Page 155 - shbh24_complete

P. 155

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – NIN

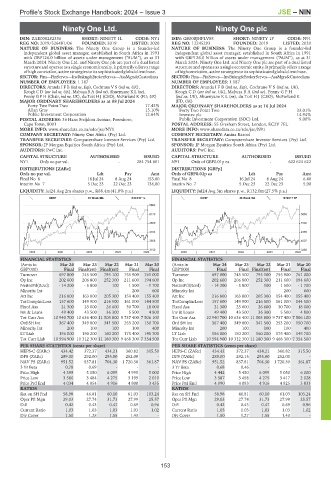

Ninety One Ltd. Ninety One plc

NIN NIN

ISIN: ZAE000282356 SHORT: NINETY 1L CODE: NY1 ISIN: GB00BJHPLV88 SHORT: NINETY 1P CODE: N91

REG NO: 2019/526481/06 FOUNDED: 2019 LISTED: 2020 REG NO: 12245293 FOUNDED: 2019 LISTED: 2020

NATURE OF BUSINESS: The Ninety One Group is a founder-led NATURE OF BUSINESS: The Ninety One Group is a founder-led

independent global asset manager, established in South Africa in 1991 independent global asset manager, established in South Africa in 1991

with GBP126.0 billion of assets under management (“AUM”), as at 31 with GBP126.0 billion of assets under management (“AUM”), as at 31

March 2024. Ninety One Ltd. and Ninety One plc are part of a dual listed March 2024. Ninety One Ltd. and Ninety One plc are part of a dual listed

structure andoperate as a single economic entity. It primarily offers a range structure andoperate as a single economic entity. It primarily offers a range

ofhigh conviction,activestrategiestoitssophisticatedglobalclientbase. ofhighconviction, activestrategiestoitssophisticatedglobalclientbase.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

NUMBER OF EMPLOYEES: 1 187 NUMBER OF EMPLOYEES: 1 187

DIRECTORS: Aranda I F B (ind ne, Esp), Cochrane V S (ind ne, UK), DIRECTORS: ArandaIFB(ind ne, Esp), CochraneVS(ind ne, UK),

Keogh C D (snr ind ne, UK), Mabuza BA(ind ne), Shuenyane K L (ne), KeoghCD(snr ind ne, UK), MabuzaBA(ind ne), PennyGPH

Penny G P H (Chair, ind ne, UK), du Toit H J (CEO), McFarland K (FD, UK) (ind ne, UK), ShuenyaneKL(ne), du Toit H J (CEO), McFarland K

MAJOR ORDINARY SHAREHOLDERS as at 08 Jul 2024 (FD, UK)

Forty Two Point Two 17.42% MAJOR ORDINARY SHAREHOLDERS as at 16 Jul 2024

Allan Gray 15.10% Forty Two Point Two 33.01%

Public Investment Corporation 12.64% Investec plc 14.94%

POSTAL ADDRESS: 36 Hans Strijdom Avenue, Foreshore, Public Investment Corporation (SOC) Ltd. 9.00%

Cape Town, 8001 POSTAL ADDRESS: 55 Gresham Street, London, EC2V 7EL

MORE INFO: www.sharedata.co.za/sdo/jse/NY1 MORE INFO: www.sharedata.co.za/sdo/jse/N91

COMPANY SECRETARY: Ninety One Africa (Pty) Ltd. COMPANY SECRETARY: Amina Rasool

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd. SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

AUDITORS: PwC Inc. AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

NY1 Ords no par val. - 284 754 801 N91 Ords of GBP0.01p ea - 622 624 622

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [GBPp]

Ords no par val. Ldt Pay Amt Ords of GBP0.01p ea Ldt Pay Amt

Final No 8 16 Jul 24 8 Aug 24 153.00 FinalNo 8 16 Jul24 8 Aug 24 6.40

Interim No 7 5 Dec 23 22 Dec 23 136.00 Interim No 7 5 Dec 23 22 Dec 23 5.90

LIQUIDITY: Jul24 Avg 2m shares p.w., R88.4m(41.0% p.a.) LIQUIDITY: Jul24 Avg 3m shares p.w., R132.0m(27.5% p.a.)

