Page 160 - shbh24_complete

P. 160

JSE – OLD Profile’s Stock Exchange Handbook: 2024 – Issue 3

Old Mutual Ltd. Omnia Holdings Ltd.

OLD OMN

ISIN: ZAE000255360 SHORT: OMUTUAL CODE: OMU ISIN: ZAE000005153 SHORT: OMNIA CODE: OMN

REG NO: 2017/235138/06 FOUNDED: 2017 LISTED: 2018 REG NO: 1967/003680/06 FOUNDED: 1953 LISTED: 1980

NATURE OF BUSINESS: Old Mutual is a premium African financial NATURE OF BUSINESS: Omnia is a diversified group that conducts

services group that offers a broad spectrum of financial solutions to retail research and development, manufactures and supplies chemicals,

andcorporate customers across key markets segments in 14 countries. Old specialised services and solutions for the Agriculture, Mining and

Mutual’s primary operations are in South Africa and the rest of Africa, and Chemicals application industries.

it has a niche business in China. With over 176 years of heritage across SECTOR: Basic Materials—Chemicals—Chemicals—Chemicals:Diversified

sub-Saharan Africa, Old Mutual is a crucial part of the communities we NUMBER OF EMPLOYEES: 3 869

serve and broader society on the continent. DIRECTORS: Binedell Prof N A (ind ne), Bowen R C (ind ne, UK),

SECTOR: Fins—Insurance—Life Insurance—Life Insurance Cavaleros G (ind ne), MncwangoS(ind ne), Mokgosi-Mwantembe T (ind ne),

NUMBER OF EMPLOYEES: 31 032 Plaizier W (ind ne), van Dijk R (ne), Eboka T N M (Chair, ind ne),

DIRECTORS: Armstrong Dr B (ind ne), Ighodaro O (ind ne), Gobalsamy T (CEO), Serfontein S P (Group FD)

Kgaboesele I (ind ne), Langer J (ind ne), ListerJR(ind ne, UK), MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

Magwentshu-RensburgSM(ld ind ne), Mokgosi-Mwantembe T (ind ne), Public Investment Company SOC Ltd. 19.11%

MwangiJI(ind ne, Keny), Nqweni N (ind ne), Silwanyana B (ind ne), Camissa Asset Management (Pty) Ltd. 14.23%

StrydomJJ(ind ne), van GraanSW(ind ne), Manuel T (Chair, ind ne), M&G Investments 12.74%

Williamson I G (CEO), Troskie C G (CFO) POSTAL ADDRESS: PO Box 69888, Bryanston, 2021

MAJOR ORDINARY SHAREHOLDERS as at 19 Apr 2024 MORE INFO: www.sharedata.co.za/sdo/jse/OMN

Public Investment Corporation 16.12% GROUP SECRETARY: Altovise Alaxa Ellis

Allan Gray 5.99% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

BlackRock Inc 5.38% SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

POSTAL ADDRESS: PO Box 66, Cape Town, South Africa, 8000 AUDITORS: Deloitte & Touche Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/OMU

COMPANY SECRETARY: E M Kirsten CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. OMN Ords no par value - 165 124 361

SPONSOR: Tamela Holdings (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: Deloitte & Touche Inc., Ernst & Young Ords no par value Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 64 13 Aug 24 19 Aug 24 375.00

OMU Ords 100c ea 10 000 000 000 4 790 906 428 Special No 3 13 Aug 24 19 Aug 24 325.00

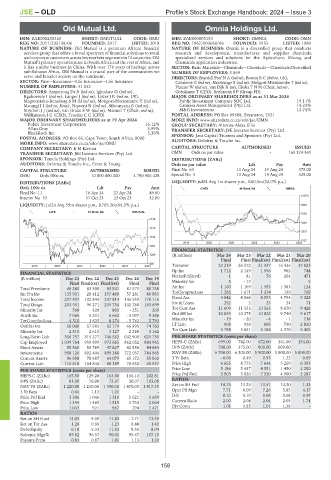

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul24 Avg 1m shares p.w., R60.5m(32.0% p.a.)

