Page 178 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 178

JSE – REN Profile’s Stock Exchange Handbook: 2024 – Issue 4

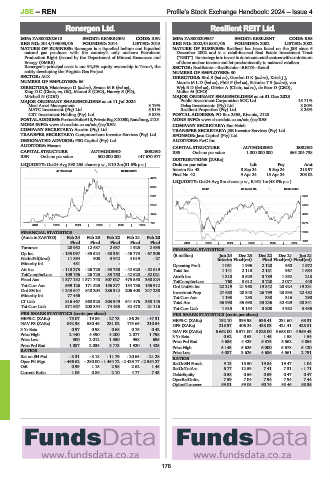

Renergen Ltd. Resilient REIT Ltd.

REN RES

ISIN: ZAE000202610 SHORT: RENERGEN CODE: REN ISIN: ZAE000209557 SHORT: RESILIENT CODE: RES

REG NO: 2014/195093/06 FOUNDED: 2014 LISTED: 2015 REG NO: 2002/016851/06 FOUNDED: 2002 LISTED: 2002

NATURE OF BUSINESS: Renergen is a liquefied helium and liquefied NATURE OF BUSINESS: Resilient has been listed on the JSE since 6

natural gas producer with the country’s only onshore Petroleum December 2002 and is a retail-focused Real Estate Investment Trust

Production Right (issued by the Department of Mineral Resources and (“REIT”).Itsstrategyistoinvestindominantretailcentreswithaminimum

Energy (DMRE). of three anchor tenants and let predominantly to national retailers.

Renergen’s principal asset is our 94,5% equity ownership in Tetra4, the SECTOR: RealEstate—RealEstate—REITS—Retail

entity developing the Virginia Gas Project. NUMBER OF EMPLOYEES: 30

SECTOR: AltX DIRECTORS: Bird S (ind ne), GordonDK(ind ne), Kriek J J,

NUMBER OF EMPLOYEES: 66 MaroleMLD(ind ne), Phili P (ind ne), SishubaTS(ind ne), van

DIRECTORS: Hlatshwayo D (ind ne), SwanaMB(ind ne), WykBD(ind ne), Olivier A (Chair, ind ne), de Beer D (CEO),

King D C (Chair, ne, UK), Marani S (CEO), Harvey B (FD), Muller M (CFO)

Mitchell N (COO) MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

MAJOR ORDINARY SHAREHOLDERS as at 11 Jul 2024 Public Investment Corporation SOC Ltd. 15.71%

Mazi Asset Management 8.79% Delsa Investments (Pty) Ltd. 8.80%

MATC Investment (Pty) Ltd. 5.91% Resilient Properties (Pty) Ltd. 8.26%

CRT Investment Holding (Pty) Ltd. 5.83% POSTAL ADDRESS: PO Box 2555, Rivonia, 2128

POSTALADDRESS:PostnetSuite610,PrivateBagX10030,Randburg,2125 MORE INFO: www.sharedata.co.za/sdo/jse/RES

MORE INFO: www.sharedata.co.za/sdo/jse/REN COMPANY SECRETARY: Sue Hsieh

COMPANY SECRETARY: Acorim (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Java Capital (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. AUDITORS: PwC Inc.

AUDITORS: Mazars

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED RES Ords no par value 1 000 000 000 365 204 738

REN Ords no par value 500 000 000 147 670 977

DISTRIBUTIONS [ZARc]

LIQUIDITY: Oct24 Avg 898 255 shares p.w., R10.2m(31.6% p.a.) Ords no par value Ldt Pay Amt

Interim No 43 3 Sep 24 9 Sep 24 218.97

40 Week MA RENERGEN

Final No 42 9 Apr 24 15 Apr 24 203.02

4270

LIQUIDITY: Oct24 Avg 3m shares p.w., R162.1m(48.0% p.a.)

3565

REIV 40 Week MA RESILIENT

2861 6451

2156 5559

1452 4667

747 3775

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 2883

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final Final Final Final 2019 | 2020 | 2021 | 2022 | 2023 | 2024 1991

Turnover 28 952 12 687 2 637 1 925 2 635 FINANCIAL STATISTICS

Op Inc - 135 097 - 35 524 - 38 361 - 46 773 - 67 305 (R million) Jun 24 Dec 23 Dec 22 Dec 21 Jun 21

NetIntPd(Rcvd) 11 894 908 3 942 4 019 - 27 Interim Final(rst) Final Final(rst) Final(rst)

Minority Int 481 - - - - Operatng Proft 1 051 1 996 2 128 950 1 672

Att Inc - 110 273 - 26 725 - 33 750 - 42 620 - 52 619 Total Inc 1 141 2 118 2 181 967 1 684

TotCompIncLoss 109 756 - 26 725 - 33 750 - 42 620 - 52 021 Attrib Inc 1 310 3 529 3 789 1 892 213

Fixed Ass 1 877 132 1 371 748 807 027 475 558 350 824 TotCompIncLoss 760 3 612 3 720 2 077 440

Tot Curr Ass 599 126 171 525 156 377 154 786 156 912 Ord UntHs Int 22 219 21 968 19 842 20 424 19 231

Ord SH Int 1 243 647 840 204 286 312 206 408 247 230 Investmnt Prop 27 680 28 348 26 799 23 933 22 482

Minority Int 77 456 - - - -

Tot Curr Ass 1 193 285 338 316 290

LT Liab 816 467 860 323 803 949 541 476 358 145 Total Ass 36 990 35 698 33 236 32 429 30 341

Tot Curr Liab 571 557 200 354 74 433 32 478 21 116 Tot Curr Liab 1 615 5 154 3 808 4 982 3 435

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 75.07 - 19.86 - 27.73 - 36.29 - 47.31 HEPS-C (ZARc) 192.10 393.95 536.41 231.60 65.31

NAV PS (ZARc) 842.98 580.46 231.02 175.65 210.54 DPS (ZARc) 218.97 406.24 438.03 421.41 428.81

3 Yr Beta 0.97 0.98 0.68 0.75 0.42 NAV PS (ZARc) 6 652.00 6 571.00 5 826.00 5 658.00 4 959.43

Price High 2 440 4 390 4 200 2 077 1 798 3 Yr Beta 0.62 0.63 1.45 1.58 1.54

Price Low 900 2 012 1 550 958 695 Price Prd End 4 686 4 429 5 375 5 562 4 854

Price Prd End 1 087 2 035 3 713 1 920 1 425 Price High 5 143 5 625 6 000 5 678 5 120

RATIOS Price Low 4 087 3 625 4 686 4 561 2 791

Ret on SH Fnd - 8.31 - 3.18 - 11.79 - 20.65 - 21.28 RATIOS

Oper Pft Mgn - 466.62 - 280.00 - 1 454.72 - 2 429.77 - 2 554.27 RetOnSH Funds 9.13 15.50 19.84 19.47 1.04

D:E 0.99 1.15 2.98 2.62 1.45 RetOnTotAss 6.77 12.59 7.41 7.31 - 1.71

Current Ratio 1.05 0.86 2.10 4.77 7.43 Debt:Equity 0.58 0.56 0.59 0.47 0.47

OperRetOnInv 7.59 7.04 7.94 7.94 7.44

OpInc:Turnover 59.01 59.05 60.74 58.46 58.36

176