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 (Amts in Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

GBP’000) Final Final(rst) Final(rst) Final Final GBP’000) Final Final Final(rst) Final Final

Turnover 697 800 745 500 795 100 755 900 761 000 Turnover 697 800 745 500 795 100 755 900 761 000

Op Inc 202 600 206 800 252 300 211 600 194 600 Op Inc 202 600 206 800 252 300 211 600 194 600

NetIntPd(Rcvd) - 14 200 - 5 800 100 1 500 - 1 700 NetIntPd(Rcvd) - 14 200 - 5 800 100 1 500 - 1 700

Minority Int - - - 200 600 Minority Int - - - 200 600

Att Inc 216 800 163 800 205 300 154 400 155 400 Att Inc 216 800 163 800 205 300 154 400 155 400

TotCompIncLoss 157 600 149 900 216 500 161 000 144 500 TotCompIncLoss 157 600 149 900 216 500 161 000 144 500

Fixed Ass 21 300 23 000 26 600 30 700 18 000 Fixed Ass 21 300 23 000 26 600 30 700 18 000

Inv & Loans 49 400 43 500 36 300 5 500 4 800 Inv & Loans 49 400 43 500 36 300 5 500 4 800

Tot Curr Ass 10 940 700 10 636 400 11 503 800 9 737 400 7 506 100 Tot Curr Ass 10 940 700 10 636 400 11 503 800 9 737 400 7 506 100

Ord SH Int 367 400 349 800 341 500 253 200 150 700 Ord SH Int 367 400 349 800 341 500 253 200 150 700

Minority Int 200 100 100 100 400 Minority Int 200 100 100 100 400

LT Liab 156 000 150 200 160 200 175 400 145 700 LT Liab 156 000 150 200 160 200 175 400 145 700

Tot Curr Liab 10 594 900 10 312 300 11 180 300 9 468 300 7 354 500 Tot Curr Liab 10 594 900 10 312 300 11 180 300 9 468 300 7 354 500

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 434.42 372.37 434.21 360.82 315.50 HEPS-C (ZARc) 434.42 372.37 434.21 360.82 315.50

DPS (ZARc) 289.00 292.00 295.00 252.00 - DPS (ZARc) 289.00 292.15 295.00 252.00 -

NAV PS (ZARc) 951.52 837.81 704.30 1 720.30 361.87 NAV PS (ZARc) 951.52 837.81 704.30 1 720.30 361.87

3 Yr Beta 0.78 0.69 - - - 3 Yr Beta 0.68 0.46 - - -

Price High 4 399 5 150 6 099 4 995 5 000 Price High 4 442 5 450 6 099 5 050 6 000

Price Low 3 566 3 484 4 275 3 199 2 010 Price Low 3 587 3 458 4 275 3 417 2 028

Price Prd End 4 034 4 054 4 916 4 800 3 435 Price Prd End 4 090 4 083 4 916 4 825 3 833

RATIOS RATIOS

Ret on SH Fnd 58.98 46.81 60.10 61.03 103.24 Ret on SH Fnd 58.98 46.81 60.10 61.03 103.24

Oper Pft Mgn 29.03 27.74 31.73 27.99 25.57 Oper Pft Mgn 29.03 27.74 31.73 27.99 25.57

D:E 0.42 0.43 0.47 0.69 0.96 D:E 0.42 0.43 0.47 0.69 0.96

Current Ratio 1.03 1.03 1.03 1.03 1.02 Current Ratio 1.03 1.03 1.03 1.03 1.02

Div Cover 1.50 1.28 1.55 1.43 - Div Cover 1.50 1.27 1.55 1.43 -

153