Page 199 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 199

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – STA

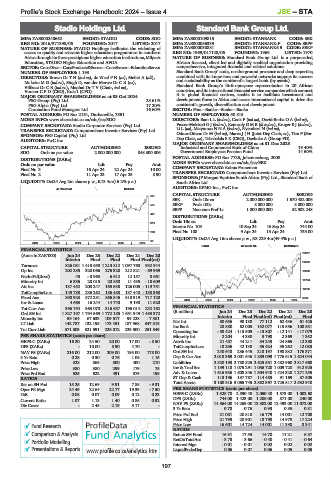

Stadio Holdings Ltd. Standard Bank Group Ltd.

STA STA

ISIN: ZAE000248662 SHORT: STADIO CODE: SDO ISIN: ZAE000109815 SHORT: STANBANK CODE: SBK

REG NO: 2016/371398/06 FOUNDED: 2017 LISTED: 2017 ISIN: ZAE000056339 SHORT: STANBANK-P CODE: SBPP

NATURE OF BUSINESS: STADIO Holdings facilitates the widening of ISIN: ZAE000038881 SHORT: STANBANK6.5 CODE: SBKP

access to quality and relevant higher education programmes in southern REG NO: 1969/017128/06 FOUNDED: 1969 LISTED: 1970

Africa through its three prestigious higher education institutions, Milpark NATURE OF BUSINESS: Standard Bank Group Ltd. is a purpose-led,

Education, STADIO Higher Education and AFDA. African focused, client led and digitally enabled organisation providing

SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—EducationServcs comprehensive, integrated financial and related solutions.

NUMBER OF EMPLOYEES: 1 193 Standard Bank Group’ scale, on-the-ground presence and deep expertise,

DIRECTORS: Brown DrTH(ind ne), de WaalPN(ne), Mellet A (alt), combined with its know-how and powerful networks support its success

MokokaMG(ind ne), Singh D, van der Merwe DrCR(ne), and sustainability as the continent’s largest bank (by assets).

Vilikazi DrCB(ind ne), Maphai Dr T V (Chair, ind ne), Standard Bank Group’s fit-for-purpose representation in 20 African

VorsterCPD (CEO), Kula I (CFO) countries, and its international financial service companies which connect

MAJOR ORDINARY SHAREHOLDERS as at 03 Oct 2024 it to global financial centres, enable it to facilitate investment and

PSG Group (Pty) Ltd. 25.61% development flows in Africa and access international capital to drive the

PSG Alpha (Pty) Ltd. 17.20% continent’s growth, diversification and development.

Coronation Fund Managers Ltd. 16.60% SECTOR: Fins—Banks—Banks—Banks

POSTAL ADDRESS: PO Box 2161, Durbanville, 7551 NUMBER OF EMPLOYEES: 50 815

MORE INFO: www.sharedata.co.za/sdo/jse/SDO DIRECTORS: BamLL(ind ne), Cook P (ind ne), David-Borha O A (ind ne),

COMPANY SECRETARY: Stadio Corporate Services (Pty) Ltd. Fraser-Moleketi G J (ind ne), Kennealy G M B (ld ind ne), Kruger B J (ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Li L (ne), Matyumza N N A (ind ne), Nyembezi N (ind ne),

SPONSOR: PSG Capital (Pty) Ltd. Oduor-Otieno Dr M (ind ne), Maree J ( H (Joint Dep Chair, ne), Tian F (Snr

AUDITORS: PwC Inc. Dep Chair, ne), Tshabalala S K (CEO), Daehnke A (Group FD)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

CAPITAL STRUCTURE AUTHORISED ISSUED Industrial and Commercial Bank of China 19.40%

SDO Ords no par value 2 000 000 000 848 300 306 Government Employees Pension Fund 14.50%

POSTAL ADDRESS: PO Box 7725, Johannesburg, 2000

DISTRIBUTIONS [ZARc] MORE INFO: www.sharedata.co.za/sdo/jse/SBK

Ords no par value Ldt Pay Amt

Final No 3 16 Apr 24 22 Apr 24 10.00 COMPANY SECRETARY: Kobus Froneman

Final No 2 11 Apr 23 17 Apr 23 8.90 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: JP Morgan Equities South Africa (Pty) Ltd., Standard Bank of

LIQUIDITY: Oct24 Avg 2m shares p.w., R13.4m(15.2% p.a.) South Africa Ltd.

AUDITORS: KPMG Inc., PwC Inc.

