ind ne),

NATURE OF BUSINESS: Rupert A (ne), Vosloo C P (alt), Rupert J P (Chair, ne),

Originally established in the 1940s by the late Dr Anton Robertson F (Co Dep Chair, ind ne), Durand J J (CEO), Williams N (CFO)

Rupert, Remgro’s investment portfolio has evolved substan- POSTAL ADDRESS: PO Box 456, Stellenbosch, 7599

tially since then and currently includes investee companies EMAIL: dh@remgro.com

WEBSITE: www.remgro.com

acrossnineplatforms. The Company is listed onthe Johannes- TELEPHONE: 021-888-3000

burg Stock Exchange (JSE), operated by the JSE Ltd. in South FAX: 021-888-3399

Africa under the “Financials – Financial Services – Investment COMPANY SECRETARY: Luche Joubert

Banking and Brokerage Services – Diversified Financial TRANSFER SECRETARY: ComputershareInvestor

Services (Pty) Ltd.

Services” sector, with the share code “REM”. From 3 January SPONSOR: Rand Merchant Bank (A division of

2022, the Company also has a secondary listing on the A2X. FirstRand Bank Ltd.)

Remgro’s interests consist mainly of investments in the AUDITORS: Ernst & Young Inc.

healthcare, consumer products, financial services, infrastruc- Scan the QR code to BANKERS: First National Bank

visit our website

ture, industrial and media industries.

Remgro’s most significant investments are as follows: CALENDAR Expected Status

Mediclinic Group Ltd. (Mediclinic) (50.0% interest), Annual General Meeting Dec 2024 Unconfirmed

OUTsurance Group Ltd. (OUTsurance Group) (30.6%

interest), Community Investment Ventures Holdings (Pty) Next Interim Results Mar 2025 Unconfirmed

Next Final Results Sep 2025 Unconfirmed

Ltd. (CIVH) (57.0% interest), Heineken Beverages Holdings

Ltd. (Heineken Beverages) (18.8% interest), RCL Foods Ltd.

ISSUED

(RCL Foods) (80.2% interest), FirstRand Ltd. (FirstRand) CAPITAL STRUCTURE AUTHORISED 529 217 007

REM

Ords no par

1 000 000 000

(2.2% interest), Discovery Ltd. (Discovery) (7.8% interest),

Siqalo Foods (Pty) Ltd. (Siqalo Foods) (100.0% interest), Air DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

Products South Africa (Pty) Ltd. (Air Products) (50.0% Final No 48 12 Nov 24 18 Nov 24 184.00

interest), TotalEnergies Marketing South Africa (Pty) Ltd. Interim No 47 16 Apr 24 22 Apr 24 80.00

(TotalEnergies) (24.9% interest) and Kagiso Tiso Holdings Final No 46 7 Nov 23 13 Nov 23 160.00

(Pty) Ltd. (KTH) (43.5% interest). These investments con- Interim No 45 18 Apr 23 24 Apr 23 80.00

tribute approximately 88% to Remgro’s intrinsic net asset LIQUIDITY: Sep24 Avg 7m shares p.w., R923.3m(65.6% p.a.)

value (INAV after tax). GENF 40 Week MA REMGRO

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs 16510

CONTROLLED BY: Rupert Beleggings (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 25 Jan 2024 14874

Public Investment Commissioner 16.62%

Ninety One SA (Pty) Ltd. 5.10% 13238

NOTES:Remgrounbundledsharesintheapportionmentratioof0.7255039

unbundled shares on 8 June 2020. 11602

FINANCIAL STATISTICS 9966

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final Final(rst) Final Final 8330

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Sales 50 424 48 151 41 876 65 803 54 732

Op Inc 2 683 2 335 2 057 4 449 1 545 Recent Announcements

NetIntPd(Rcvd) 147 17 499 1 102 1 014

Tax 948 832 757 1 135 452 Remgro final result June 2024 - Thursday, 19 September 2024:

Minority Int 1 135 1 196 1 840 1 505 - 63 Continuing operations

Att Inc 1 241 9 624 13 139 3 550 6 646 Revenue for the year increased to R50.4 billion (R48.2 billion)

TotCompIncLoss - 205 21 618 13 033 2 543 3 167 with trading profit rising to R2.7 billion (R2.3 billion). Net

Hline Erngs-CO 5 646 6 642 5 816 2 885 1 737 profit for the year attributable to equity holders stumbled to

Fixed Ass 11 052 10 230 17 968 16 889 16 954 R814 million (R5.8 billion). Additionally, headline earnings per

Inv in Assoc 70 691 76 445 50 771 50 207 50 991

Inv & Loans 20 066 22 747 21 047 14 702 12 995 share lowered to 1 018c per share (1 180c per share).

Def Tax Asset 194 176 219 208 190 Declaration of cash dividend no.48

Tot Curr Ass 26 814 23 707 44 478 37 381 43 640 A final gross dividend of 184 cents (2023: 160 cents) per share

Ord SH Int 112 770 115 920 98 443 88 059 86 773 has been declared out of income reserves in respect of both the

Minority Int 7 047 6 521 17 437 15 517 14 670 ordinary shares of no par value and the unlisted B ordinary

LT Liab 7 030 11 787 21 128 20 103 23 139 shares of no par value, for the year ended 30 June 2024.

Tot Curr Liab 12 984 12 740 19 295 17 087 22 517

Integrated annual report

PER SHARE STATISTICS (cents per share) The Integrated Annual Report will be mailed to those

EPS (ZARc) 224.00 1 710.00 2 328.00 615.77 1 152.94

HEPS-C (ZARc) 1 018.00 1 180.00 1 031.00 500.42 301.37 shareholders who requested to receive a hard copy and will be

Pct chng p.a. - 13.7 14.5 106.0 66.0 - 68.7 available on the website during October 2024.

Tr 5yr av grwth % 20.8 22.6 20.0 3.8 - 15.0 Results webcast and presentation

DPS (ZARc) 264.00 240.00 150.00 88.20 201.87 Shareholders and other interested parties were invited to join

Pct chng p.a. 10.0 60.0 70.1 - 56.3 - 49.7 managementindiscussingRemgro’syear-endresultsviawebcastat

Tr 5yr av grwth % 6.8 6.0 - 4.5 - 17.0 - 4.2

NAV PS (ZARc) 20 322.00 20 751.00 17 452.00 15 275.16 15 052.69 09:00 am SAST on Thursday, 19 September 2024 at the following

3 Yr Beta 0.55 0.52 0.84 0.92 0.92 link: 78449.themediaframe.com/links/remgro240919.html

174