Page 205 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 205

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – TIG

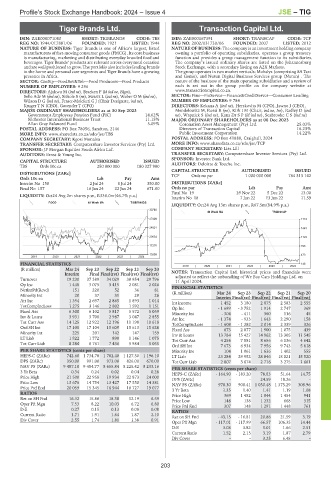

Tiger Brands Ltd. Transaction Capital Ltd.

TIG TRA

ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS ISIN: ZAE000167391 SHORT: TRANSCAP CODE: TCP

REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944 REG NO: 2002/031730/06 FOUNDED: 2007 LISTED: 2012

NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed NATURE OF BUSINESS: The company is an investment holding company

manufacturers of fast-moving consumer goods (FMCG). Its core business owning a portfolio of operating subsidiaries, operates a group treasury

is manufacturing, marketing and distributing everyday branded food and function and provides a group management function to its subsidiaries.

beverages. Tiger Brands’ products are relevant across every meal occasion The company’s issued ordinary shares are listed on the Johannesburg

and are well positioned to grow. The portfolio also includes leading brands Stock Exchange, with a secondary listing on A2X Markets.

in the home and personal care segments and Tiger Brands have a growing The group operates in two market verticals: Mobalyz (comprising SA Taxi

presence in Africa. and Gomo), and Nutun Digital Business Services group (Nutun) . The

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products nature of the business of the main operating subsidiaries and a review of

NUMBER OF EMPLOYEES: 9 296 each is set out in the group profile on the company website at

DIRECTORS: Ajukwu M (ind ne), Braeken F (ld ind ne, Blgm), www.transactioncapital.co.za.

Sello Adv M (ind ne), Sithole S (ne), Swartz L (ind ne), WeberOM(ind ne), SECTOR: Fins—FinServcs—Finance&CreditServcs—Consumer Lending

Wilson D G (ind ne), Fraser-Moleketi G J (Chair Designate, ind ne), NUMBER OF EMPLOYEES: 9 784

Kruger T N (CEO), Govender T (CFO) DIRECTORS: Kekana A (ind ne), Herskovits M (CFO), Jawno J (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023 Mendelowitz M, Rossi R (ne), Kirk I M (Chair, ind ne, Ire), Radley D (ind

Government Employees Pension Fund (PIC) 14.62% ne), Wapnick S (ind ne), Kana DrSP(ld ind ne), SeabrookeCS(ind ne)

Silchester International Business Trust 11.15% MAJOR ORDINARY SHAREHOLDERS as at 06 Dec 2023

Allan Gray Balanced Fund 5.09% Coronation Asset Management (Pty) Ltd. 25.03%

POSTAL ADDRESS: PO Box 78056, Sandton, 2146 Directors of Transaction Capital 16.23%

MORE INFO: www.sharedata.co.za/sdo/jse/TBS Public Investment Corporation 14.22%

COMPANY SECRETARY: Kgosi Monaisa POSTAL ADDRESS: PO Box 41888, Craighall, 2024

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/TCP

SPONSOR: JP Morgan Equities South Africa Ltd. COMPANY SECRETARY: Lisa Lill

AUDITORS: Ernst & Young Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

TBS Ords 10c ea 250 000 000 180 327 980 AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] TCP Ords no par 1 000 000 000 784 313 142

Ords 10c ea Ldt Pay Amt

Interim No 158 2 Jul 24 8 Jul 24 350.00 DISTRIBUTIONS [ZARc]

Final No 157 16 Jan 24 22 Jan 24 671.00 Ords no par Ldt Pay Amt

Final No 19 29 Nov 22 5 Dec 22 13.00

LIQUIDITY: Oct24 Avg 2m shares p.w., R336.0m(46.7% p.a.)

