Page 158 - shbh24_complete

P. 158

JSE – OAN Profile’s Stock Exchange Handbook: 2024 – Issue 3

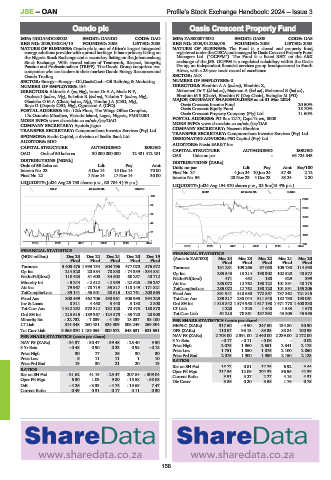

Oando plc Oasis Crescent Property Fund

OAN OAS

ISIN: NGOANDO00002 SHORT: OANDO CODE: OAO ISIN: ZAE000074332 SHORT: OASIS CODE: OAS

REG NO: 2005/038824/10 FOUNDED: 2005 LISTED: 2005 REG NO: 2003/012266/06 FOUNDED: 2005 LISTED: 2005

NATURE OF BUSINESS: Oando plc is one of Africa’s largest integrated NATURE OF BUSINESS: The Fund is a closed end property fund,

energy solutions provider with a proud heritage. It has a primary listing on registered underthe CISCAandmanagedby OasisCrescentProperty Fund

the Nigeria Stock Exchange and a secondary listing on the Johannesburg Managers Ltd. (“OCPFM”). The Fund is a listed REIT on the AltX

Stock Exchange. With shared values of Teamwork, Respect, Integrity, exchange of the JSE. OCPFM is a regulated subsidiary within the Oasis

Passion and Professionalism (TRIPP). The Oando Group comprises two Group, an independent financial services group headquartered in South

companies who are leaders in their market: Oando Energy Resources and Africa, with a 25-year track record of excellence.

Oando Trading. SECTOR: AltX

SECTOR: Energy—Energy—Oil,Gas&Coal—Oil Refining & Marketing NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 154 DIRECTORS: EbrahimAA(ind ne), Ebrahim Z,

DIRECTORS: Akinrele A (ne, Nig), Irune Dr A A, Mede N F, Mahomed Dr Y (ld ind ne), Mayman A (ind ne), Mohamed E (ind ne),

Osakwe I (ind ne, Nig), Sokefun R (ind ne), Yakubu T (ind ne, Nig), Ebrahim M S (Chair), Ebrahim N (Dep Chair), Swingler M (FD)

GbadeboOMA (Chair, ind ne, Nig), Tinubu J A (CEO, Nig), MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

Boyo O (Deputy CEO, Nig), Ogunsemi A (CFO) Oasis Crescent Income Fund 20.50%

POSTAL ADDRESS: 9th -12th Floor, The Wings Office Complex, Oasis Crescent Equity Fund 18.70%

Oasis Crescent Property Company (Pty) Ltd.

11.60%

17a Ozumba Mbadiwe, Victoria Island, Lagos, Nigeria, PMB12801

MORE INFO: www.sharedata.co.za/sdo/jse/OAO POSTAL ADDRESS: PO Box 1217, Cape Town, 8000

MORE INFO: www.sharedata.co.za/sdo/jse/OAS

COMPANY SECRETARY: Ayotola Jagun

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Nazeem Ebrahim

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd.

AUDITORS: BDO

AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

OAO Ords of 50 kobo ea 30 000 000 000 12 431 412 481 CAPITAL STRUCTURE AUTHORISED ISSUED

OAS Units no par - 65 724 843

DISTRIBUTIONS [NGNk] DISTRIBUTIONS [ZARc]

Ords of 50 kobo ea Ldt Pay Amt Units no par Ldt Pay Amt Scr/100

Interim No 23 5 Dec 14 15 Dec 14 70.00

Final No 22 7 Nov 14 17 Nov 14 30.00 Final No 37 4 Jun 24 10 Jun 24 57.43 2.12

Interim No 36 28 Nov 23 4 Dec 23 53.24 2.20

LIQUIDITY: Jul24 Avg 25 733 shares p.w., R3 784.4(-% p.a.)