Ords 100c ea Ldt Pay Amt CHES 40 Week MA OMNIA

Final No 11 16 Apr 24 22 Apr 24 49.00

12079

Interim No 10 17 Oct 23 23 Oct 23 32.00

LIQUIDITY: Jul24 Avg 59m shares p.w., R705.3m(64.3% p.a.) 9869

LIFE 40 Week MA OMUTUAL

7658

2019

5448

1776

3237

1534

1027

2019 | 2020 | 2021 | 2022 | 2023 | 2024

1291

FINANCIAL STATISTICS

1049 (R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final Final(rst) Final(rst) Final(rst)

806

2019 | 2020 | 2021 | 2022 | 2023 | 2024 Turnover 22 219 26 572 21 437 16 436 17 823

Op Inc 1 712 2 149 1 556 962 744

FINANCIAL STATISTICS

(R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 NetIntPd(Rcvd) 1 81 76 264 471

Final Final(rst) Final(rst) Final Final Minority Int 3 - 17 - - 5

Att Inc 1 160 1 169 1 353 1 383 124

Total Premiums 68 260 63 300 83 841 81 571 80 758

Inc Fm Inv 135 901 20 412 157 480 57 281 86 883 TotCompIncLoss 1 285 1 671 1 374 139 769

Total Income 217 407 102 844 247 814 146 533 176 116 Fixed Ass 4 842 4 566 4 593 4 794 5 328

Total Outgo 203 551 96 271 235 754 141 768 163 699 Inv & Loans 252 2 23 24 11

Minority Int 568 420 801 - 251 269 Tot Curr Ass 11 609 11 535 10 563 8 670 9 428

Attrib Inc 7 065 5 231 6 662 - 5 097 9 386 Ord SH Int 10 839 10 275 10 022 9 740 9 617

TotCompIncLoss 4 510 1 825 8 274 - 5 762 5 793 Minority Int - 19 - 20 - 4 - 1 118

Ord SH Int 56 060 57 585 62 174 66 995 74 763 LT Liab 908 929 805 730 2 820

Minority Int 2 515 2 615 3 127 2 328 3 162 Tot Curr Liab 5 798 5 651 5 188 4 270 5 405

Long-Term Liab 356 757 315 277 746 562 642 900 621 730 PER SHARE STATISTICS (cents per share)

Cap Employed 1 039 764 959 899 973 665 862 052 844 945 HEPS-C (ZARc) 699.00 742.00 672.00 361.00 154.00

Fixed Assets 55 560 50 789 47 827 42 558 44 884 DPS (ZARc) 700.00 375.00 800.00 600.00 -

Investments 958 120 892 404 899 388 772 037 744 965 NAV PS (ZARc) 6 700.00 6 300.00 5 900.00 5 800.00 5 800.00

Current Assets 96 858 78 887 64 079 65 172 55 860 3 Yr Beta - 0.06 0.49 0.93 1.22 0.69

Current Liab 116 818 104 846 80 189 78 630 65 957 Price High 6 655 8 775 7 644 5 259 6 393

PER SHARE STATISTICS (cents per share) Price Low 5 186 5 437 4 551 1 450 1 250

HEPS-C (ZARc) 165.50 129.20 163.80 116.10 202.81 Price Prd End 5 903 5 620 7 520 4 900 2 287

DPS (ZARc) 81.00 76.00 72.47 30.07 103.08 RATIOS

NAV PS (ZARc) 1 220.00 1 230.00 1 390.00 1 470.00 1 417.35 Ret on SH Fnd 10.75 11.23 13.51 14.20 1.33

3 Yr Beta 0.64 1.12 1.21 - - Oper Pft Mgn 7.71 8.09 7.26 5.85 4.17

Price Prd End 1 306 1 046 1 310 1 021 1 689 D:E 0.10 0.10 0.08 0.08 0.39

Price High 1 344 1 465 1 515 1 730 2 064 Current Ratio 2.00 2.04 2.04 2.03 1.74

Div Cover 1.01 1.85 1.01 1.38 -

Price Low 1 043 921 967 794 1 471

RATIOS

Ret on SH Fund 13.03 9.39 11.43 - 7.71 12.39

Ret on Tot Ass 1.26 0.66 1.23 0.48 1.40

Debt:Equity 6.18 5.32 11.52 9.35 8.04

Solvency Mgn% 89.82 96.57 90.01 95.67 107.10

Payouts:Prem 0.83 0.87 1.81 1.13 1.20

158