Interim No 18 7 Jun 22 13 Jun 22 11.59

FOOD 40 Week MA TIGBRANDS

LIQUIDITY: Oct24 Avg 13m shares p.w., R67.5m(84.9% p.a.)

30786

40 Week MA TRANSCAP

27409 1774

24031 1449

20654 1124

17276 798

13899 473

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 148

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

Interim Final Final(rst) Final(rst) Final(rst) NOTES: Transaction Capital Ltd. historical prices and financials were

Turnover 19 230 37 389 34 029 30 954 29 796 adjusted to reflect the unbundling of We Buy Cars Holdings Ltd. on

11 April 2024.

Op Inc 1 448 3 075 3 415 2 081 2 026

FINANCIAL STATISTICS

NetIntPd(Rcvd) 151 220 52 36 81

Sep 21

Sep 20

Mar 24

Sep 23

Sep 22

Minority Int 20 37 31 29 26 (R million) Interim Final(rst) Final(rst) Final(rst) Final(rst)

Att Inc 1 394 2 697 2 865 1 893 1 014 Int income 1 452 3 180 2 875 2 583 2 555

TotCompIncLoss 1 275 3 146 2 802 1 592 1 151 Op Inc - 1 699 - 3 752 1 914 2 747 369

Fixed Ass 6 300 6 102 5 817 5 572 5 059 Minority Int - 304 - 411 360 116 45

Inv & Loans 3 931 3 708 2 987 3 047 2 855 Att Inc - 1 374 - 933 1 643 2 290 158

Tot Curr Ass 14 125 12 922 12 196 11 198 10 618 TotCompIncLoss - 1 608 - 1 282 2 014 2 339 326

Ord SH Int 17 108 17 104 15 609 15 613 15 628 Fixed Ass 673 2 077 1 900 1 075 439

Minority Int 225 201 142 147 159 Inv & Loans 13 784 15 427 14 962 13 305 11 545

LT Liab 1 822 1 772 890 1 146 1 075 Tot Curr Ass 4 256 7 881 8 656 6 136 4 642

Tot Curr Liab 8 284 6 761 7 436 5 984 5 055

Ord SH Int 7 673 6 934 7 956 9 743 5 818

PER SHARE STATISTICS (cents per share) Minority Int 104 1 061 1 636 1 402 555

HEPS-C (ZARc) 742.60 1 734.70 1 702.40 1 127.30 1 196.10 LT Liab 23 284 29 952 28 046 18 021 15 520

DPS (ZARc) 350.00 991.00 973.00 826.00 670.00 Tot Curr Liab 2 807 3 674 2 716 3 275 1 661

NAV PS (ZARc) 9 487.10 9 484.77 8 655.84 8 225.42 8 233.16 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.34 0.24 0.02 0.04 0.28 HEPS-C (ZARc) - 164.90 - 183.20 78.83 51.64 14.75

Price High 21 500 22 958 19 934 22 873 24 000 DPS (ZARc) - - 24.59 18.26 -

Price Low 13 676 14 754 13 427 17 550 14 381 NAV PS (ZARc) 978.30 908.41 1 050.48 1 375.29 308.96

Price Prd End 20 059 15 345 16 944 18 727 19 077 3 Yr Beta 1.35 1.40 1.41 1.19 1.08

RATIOS Price High 369 1 482 1 844 1 454 941

Ret on SH Fnd 16.32 15.80 18.38 12.19 6.59 Price Low 148 138 1 232 668 315

Oper Pft Mgn 7.53 8.22 10.03 6.72 6.80

Price Prd End 307 148 1 291 1 448 761

D:E 0.27 0.15 0.13 0.08 0.08 RATIOS

Current Ratio 1.71 1.91 1.64 1.87 2.10 Ret on SH Fnd - 43.15 - 16.81 20.88 21.59 3.19

Div Cover 2.55 1.74 1.81 1.38 0.91

Oper Pft Mgn - 117.01 - 117.99 66.57 106.35 14.44

D:E 3.08 3.82 3.01 1.66 2.51

Current Ratio 1.52 2.15 3.19 1.87 2.79

Div Cover - - 3.25 6.48 -

203