40 Week MA STADIO

CAPITAL STRUCTURE AUTHORISED ISSUED

641

SBK Ords 10c ea 2 000 000 000 1 670 482 006

531 SBKP Prefs 100c 8 000 000 8 000 000

SBPP Non-cum Pref 1c 1 000 000 000 52 982 248

421

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt

310

Interim No 109 10 Sep 24 16 Sep 24 744.00

200 Final No 108 9 Apr 24 15 Apr 24 733.00

LIQUIDITY: Oct24 Avg 16m shares p.w., R3 229.4m(49.4% p.a.)

90

2019 | 2020 | 2021 | 2022 | 2023 | 2024

BANK 40 Week MA STANBANK

FINANCIAL STATISTICS

26312

(Amts in ZAR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final(rst)

22806

Turnover 826 031 1 413 650 1 213 812 1 097 768 932 944

Op Inc 202 285 320 066 276 328 212 821 - 69 969 19300

NetIntPd(Rcvd) 45 - 3 963 6 612 12 157 8 661

Minority Int 6 336 28 015 20 850 11 435 - 18 609 15794

Att Inc 137 452 208 247 165 638 126 005 - 119 751

12288

TotCompIncLoss 143 788 236 262 186 488 137 440 - 138 360

Fixed Ass 890 923 872 281 866 846 810 319 717 120 8782

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Inv & Loans 4 663 16 244 14 740 9 190 11 620

Tot Curr Ass 396 754 363 070 316 657 196 014 232 162 FINANCIAL STATISTICS

Ord SH Int 1 827 197 1 794 569 1 772 185 1 651 949 1 493 372 (R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Final

Final Final(rst) Final(rst)

Minority Int 59 164 67 633 109 517 99 228 - 7 381 Net Int Interim 98 188 77 112 62 436 61 425

50 656

LT Liab 142 787 132 195 173 451 187 968 347 315 Inc Bank 28 880 62 003 132 077 113 556 108 581

Tot Curr Liab 371 303 321 591 226 012 229 500 251 549

Operating Inc - 58 424 - 113 509 - 13 807 - 12 141 - 17 079

PER SHARE STATISTICS (cents per share) Minority Int 2 204 4 330 3 798 2 369 1 352

HEPS-C (ZARc) 16.20 24.50 20.00 17.00 - 8.50 Attrib Inc 21 487 44 211 34 243 24 865 12 358

DPS (ZARc) - 10.00 8.90 4.70 - TotCompIncLoss 18 296 42 138 35 424 35 262 12 083

NAV PS (ZARc) 216.00 212.00 209.00 195.00 178.00 Ord SH Int 240 648 236 445 218 197 198 832 176 371

3 Yr Beta 0.28 0.30 0.76 1.08 1.15 Dep & Cur Acc 2 018 369 2 001 646 1 889 099 1 776 615 1 624 044

Price High 528 565 500 400 210 Liabilities 2 820 193 2 788 825 2 623 531 2 482 968 2 317 668

Price Low 380 380 299 179 75 Inv & Trad Sec 1 139 118 1 075 291 1 056 720 1 009 720 912 925

Price Prd End 525 522 491 375 195 Adv & Loans 1 616 936 1 608 846 1 504 940 1 424 328 1 271 255

RATIOS ST Dep & Cash 113 196 137 787 114 483 91 169 87 505

Total Assets 3 100 316 3 065 745 2 882 397 2 725 817 2 532 940

Ret on SH Fnd 15.25 12.69 9.91 7.85 - 9.31

Oper Pft Mgn 24.49 22.64 22.77 19.39 - 7.50 PER SHARE STATISTICS (cents per share)

D:E 0.08 0.07 0.09 0.12 0.23 HEPS-C (ZARc) 1 328.70 2 590.40 2 050.40 1 573.00 1 002.60

Current Ratio 1.07 1.13 1.40 0.85 0.92 DPS (ZARc) 744.00 1 423.00 1 206.00 871.00 240.00

Div Cover - 2.45 2.19 3.17 - NAV PS (ZARc) 14 564.00 14 269.00 13 302.00 12 493.00 11 072.00

3 Yr Beta 0.78 0.76 0.93 0.85 0.81

Price Prd End 21 081 20 810 16 779 14 001 12 708

Price High 21 799 20 901 18 798 14 978 17 224

Fund Research Price Low 16 601 14 724 14 001 11 338 8 341

RATIOS

Comparison & Analysis Ret on SH Fund 16.91 17.53 14.70 11.21 6.37

RetOnTotalAss - 3.73 - 3.66 - 0.40 - 0.41 - 0.64

Portfolio Modelling

Interest Mgn - 0.01 - 0.01 0.02 0.02 0.02

Presentations & Reports www.profile.co.za/analytics.htm LiquidFnds:Dep 0.06 0.07 0.06 0.05 0.05

197