LIQUIDITY: Jul24 Avg 194 570 shares p.w., R3.9m(15.4% p.a.)

OILP 40 Week MA OANDO

REIV 40 Week MA OASIS

103

2330

82

2018

62

1706

42

1393

21

1081

1

2019 | 2020 | 2021 | 2022 | 2023 | 2024 769

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS FINANCIAL STATISTICS

(NGN million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 (Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final Final Final Final Final Final Final Final Final

Turnover 3 403 476 1 993 754 804 796 477 070 576 572 Turnover 131 251 109 266 97 050 105 738 114 590

Op Inc 214 520 20 584 78 830 - 74 339 - 334 881 Op Inc 285 543 13 214 198 302 102 520 48 572

NetIntPd(Rcvd) 110 423 81 600 34 502 60 257 40 712 NetIntPd(Rcvd) 471 452 180 629 399

Minority Int - 5 244 - 2 512 - 2 959 - 22 525 - 35 257 Att Inc 285 072 12 762 198 122 101 891 48 173

Att Inc 79 967 - 78 719 35 817 - 118 149 - 171 821 TotCompIncLoss 285 072 12 762 198 120 101 891 155 206

TotCompIncLoss - 39 141 - 56 801 30 616 - 132 761 - 200 563 Fixed Ass 891 941 818 680 772 857 737 362 721 815

Fixed Ass 800 499 462 706 430 961 906 995 394 229 Tot Curr Ass 239 317 230 044 311 548 182 790 198 061

Inv & Loans 8 311 4 450 3 440 3 138 2 808 Ord SH Int 1 813 842 1 574 950 1 617 198 1 471 770 1 400 330

Tot Curr Ass 1 512 292 370 312 132 128 70 473 188 870 LT Liab 1 220 1 325 1 448 1 583 1 678

Ord SH Int - 213 615 - 189 367 - 124 878 - 85 720 28 908 Tot Curr Liab 61 213 70 361 137 392 43 905 45 955

Minority Int - 22 732 - 7 839 - 4 139 18 037 38 100 PER SHARE STATISTICS (cents per share)

LT Liab 314 548 260 481 324 509 808 249 269 304 HEPS-C (ZARc) 317.60 - 9.90 247.50 134.80 30.90

Tot Curr Liab 3 065 070 1 189 055 800 572 648 631 621 651 DPS (ZARc) 110.67 98.13 83.33 88.84 100.99

NAV PS (ZARc) 2 703.00 2 391.00 2 440.00 2 239.00 2 172.00

PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) - 34.37 - 30.47 - 39.48 - 25.40 9.30 3 Yr Beta - 0.17 - 0.11 - 0.06 - 0.02

3 Yr Beta - 0.48 0.90 0.23 0.98 - 0.18 Price High 2 075 1 960 2 651 2 341 2 175

1 751

2 100

1 875

1 850

2 050

Price Low

Price High 30 77 26 30 30 Price Prd End 2 075 1 900 1 950 2 150 2 125

Price Low 6 11 11 1 10 RATIOS

Price Prd End 19 30 21 20 13 Ret on SH Fnd 15.72 0.81 12.25 6.92 3.44

RATIOS Oper Pft Mgn 217.55 12.09 204.33 96.96 42.39

Ret on SH Fnd - 31.62 41.19 - 25.47 207.84 - 309.04 Current Ratio 3.91 3.27 2.27 4.16 4.31

Oper Pft Mgn 6.30 1.03 9.80 - 15.58 - 58.08 Div Cover 3.86 0.20 3.58 1.76 0.75

D:E - 4.26 - 3.33 - 4.74 - 15.69 7.47

Current Ratio 0.49 0.31 0.17 0.11 0.30

156