Page 157 - shbh24_complete

P. 157

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – NUM

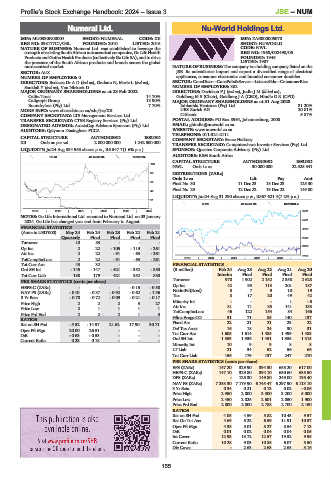

Numeral Ltd. Nu-World Holdings Ltd.

NUM NUW

ISIN: MU0330N00004 SHORT: NUMERAL CODE: XII ISIN: ZAE000005070

REG NO: 098177C1/GBL FOUNDED: 2010 LISTED: 2016 SHORT: NUWORLD

NATURE OF BUSINESS: Numeral Ltd. was established to leverage the CODE: NWL

strength of existing South African nutraceutical companies, Go Life Health REG NO: 1968/002490/06

Products and Gotha Health Products (collectively Go Life SA), and to drive FOUNDED: 1946

the presence of the South African products and brands across the global LISTED: 1987

nutraceutical market. NATURE OF BUSINESS: The company is a holding company listed on the

SECTOR: AltX JSE. Its subsidiaries import and export a diversified range of electrical

NUMBER OF EMPLOYEES: 0 appliances, consumer electronics and branded consumer durables.

DIRECTORS: Bedacee DrAD(ind ne), Graham N, Marie L (ind ne), SECTOR: ConsDiscr—ConsPdts&Servcs—LeisureGds—ConsumerElec

Sooklall Y (ind ne), Van Niekerk D NUMBER OF EMPLOYEES: 302

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2022 DIRECTORS: DavidsonFJ(ind ne), JudinJM(ld ind ne),

Calitz Trust 14.70% Goldberg M S (Chair), Goldberg J A (CEO), Hindle G R (CFO)

Caligraph Group 13.90% MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2023

Boundryless (Pty) Ltd. 7.70% Inhlanhla Ventures (Pty) Ltd. 31.20%

MORE INFO: www.sharedata.co.za/sdo/jse/XII UBS Zurich AG 20.81%

COMPANY SECRETARY: LTS Management Services Ltd. Citibank 5.87%

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. POSTAL ADDRESS: PO Box 8964, Johannesburg, 2000

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. EMAIL: ghindle@nuworld.co.za

AUDITORS: Qaiyoom Dustagheer FCCA WEBSITE: www.nuworld.co.za

TELEPHONE: 011-321-2111

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Bruce Haikney

XII Ords no par val 2 000 000 000 1 242 500 000

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

LIQUIDITY: Jul24 Avg 384 953 shares p.w., R6 547.7(1.6% p.a.) SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: RSM South Africa

PHAR 40 Week MA NUMERAL

CAPITAL STRUCTURE AUTHORISED ISSUED

100

NWL Ords 1c ea 30 000 000 22 525 541

80 DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

60

Final No 30 11 Dec 23 18 Dec 23 125.30

Final No 29 12 Dec 22 19 Dec 22 149.80

40

LIQUIDITY: Jun24 Avg 31 290 shares p.w., R867 621.4(7.2% p.a.)

21

ALSH 40 Week MA NUWORLD

1

2019 | 2020 | 2021 | 2022 | 2023 | 2024 6701

NOTES: Go Life International Ltd. renamed to Numeral Ltd. on 03 January

2024. Go Life has changed year end from February to August. 5781

FINANCIAL STATISTICS 4860

(Amts in USD’000) May 24 Feb 24 Feb 23 Feb 22 Feb 21

Quarterly Final Final Final Final 3940

Turnover 10 83 - - -

3020

Op Inc 2 22 - 105 - 119 - 261

Att Inc 2 22 - 91 - 63 - 261 2100

2019 | 2020 | 2021 | 2022 | 2023 |

TotCompIncLoss 2 22 - 91 - 63 - 261

Tot Curr Ass 43 32 - - - FINANCIAL STATISTICS

Ord SH Int - 145 - 147 - 421 - 352 - 850 (R million) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20

Tot Curr Liab 188 179 421 352 850 Interim Final Final Final Final

Turnover 970 1 902 2 152 2 358 2 628

PER SHARE STATISTICS (cents per share)

Op Inc 42 95 113 201 187

HEPS-C (ZARc) - - - - 0.15 - 0.50

NAV PS (ZARc) - 0.01 - 0.37 - 0.92 - 0.62 - 1.36 NetIntPd(Rcvd) 3 7 9 10 19

3 Yr Beta - 0.70 - 0.72 - 0.09 - 0.21 - 0.17 Tax 8 17 20 49 42

Price High 2 2 2 3 27 Minority Int - - - 1 - 6

Price Low 2 1 1 1 1 Att Inc 31 71 85 141 133

TotCompIncLoss 46 122 154 84 166

Price Prd End 2 2 2 1 3

RATIOS Hline Erngs-CO 31 71 85 140 137

Ret on SH Fnd - 5.52 - 14.97 21.62 17.90 30.71 Fixed Ass 22 21 21 23 22

Oper Pft Mgn 20.00 26.51 - - - Def Tax Asset 16 18 24 30 31

D:E - 0.63 - 0.53 - - - Tot Curr Ass 1 605 1 614 1 485 1 499 1 483

Current Ratio 0.23 0.18 - - - Ord SH Int 1 553 1 536 1 451 1 355 1 315

Minority Int 10 9 9 8 8

LT Liab 21 34 52 56 66

Tot Curr Liab 156 179 137 247 270

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 147.20 329.90 394.30 655.20 617.00

HEPS-C (ZARc) 147.10 329.80 394.10 650.60 635.50

DPS (ZARc) - 125.30 149.80 249.00 195.40

NAV PS (ZARc) 7 258.30 7 179.90 6 745.47 6 297.90 6 113.10

3 Yr Beta 0.34 0.21 0.13 0.02 - 0.06

Price High 2 950 2 800 3 500 3 200 5 000

Price Low 2 450 2 025 2 601 2 050 1 900

Price Prd End 2 800 2 800 2 788 2 700 2 150

RATIOS

Ret on SH Fnd 4.05 4.59 5.82 10.43 9.57

Ret On Tot Ass 4.69 5.22 6.59 11.91 10.57

Oper Pft Mgn 4.38 5.01 5.27 8.54 7.13

D:E 0.01 0.02 0.04 0.04 0.05

Int Cover 12.93 13.72 12.57 19.52 9.95

Current Ratio 10.28 9.03 10.85 6.07 5.50

Div Cover - 2.63 2.63 2.63 3.16

155