Page 150 - shbh24_complete

P. 150

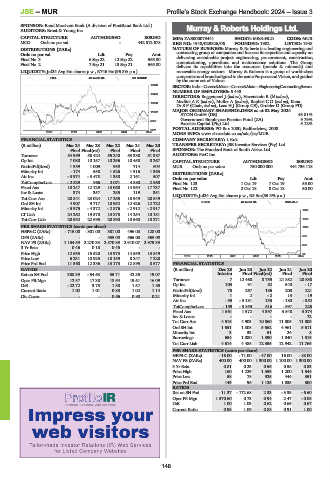

JSE – MUR Profile’s Stock Exchange Handbook: 2024 – Issue 3

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: Ernst & Young Inc. Murray & Roberts Holdings Ltd.

MUR

CAPITAL STRUCTURE AUTHORISED ISSUED ISIN: ZAE000073441 SHORT: M&R-HLD CODE: MUR

MCG Ords no par val - 442 512 678 REG NO: 1948/029826/06 FOUNDED: 1902 LISTED: 1948

DISTRIBUTIONS [ZARc] NATURE OF BUSINESS: Murray & Roberts is a leading engineering and

Ords no par val Ldt Pay Amt contracting group of companies and focuses its expertise and capacity on

Final No 3 6 Sep 22 12 Sep 22 565.00 delivering sustainable project engineering, procurement, construction,

Final No 2 7 Sep 21 13 Sep 21 565.00 commissioning, operations and maintenance solutions. The Group

delivers its capabilities into the resources (metals & minerals) and

LIQUIDITY: Jul24 Avg 8m shares p.w., R746.9m(96.8% p.a.) renewable energy sectors. Murray & Roberts is a group of world-class

companies and brands aligned to the same Purpose and Vision, and guided

FTEL 40 Week MA MC GROUP

by the same set of Values.

19049 SECTOR: Inds—Constr&Mats—Constr&Mats—EngineeringContractingServcs

NUMBER OF EMPLOYEES: 5 443

16494

DIRECTORS: Boggenpoel J (ind ne), Havenstein R (ld ind ne),

MaditsiAK(ind ne), Muller A (ind ne), RaphiriCD(ind ne), Kana

13938

Dr S P (Chair, ind ne), Laas H J (Group CE), Grobler D (Group FD)

MAJOR ORDINARY SHAREHOLDERS as at 02 May 2024

11382

ATON GmbH (DE) 43.81%

Government Employees Pension Fund (ZA) 9.79%

8827

Excelsia Capital (Pty) Ltd. 5.12%

POSTAL ADDRESS: PO Box 1000, Bedfordview, 2008

6271

2020 | 2021 | 2022 | 2023 | 2024

MORE INFO: www.sharedata.co.za/sdo/jse/MUR

FINANCIAL STATISTICS COMPANY SECRETARY: L Kok

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Final Final(rst) Final Final Final SPONSOR: The Standard Bank of South Africa Ltd.

Turnover 54 999 58 424 55 240 53 338 51 387 AUDITORS: PwC Inc.

Op Inc 7 080 10 157 10 296 10 458 8 267 CAPITAL STRUCTURE AUTHORISED ISSUED

NetIntPd(Rcvd) 1 359 1 009 950 714 604 MUR Ords no par value 750 000 000 444 736 118

Minority Int - 174 558 1 526 1 916 1 363 DISTRIBUTIONS [ZARc]

Att Inc - 3 974 - 3 478 1 358 2 161 507 Ords no par value Ldt Pay Amt

TotCompIncLoss - 2 529 966 2 071 4 380 2 950 Final No 123 1 Oct 19 7 Oct 19 55.00

Fixed Ass 10 247 12 129 13 060 14 964 17 737 Final No 122 2 Oct 18 8 Oct 18 50.00

Inv & Loans 374 357 255 119 351

Tot Curr Ass 20 841 23 024 17 265 18 949 20 849 LIQUIDITY: Jul24 Avg 5m shares p.w., R5.3m(55.3% p.a.)

Ord SH Int 4 907 9 717 10 952 12 426 12 722 CONM 40 Week MA M&R-HLD

Minority Int - 5 975 - 4 372 - 2 876 - 2 912 - 2 917 1633

LT Liab 24 262 19 570 13 875 14 254 18 181

Tot Curr Liab 20 532 22 695 20 890 18 560 18 271 1319

PER SHARE STATISTICS (cents per share) 1005

HEPS-C (ZARc) - 715.00 - 301.00 381.00 496.00 128.00

DPS (ZARc) - - 565.00 565.00 565.00 691

NAV PS (ZARc) 1 154.59 2 270.33 2 570.89 2 910.07 2 979.39

376

3 Yr Beta 0.46 0.18 0.45 - -

Price High 12 653 15 520 13 973 14 559 13 849 62

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Price Low 6 231 10 925 10 159 8 247 7 228

Price Prd End 11 360 12 336 13 173 12 895 8 577 FINANCIAL STATISTICS

RATIOS (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Ret on SH Fnd 388.39 - 54.63 35.71 42.85 19.07 Interim Final Final(rst) Final Final

Oper Pft Mgn 12.87 17.38 18.64 19.61 16.09 Turnover 7 12 460 8 755 21 882 20 838

D:E - 22.72 3.73 1.88 1.57 1.85 Op Inc 103 91 82 540 - 17

Current Ratio 1.02 1.01 0.83 1.02 1.14 NetIntPd(Rcvd) 75 267 186 208 221

Div Cover - - 0.56 0.90 0.21 Minority Int 1 2 - 2 13 - 19

Att Inc - 95 - 3 181 135 - 180 - 352

TotCompIncLoss - 159 - 3 853 616 - 597 225

Fixed Ass 1 561 1 572 4 397 3 548 3 374

Inv & Loans - - - - 72

Tot Curr Ass 4 516 4 903 10 860 11 805 11 805

Ord SH Int 1 651 1 808 5 662 4 961 5 611

Minority Int 3 33 51 24 8

Borrowings 654 1 080 1 390 1 040 1 515

Tot Curr Liab 4 614 4 485 12 355 12 942 11 765

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 16.00 - 71.00 - 47.00 16.00 - 88.00

NAV PS (ZARc) 400.00 400.00 1 300.00 1 100.00 1 300.00

3 Yr Beta 0.81 0.23 0.56 0.58 0.83

Price High 160 1 229 1 559 1 200 1 544

Price Low 58 78 925 444 351

Price Prd End 149 96 1 125 1 035 500

RATIOS

Ret on SH Fnd - 11.37 - 172.68 2.33 - 3.35 - 6.60

Oper Pft Mgn 1 570.60 0.73 0.94 2.47 - 0.08

D:E 1.00 1.03 0.62 0.65 0.67

Current Ratio 0.98 1.09 0.88 0.91 1.00

148